Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

This is the final Podwires newsletter of 2025, and I’m excited to leave you with something to think about over the break! We’ll be back on 3 January – see you then!

We would like to say a huge thank you to all our subscribers and supporters who continue to show their amazing support for our work by choosing to pay their subscription.

The Podwires Team is absolutely thrilled!

A huge thank you to my amazing team! Your hard work has really paid off, and we couldn’t have done it without you. We are so excited to announce that we will be back next year for our fourth anniversary!

A huge thank you to everyone! Have the most wonderful holiday!

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (20 December 2025)

🎙️Today, we’ve got the inside scoop on:

Golden Globes Podcast Nominees Reveal What Download Numbers Never Will

Video Podcasts Surge 54% as Platforms Battle for Creator Dominance

YouTube Podcast Ads Convert 25% Worse Than Audio Despite Industry’s Video-First Rush

Podcast Insight: YouTube Isn't Just Beating Netflix. It's Becoming the Default Screen.

PodBusiness : YouTube Podcast Ads Underperform Audio-Only By 25% Even As Industry Doubles Down on Video

Job Board : ARN - The Christian O’connell Breakfast Show – Audio Producer

EDISON RESEARCH

Golden Globes Podcast Nominees Reveal What Download Numbers Never Will

Podwires Rundown : Podcasting just got its Hollywood moment. But here’s the thing: the real story isn’t the red carpet. It’s what’s hiding in the demographic data.

