Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

We are thrilled to present the latest Saturday edition of Podcast In Brief! And don't worry, our loyal listeners — you'll still get the occasional real-time update!

Thank you to all our free and paid subscribers for continuing to support us. As an independent media organisation, we can only continue our work with the support of readers like you, unlike others who are supported by well-funded organisations.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today's reading time is 5 minutes. - Miko Santos

🎙️Today, we've got the inside scoop on:

The Audio Reality Check: What Podcasters Need to Know About the Real Audio Landscape

Spanish-language podcast demand surges as content supply lags

Indonesian Study Shows Podcasts Reach Only 21% of Consumers as Video Platforms Dominate

Digital Car Tech Boosts Streaming Audio but Leaves Podcasts Behind

The Audio Reality Check: What Podcasters Need to Know About the Real Audio Landscape

The Breakdown: Here's a reality check that might sting: while we're busy debating podcast app features and celebrating our latest download numbers, AM/FM radio is quietly eating 66% of all ad-supported audio listening in America. That's not a typo.

According to new research from the Cumulus Media | Westwood One Audio Active Group, traditional radio's share is 13 times larger than Spotify and 16 times larger than Pandora. Before you dismiss this as irrelevant old-media noise, consider this: if brands are allocating audio budgets based on actual listening behavior, podcasting is fighting for scraps from a much smaller pie than we thought.

This analysis comes from Pierre Bouvard, Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group, based on data from Edison Research's "Share of Ear" Report, Nielsen's Nationwide, and Nielsen's Media Impact platform. The research addresses common media planning questions about audio strategy and reveals significant gaps between marketer perceptions and actual listening behavior across audio platforms.

The Key Points:

AM/FM radio dominates ad-supported audio with a 66% share, vastly outperforming streaming platforms.

Digital audio alone (Spotify, Pandora, podcasts) only reaches 30% of Americans daily, while adding AM/FM radio jumps reach to 75%.

Podcasting ranks as the "strong number two" in ad-supported audio, particularly valuable among younger demographics

Most radio listening (58%) happens outside traditional "drive time," challenging conventional media buying wisdom

Adding AM/FM radio to digital/TV campaigns can increase reach by 75% with the same budget investment

Why It Matters: This research exposes a fundamental disconnect between how the audio industry talks about itself and how audiences actually consume audio content. For podcasters, this means competing for advertiser attention in a landscape where traditional radio still commands the lion's share of listening time and media budgets. Understanding these numbers is crucial for realistic revenue projections and positioning podcasts as complementary rather than replacement media in advertiser conversations.

The Big Picture: For podcasters and producers, this data provides essential context for revenue discussions and partnership strategies. Rather than positioning podcasts as the future of audio, smart creators will frame their content as the premium complement to mass-reach radio advertising.

The research shows podcasts excel with younger demographics and engaged audiences – perfect for brands seeking quality over quantity. Producers should use these insights to justify premium CPMs and demonstrate how podcast campaigns can efficiently target the 30% of Americans that digital audio reaches, especially when layered with broader audio strategies.

The industry benefits by finally having concrete data to counter the "podcasting is tiny" narrative while honestly acknowledging our place in the broader audio ecosystem. This isn't about admitting defeat – it's about fighting smarter with better ammunition.

Spanish-language podcast demand surges as content supply lags

The Breakdown: A lot of English-language podcasters complain about how hard it is to find new shows and how many there are. But there is a huge audience right in front of us that most of us are ignoring.

According to new research from Crowd React Media, the number of people who listen to Spanish-language podcasts went up by 9% in just one year. Now, almost half of Hispanic listeners listen to them every week.

But here's the kicker: 44% say they can't find enough Spanish-language podcasts that they like. It's not a niche; 68% of Spanish-speaking people have listened to podcasts (compared to only 51% of English speakers), and they need more of them. We're all trying to get the same English-speaking audience, but a whole room of people are just waving money at it.

Crowd React Media, a part of Harker Bos Group, did a survey of more than 500 Spanish-language media consumers in the U.S. from April to June 2025. This analysis is based on that survey. The study examined consumption habits among Hispanic audiences who are bilingual in Spanish and English or primarily Spanish-speaking, concentrating on radio, streaming television, podcasts, social media, music streaming, YouTube, and video games.

The Key Points:

Spanish-language podcast weekly listenership grew from 40% to 49% year-over-year, with frequent listening (3+ times weekly) jumping from 18% to 26%.