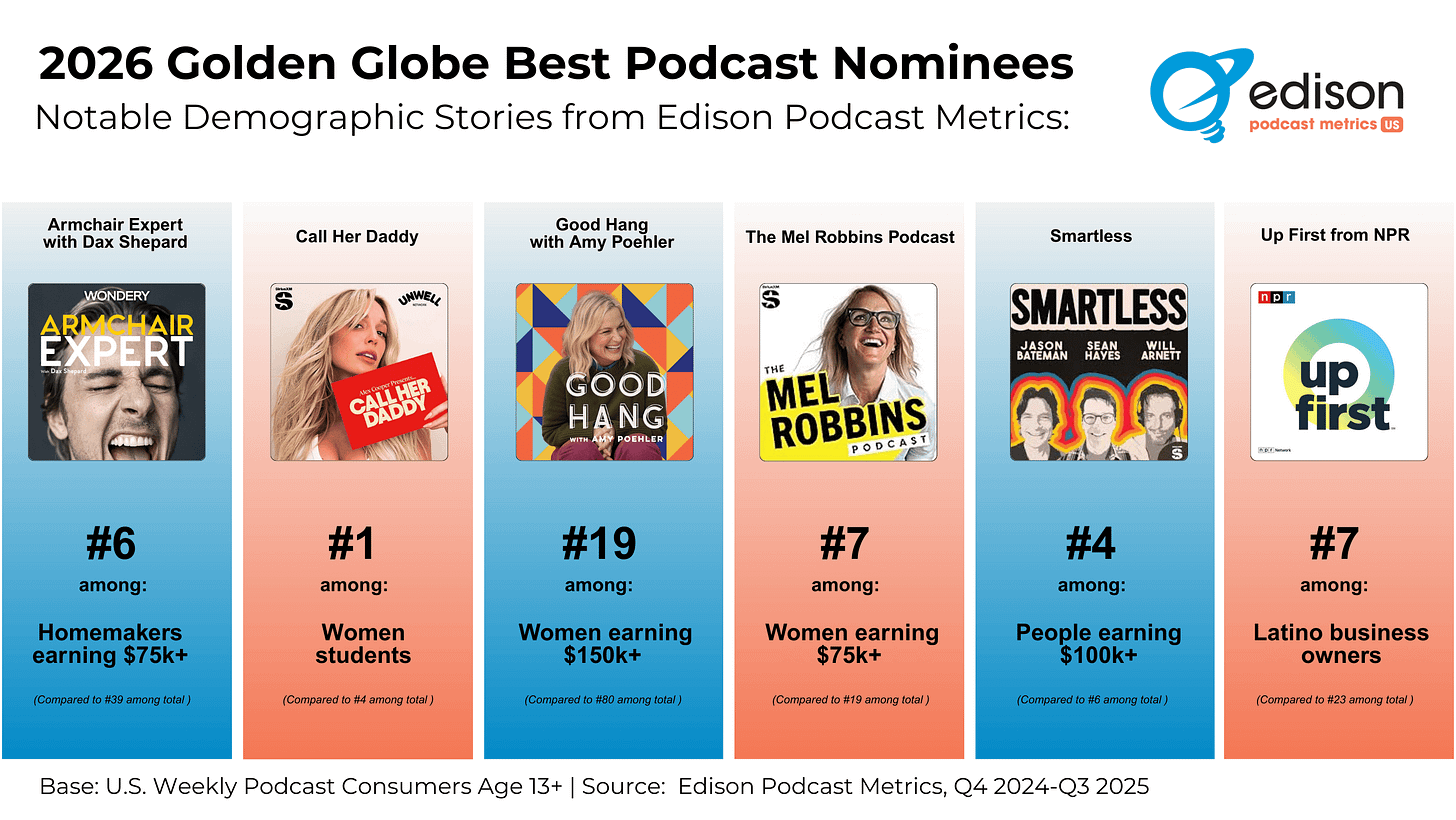

The Golden Globes announced their first-ever podcast category for 2026, nominating six titles: Armchair Expert with Dax Shepard, Call Her Daddy, Good Hang with Amy Poehler, The Mel Robbins Podcast, Smartless, and Up First from NPR. Edison Research’s Podcast Metrics data reveals something advertisers should be paying very close attention to—these shows don’t just have big audiences. They have specific audiences. Up First ranks 23rd overall for weekly reach. But it’s 7th for Latino business owners and 7th for all business owners earning more than $150,000 per year. That’s not a coincidence. That’s a media buy.

Summary: Edison Research published demographic insights on the six podcasts nominated for the inaugural Golden Globe Best Podcast category, using data from their Edison Podcast Metrics platform. The analysis, covering Q4 2024 through Q3 2025, highlights how each nominee overperforms with specific audience segments—information that transforms how advertisers should evaluate podcast inventory beyond raw reach numbers.

The Key Points:

2026 marks the first year podcasts have been included in the Golden Globe Awards, a legitimizing milestone for the medium

Up First from NPR ranks 23rd overall but jumps to 7th among Latino business owners and high-income business owners ($150K+)

Good Hang and The Mel Robbins Podcast have “exploded in popularity” over the past year, with recent quarters outperforming their rolling annual averages

Edison Podcast Metrics’ “Notable Demographic Stories” feature surfaces where shows overperform against specific audience segments

Each nominated show has a distinct demographic signature, providing advertisers granular targeting opportunities beyond total downloads

Why It Matters

Download numbers lie. Or rather, they tell an incomplete story. A show ranked 23rd overall might be your single best buy if your target audience is high-income business owners. The Golden Globes nomination list reads like a popularity contest, but Edison’s demographic breakdowns reveal these shows are actually precision instruments for reaching specific audiences. For podcast advertisers still buying on CPMs alone, this is your wake-up call. For creators, it’s proof that building a loyal niche audience can be more valuable than chasing scale.

The Big Picture

For podcasters: Stop obsessing over total downloads. Your show’s demographic overperformance is what makes you valuable to advertisers. If you’re not commissioning listener research or participating in measurement panels, you’re leaving money on the table. Know your audience better than your buyers do.

For producers: The Golden Globes inclusion signals that podcast production quality and storytelling are being recognized at the highest levels of entertainment. But the Edison data suggests the real competitive advantage isn’t just making good content—it’s understanding who your content resonates with most. Build that into your pitch decks.

For the industry: This is validation that podcasting has arrived as a mainstream entertainment category. But the smarter read is what’s underneath: we now have the measurement infrastructure to prove that podcast audiences aren’t just large—they’re targetable. That’s what unlocks premium ad dollars and shifts the buying conversation from “how many downloads” to “which audiences can you deliver.”

Let that sink in. The Golden Globes just gave podcasting its prestige moment. Edison just showed why the business model works.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

DIGIDAY

YouTube Isn't Just Beating Netflix. It's Becoming the Default Screen.

Podwires Rundown : And podcasters need to pay attention to what that actually means.

Netflix just admitted something remarkable. While pitching its proposed acquisition of Warner Bros Discovery’s streaming assets, Netflix co-CEO Greg Peters pointed to YouTube—not Disney+, not Max, not Paramount+—as the competitor they’d still trail even after the deal. Let that sink in. Netflix, the company that fundamentally changed how we watch television, is now positioning itself as the underdog against a platform most people still think of as “where you watch cat videos.” YouTube commands 12.9% of total TV watch time versus Netflix’s 8%. It has 249.9 million users to Netflix’s 202.5 million. And here’s the uncomfortable part: 835 billion viewing hours in the first half of 2025 compared to Netflix’s 95 billion. That’s not competition. That’s domination.

Summary: Digiday’s Krystal Scanlon published a data-rich analysis of YouTube’s competitive position against Netflix, drawing on Nielsen’s October gauge data, eMarketer forecasts, Owl & Co revenue figures, Enders Analysis viewing trends, and HUB Entertainment Research consumer behavior studies. The piece highlights a quote from Canvas Worldwide’s Hermelinda Fernandez that should stop every podcaster in their tracks: “Podcasts are huge and all the really big podcasts are on YouTube, and people are watching it like a primetime show on their CTV in their living room.”

The Key Points

YouTube captured 12.9% of total TV watch time in October 2025, up 4% month-over-month; Netflix sat at 8%—in sixth place among streamers

Even with HBO and Max acquisition, Netflix would reach only 9% of viewed hours—still trailing YouTube’s 13%, per Netflix’s own CEO

80% of consumers turn to YouTube when they can’t find anything else to watch, rising to 90% among 16-34 year olds

YouTube generated $28.1 billion in H1 2025 revenue (up 17% YoY) versus Netflix’s $21.6 billion (up 14% YoY)

YouTube now “owns the vodcast space” with podcasts being watched “like primetime shows” on connected TVs

Why It Matters:

YouTube has stopped being the place you go instead of television. It’s become the place you go first. The platform captures moments of boredom and indecision that no other streaming service can. For podcasters still debating whether video is worth the investment, the math just changed. YouTube isn’t a distribution channel. It’s the distribution channel. When 80% of viewers default to YouTube when they’re undecided—and when industry executives explicitly call out podcasts as driving that dominance—the question isn’t whether to be on YouTube. It’s whether you can afford not to be.

The Big Picture

For podcasters: YouTube isn’t competing with Spotify or Apple Podcasts for your audience. It’s competing with Netflix. And winning. If your show isn’t optimized for YouTube discovery—thumbnails, titles, chapters, Shorts—you’re invisible to the largest viewing platform on earth. The CTV living room is now podcast territory. Act accordingly.

For producers: Canvas Worldwide’s SVP just called it: podcasts are being consumed “like primetime shows” on connected TVs. That changes everything about production value expectations, visual storytelling, and episode pacing. Audio-first production with a camera bolted on won’t cut it anymore. You’re competing for the same eyeballs as prestige TV.

For the industry: YouTube generated nearly 9x Netflix’s viewing hours in the first half of 2025. The advertising implications are staggering. Podcast ad buyers accustomed to audio CPMs need to start thinking about YouTube’s CTV inventory—and the premium rates that come with living room attention. The platform that “owns the vodcast space” is also the platform capturing the largest share of television.

REALLY? Yes. Really.

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

RADIOCENTRE

Video Podcasts Surge 54% as Platforms Battle for Creator Dominance

Podwires Rundown : Spotify’s video podcast consumption jumped 54% year-over-year, with video viewers consuming 1.5 times more content than audio-only listeners, according to Josh Patridge, Spotify’s head of EMEA sales.

The shift has triggered a wave of strategic moves across the industry, including Spotify’s partnership with Netflix to feature top video podcasts on the streaming giant’s platform starting in 2026, Global’s launch of video-first production studio Global Studios, and Acast’s partnership with Little Dot Studios to enable premium dynamic video ads on YouTube.

The Media Leader reports UK podcast ad spend reached £90 million in 2025 (+8% YoY), with global forecasts projecting $3 billion as video transforms podcasts into “shows” with deeper audience engagement and expanded monetization opportunities.