The 35-54 age group leads in frequent podcast consumption at 29%, outpacing the typically assumed younger core audience at 23% .

Supply-demand gap is particularly acute for male listeners: only 47% of men feel there are enough Spanish podcasts matching their interests versus 65% of women .

Visual integration is critical for discovery and engagement, with 69% finding podcasts on YouTube and 63% through social media platforms .

Genre preferences span broadly from film/TV (90%) to news (89%) and education (88%), indicating diverse content opportunities beyond lifestyle programming.

Why It Matters: This represents one of the clearest growth opportunities in podcasting today. While English-language creators scramble for audience attention in an increasingly crowded market, Spanish-language audiences are actively seeking content that simply doesn't exist yet.

The demographic data challenges conventional wisdom too – middle-aged listeners are driving engagement more than Gen Z, suggesting advertisers have been targeting the wrong age groups. For podcast networks and independent creators, this isn't just about translation; it's about recognizing that Hispanic audiences consume media differently, with higher conversion rates and stronger loyalty when content resonates culturally.

The Big Picture: For podcast creators and networks, this research reveals a blue ocean opportunity disguised as a language barrier. The infrastructure already exists – these audiences are finding podcasts on the same platforms, they just can't find content that serves them. Smart creators should consider bilingual programming or Spanish-language versions of successful formats, especially in underserved genres like sports, comedy, and self-improvement where male listeners feel particularly neglected.

Podcast platforms should prioritize Spanish-language content discovery and promotion, while advertisers need to recognize that Hispanic podcast audiences not only have higher engagement rates but also represent an undermonetized market segment.

The real opportunity isn't just creating Spanish content – it's understanding that these audiences prefer visual elements, discover through social media, and value cultural authenticity over direct translation. The question isn't whether this market will grow; it's whether the podcast industry will be smart enough to serve it before someone else does.

Indonesian Study Shows Podcasts Reach Only 21% of Consumers as Video Platforms Dominate

The Rundown: Looking at this Indonesian podcast data, I'm reminded of those early days when we'd all smugly proclaim that "podcasting was going mainstream" while ignoring the uncomfortable truth staring us in the face.

Here's the reality check from Populix's latest study: only one in five Indonesians accessed podcasts in the past three months. Meanwhile, YouTube captured 77% of that same audience, Instagram grabbed 72%, and TikTok snatched 69%.

The numbers don't lie, and they're telling us something we've been reluctant to admit – we're still fighting for scraps while video platforms feast at the main table. But here's the kicker that should make every podcaster pay attention: when Indonesians do choose podcasts, 69% are seeking inspiration and learning, 63% want to stay updated, and they're spending real time with the medium – most tuning in 2-3 times weekly for 30-60 minute sessions during their evening wind-down between 8-10 PM.

This comprehensive study from Indonesian market research firm Populix surveyed 1,100 consumers across the archipelago in June 2025, revealing detailed insights into how Southeast Asia's largest podcast market actually consumes audio and video content in their daily routines.

The Key Points:

Only 21% of Indonesian consumers accessed podcasts in the past three months, compared to 77% for YouTube and 72% for Instagram, highlighting podcasting's persistent niche status in the broader digital entertainment landscape

Video podcasts dominate consumption preferences with 54% choosing video-only formats versus just 7% preferring audio-only, while YouTube captures 96% of video podcast viewing and Spotify leads audio consumption at 87%

Educational content drives engagement, with 69% seeking inspiration and learning, 64% wanting motivational content, and 55% looking for entertainment, while interview formats (62%) significantly outperform solo presentations (12%)

Millennials and upper socioeconomic groups show the strongest podcast engagement, with 32% of upper-income listeners accessing podcasts versus 16% of middle-income and 11% of lower-income consumers

Mobile devices dominate consumption at 89%, with most listeners tuning in during evening hours (8-10 PM peak at 43%) and preferring 30-60 minute episodes consumed 2-3 times weekly

Why It Matters: These findings reveal podcasting's fundamental challenge in competing against visual platforms while also highlighting its unique value proposition. Indonesian listeners who choose podcasts demonstrate serious intent – they're not casual browsers but engaged audiences seeking substantial content for learning and inspiration. The preference for video formats and YouTube's dominance suggests podcasters must think beyond traditional audio-first strategies, while the strong educational focus indicates opportunities for creators who can deliver meaningful, actionable content rather than pure entertainment.