The Key Points:

Spotify’s video podcast viewers consume 1.5x more content than audio-only listeners, demonstrating that video doesn’t just add a viewing option—it fundamentally changes consumption behavior and creates stickier audiences that platforms desperately want to own.

The Spotify-Netflix partnership launching in early 2026 will pull full video podcast episodes off YouTube (except clips on individual show channels), representing Spotify’s most aggressive move yet to challenge YouTube’s dominance with younger podcast audiences who’ve made the Google-owned platform their default podcast destination.

Industry leaders are abandoning “video as nice-to-have” positioning, with Global’s commercial podcast director Sarah Ray calling the company’s Global Studios launch and Fellas Studios acquisition a “huge statement of intent” that signals video-first isn’t optional anymore—it’s survival strategy for major podcast networks.

Acast became the first UK podcast monetization company to enable premium, dynamic, targeted video ads on YouTube, creating a new revenue stream that acknowledges the reality that YouTube has become a podcast platform whether the traditional podcast industry likes it or not.

The shift from podcasts to “shows” creates communities around content that attract brand partnerships beyond traditional audio advertising, exemplified by the Bundesliga giving live match rights to content creator podcasts on YouTube—a move unthinkable in the audio-only era.

Why It Matters

The video podcast boom represents the most significant format shift in podcasting since the medium’s inception, forcing creators and networks to choose between competing platform strategies while fundamentally changing production economics. For podcast producers, this means potentially doubling production costs to create video-quality content while navigating exclusive platform deals that could fragment their audiences. The 1.5x consumption increase matters because it suggests video doesn’t cannibalize audio listening—it creates super-consumers who drive higher engagement metrics that translate to better monetization, but only if creators can afford the production leap and pick the right platform partners.

The Big Picture

Here’s the uncomfortable part: the video podcast revolution is accelerating platform consolidation at precisely the moment independent creators thought they’d escaped the walled gardens. Spotify’s Netflix partnership isn’t about giving creators more distribution—it’s about locking premium content into Spotify’s ecosystem by offering Netflix’s massive reach as the carrot. Let that sink in. When full episodes leave YouTube, creators lose direct audience relationships and algorithmic discovery on the world’s second-largest search engine.

For podcast producers, the strategic question isn’t whether to add video—that debate ended when consumption jumped 54%. The question is how to produce video content without becoming dependent on platforms that will inevitably prioritize their own interests over creator economics. The Acast-Little Dot partnership offers a glimpse at the alternative: enable monetization across platforms rather than betting everything on exclusive deals.

Independent creators face brutal math. Video production costs 2-3x more than audio, requiring lighting, cameras, editing expertise, and studio space that audio-only productions avoided. Meanwhile, the platforms driving video consumption take the same revenue cuts (or higher) despite creators absorbing all the additional costs. Fair play to Global and major networks that can afford dedicated video studios, but most podcast producers don’t have that luxury.

The Bundesliga example reveals where this is heading: podcasts becoming “shows” that attract partnership opportunities beyond traditional advertising. But those opportunities flow to creators who can afford professional video production and have audiences large enough to interest major brands. The middle tier of podcasters—successful enough to quit their day jobs but not big enough for Netflix deals—risk getting squeezed between expensive video expectations and stagnant CPMs.

For podcast producers: Start treating video as a separate content strategy, not just “turning on the camera” during audio recording. Test vertical video clips optimally formatted for different platforms before committing to full-length video episodes. Consider the 1.5x consumption multiplier when calculating ROI on video production costs—if your audio show generates $50k annually, can video increase that to $75k while costing less than $25k to produce? If not, you’re subsidizing platform growth with your money.

For podcast networks: The Global Studios and Fellas acquisition strategy makes sense if you’re fighting for premium creator talent. But don’t force every show into video if the format doesn’t serve the content. Audio-only still represents the majority of podcast consumption, and plenty of categories (true crime, news, educational content) don’t benefit from talking-head video.

The industry proclaimed “video is no longer a nice-to-have,” but that’s marketing speak from platforms with billions in venture funding. For most creators, video remains exactly what it’s always been: a calculated bet that requires honest assessment of whether the format serves your specific audience and whether the economics actually work. The platforms pushing hardest for video podcasts aren’t the ones paying production costs.