The Big Picture:

For podcasters and producers, this data presents both sobering reality and clear opportunity. The dominance of video consumption means creators should prioritize multi-format content strategies, ensuring their shows work effectively on YouTube while maintaining audio quality for Spotify listeners.

The educational content preference suggests successful Indonesian podcasters should focus on teaching, inspiring, and providing actionable insights rather than competing in the crowded entertainment space.

Producers should target the premium millennial and upper-income demographics who show genuine engagement, design content for mobile consumption during evening listening sessions, and structure episodes for the sweet spot of 30-60 minutes.

Most critically, the interview format preference indicates creators should prioritize guest-driven content over solo monologues. The industry benefits from understanding that while podcasting remains niche, engaged listeners demonstrate loyalty and intentionality that video platforms struggle to match – but only when creators deliver the educational value and professional production quality this audience demands.

Digital Car Tech Boosts Streaming Audio but Leaves Podcasts Behind

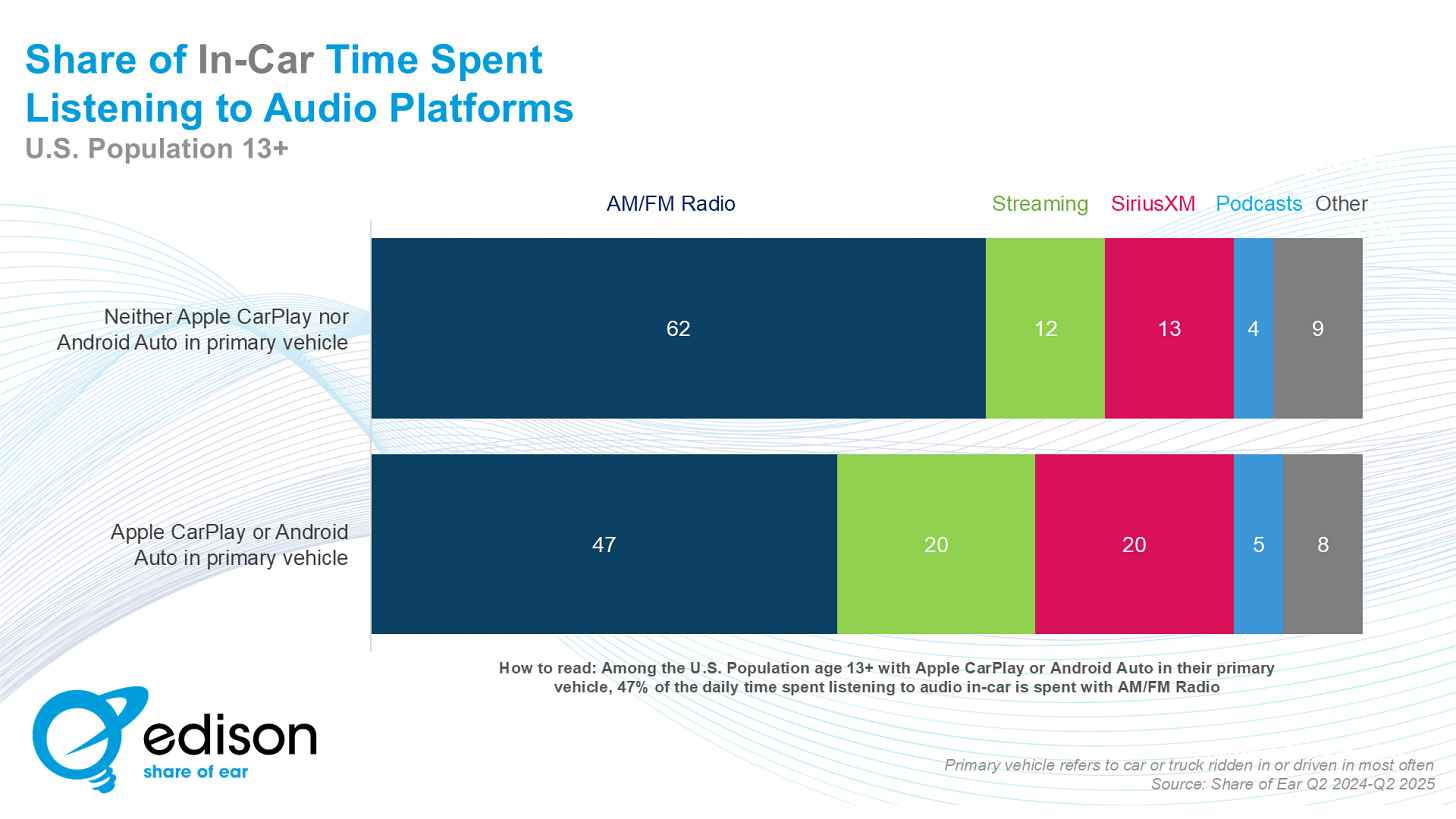

The Rundown: Looking at this Edison Research data, I see something that should make every podcaster pay attention. Radio still dominates in-car listening at 47% even WITH CarPlay and Android Auto, but here's the kicker: podcast listening time stays "relatively modest and stable" whether you have these technologies or not. That's not great news for an industry banking on mobile-first growth. While streaming audio and SiriusXM are eating radio's lunch when people get digital car integration, podcasts aren't capitalizing on this shift. We're missing a massive opportunity in the one place Americans still have captive audio time.

Edison Research's latest Share of Ear® data reveals how Apple CarPlay and Android Auto are reshaping in-car audio consumption. The study shows that while AM/FM radio maintains dominance at 47% of listening time even among users with digital car integration, streaming audio and SiriusXM each capture 20% of in-car time when these technologies are present. Despite increased digital platform adoption, podcast listening remains consistently low regardless of car technology.

The Key Points: • Just over one-third of Americans 13+ have Apple CarPlay or Android Auto in their primary vehicle as of Q2 2025 • 83% of Americans 18+ who have access to these technologies actively use them • Radio drops from majority share to 47% among CarPlay/Android Auto users but still leads • Streaming audio and SiriusXM each gain significantly, reaching 20% of in-car listening time • Podcast listening time remains "relatively modest and stable" across both user groups

Why It Matters: Cars represent one of the last places where people have dedicated audio time without visual distractions, making them crucial for audio content consumption. As more vehicles integrate smartphone technology, the audio landscape is shifting toward on-demand and subscription services. However, podcasts aren't benefiting from this digital transformation the way other audio formats are, suggesting the medium needs better car-specific strategies and integration.

The Big Picture: For podcasters and producers, this data reveals both a challenge and an opportunity. The car remains audio's most important real estate, but podcasts aren't winning mindshare when listeners get more choices.

Producers should prioritize making their shows more discoverable and accessible through CarPlay and Android Auto interfaces, potentially creating car-specific content or shorter formats suited for commute listening. The industry needs to address why podcasts aren't gaining ground when digital audio options expand – whether that's discovery issues, format problems, or integration gaps. Success means treating the car as a distinct consumption environment that requires targeted content strategy, not just hoping mobile podcast apps work well enough in vehicles.

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand's voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

MORE FROM PODWIRES:

🎙️ EVERYTHING ELSE IN PODCASTING TODAY

Signal Awards Submission Deadline Approaching: Podcast Competition Closes Friday with NPR and Vox Judges.

ABC Audio Launches True Crime Podcast on Vanessa Guillén Murder Case, Expands "20/20: The After Show" to Video Format.

AudioUK Opens 2025 APAs Awards Program with 24 Categories for Podcast and Audio Industry Recognition.

Podscribe Launches Geographic Analytics and Custom YouTube Modeling for Podcast Simulcast Campaigns.

New Data Challenges Claims That Podcasts Need Video to Succeed in 2025

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

🎧 PODCASTING JOB OPPORTUNITIES

Snapshot - Podcast Producer & Marketer

NPR - Manager, Business Strategy & Planning

ACAST - US Event & Trade Marketing Manager

SiriusXM - Sales Executive

Blockworks - Podcast Producer'

Dear Media - Senior Podcast Producer

👀 Hiring? Or looking for a new job

Grow your business through podcasting. Marketplace Podwires connects you with skilled producers who can craft compelling stories that align with your brand. Start your podcast journey today! 👈

🛑 MORE ON KANGAROOFERN FERN MEDIA LAB

Read our last Politics newsletter : Bendigo Bank Axes 158 Roles

Read our last AI newsletter : Anthropic Raises $13B Series F

Read our last Tech newsletter : Australian Court Rules Apple

Read our last Podcast newsletter : YouTube captures 60% of podcast simulcast consumption

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it's newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

Podwires is here because of our incredible partners' unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support The Podwires