OXFORD | PODCRIBE

YouTube Podcast Ads Convert 25% Worse Than Audio Despite Industry's Video-First Rush

Podwires Rundown: YouTube podcast ads are 18-25% less effective at driving purchases than audio-only podcast ads, according to research analyzing over 1,000 campaigns across 100+ brands conducted by Oxford Road and Podscribe.

The finding exposes a dangerous disconnect: while the industry races toward video-first strategies based on engagement metrics—Spotify reports video podcast consumption up 54% year-over-year with viewers consuming 1.5x more content—the actual advertising performance data reveals YouTube’s fundamental architecture undermines the intimate, intentional listening experience that made podcast advertising valuable.

In the promo code dataset, 78% of brands (18 of 23) showed declining conversion rates as YouTube’s share of impressions increased, with regression analysis estimating YouTube views deliver 25% worse response rates than RSS downloads. A separate post-purchase survey dataset of 22 advertisers found 6 of 7 brands with complete data showed performance declines, estimating an 18% effectiveness gap. This matters because advertisers are pricing and planning YouTube and audio podcast impressions as fungible—treating a YouTube view the same as an RSS download—while unknowingly accepting significantly worse performance.

The Key Points:

Oxford Road and Podscribe analyzed two independent datasets measuring different outcomes (promo code redemptions and post-purchase survey responses), with both datasets converging on the same conclusion that YouTube impressions underperform audio downloads by 18-25% at driving purchases, providing cross-validation that this isn’t a measurement artifact.

The research methodology divided each advertiser’s campaigns into deciles based on YouTube’s share of total impressions, revealing that for 78% of brands, response rates consistently declined as YouTube’s percentage increased—a pattern too consistent across diverse advertisers to attribute to coincidence or creative quality.

The performance gap stems from fundamental consumption differences: audio-only listeners deliberately select shows and engage during activities with high switching costs (commuting, exercising), while YouTube viewers often arrive via algorithmic suggestions in an environment where “thumbnails and other options compete for attention, encouraging clicking away within 30 seconds,” according to Oxford Road’s Giles Martin.

YouTube’s view counting methodology allows multiple views per day for the same content, while podcast downloads can only be counted once per 24 hours, meaning view counts “might exceed downloads for the same amount of consumption”—potentially inflating YouTube’s apparent reach relative to actual unique audience exposure.

The industry’s standard practice of treating RSS impressions and YouTube views as fungible in media planning and MMM modeling means advertisers spending $1M on YouTube podcast impressions “may be losing up to $250K in conversion value” without realizing it, because they’re pricing both formats identically despite the 25% effectiveness difference.

Why It Matters

This research represents the first industry attempt to measure relative performance between audio-only and YouTube simulcast podcast advertising using actual conversion data rather than engagement proxies. The 18-25% gap isn’t a minor optimization opportunity—it fundamentally challenges the economic case for the video podcast boom that’s reshaping production economics across the industry. When major advertisers like BetterHelp (November’s top spender at $5.9M) announce they’re “doubling down on visual opportunities” in 2026, they’re making strategic bets that contradict the largest cross-platform effectiveness study available.

The timing couldn’t be worse. Podcast producers face brutal economics: video production costs 2-3x more than audio while Oxford Road’s data suggests it delivers 25% worse advertiser outcomes. That’s not a sustainable business model—that’s subsidizing platform growth metrics with creator budgets. Fair play to platforms pushing video engagement numbers, but engagement and advertising effectiveness aren’t the same thing, and this research exposes the gap.

The Big Picture

Here’s the uncomfortable part: the entire industry committed to video before understanding whether it actually works for the people funding the ecosystem. Spotify partnering with Netflix. Global launching video-first Global Studios. Acast enabling premium YouTube ads. Every major player sprinted toward video based on consumption metrics—54% YoY growth, viewers consuming 1.5x more content—without asking whether those viewers convert better or worse than audio listeners. Let that sink in.

The Oxford Road/Podscribe research explains why the gap exists, and none of the reasons are fixable with better creative:

Podcast listening is intentional. Audio-only listeners deliberately select shows and consume them during high-engagement activities. YouTube viewers often arrive via algorithmic discovery, creating “more rapid viewer loss” as the algorithm serves competing options designed to pull attention away.

Audio listeners are conditioned to use promo codes. Long-term podcast listeners have spent years supporting shows through code redemptions. “This expectation doesn’t exist in the same way in the YT environment,” the research notes. You can’t fix audience behavior differences with production quality.

YouTube audiences skew international. International listeners see ads for products unavailable in their markets, “diminishing response.” Audio podcast audiences are more geographically targeted because distribution is controlled by the creator, not YouTube’s algorithm.

View inflation versus download accuracy. YouTube’s multiple-views-per-day counting inflates impression numbers compared to podcast downloads’ once-per-24-hours methodology, meaning advertisers are buying less unique reach than they think.

The Magellan AI November spending data reveals the stakes. BetterHelp spent $5.9M, Washable Sofas $5.8M, T-Mobile $5.4M. As these advertisers shift budgets toward video platforms without understanding the 25% effectiveness penalty, they’re accepting worse performance while podcast producers bear triple the production costs. When someone eventually runs the numbers—and Oxford Road just did—the entire video podcast advertising market faces a reckoning.

1Password’s CMO Melton Littlepage offers the counterargument: “The visual storytelling makes all of the difference for us, because it allows consumers to quickly see how the product works.” The company reports better results from video podcasts. But 1Password sells software with UI/UX that benefits from visual demonstration. For the 78% of Oxford Road clients whose performance declined with increased YouTube share, visual storytelling apparently didn’t overcome the fundamental engagement and audience behavior gaps.

Oxford Road’s 10-step action plan reveals how deep this problem runs:

“Do not treat RSS downloads and YouTube views as fungible.” This is currently standard industry practice. Media planners routinely combine audio and video impressions into total podcast reach numbers, pricing them identically.

“Price simulcast deliberately. Calibrate YouTube CPMs to reflect the per-impression gap you’re likely to see in performance.” Translation: YouTube podcast ads should cost 18-25% less than audio podcast ads. Currently they don’t, meaning advertisers are overpaying.

“Consider reducing pixel weights for video if you’re assuming 1:1 performance.” Many advertisers using pixel-based attribution treat video and audio podcast impressions identically in their MMM models, systematically overestimating YouTube’s contribution.

The research acknowledges limitations worth noting. It doesn’t distinguish between true video ads (with product visuals and demonstrations) versus audio read over static images. It doesn’t control for international impression percentages. The datasets rely on promo codes and surveys, not pixel-based attribution. Further research should segment these variables.

But two independent methodologies converging on an 18-25% gap across 100+ brands isn’t noise. That’s signal.

For podcast advertisers: Demand separate reporting and pricing for video versus audio-only placements. If your agency treats YouTube views and RSS downloads as fungible impressions, you’re overpaying for video by roughly 20%. Either negotiate lower YouTube CPMs or require proof that specific shows don’t exhibit the effectiveness gap. BetterHelp, Quince, and other top spenders: your video podcast bets better outperform this industry average, or you’re burning seven figures annually.

For podcast producers: Before investing in video production capabilities, calculate actual ROI. If video costs 3x more to produce and converts 25% worse for advertisers, you need video to deliver 4x the CPMs just to break even. That’s not happening. The Oxford Road data suggests you should be charging less for video inventory, not more. Ask existing sponsors for cross-platform performance data before doubling video production budgets. If they can’t provide it, you’re making production decisions based on platform marketing rather than advertiser outcomes.

For the industry: The video podcast boom created a measurement crisis that threatens long-term advertiser confidence. When your top spenders benchmark video versus audio performance and discover the 25% gap, they won’t blame themselves—they’ll question podcasting’s effectiveness claims. The medium built its reputation on superior engagement and conversion rates. Systematically destroying that advantage by chasing video metrics that don’t correlate with business outcomes is how you lose advertiser trust.

Google’s response to WSJ is telling: “Advertisers on YouTube already recognize the differences between audio-only services and its video ad offerings.” That’s corporate-speak for “we price them differently because we know they perform differently.” Except podcast publishers don’t price them differently, because most don’t have the cross-platform data Oxford Road and Podscribe just revealed.

The 71% of U.S. creators now producing video versions of their shows are responding rationally to audience migration. YouTube surpassed Spotify to become the most popular podcast platform. But audience size and advertising effectiveness aren’t the same thing, and this research proves it. The industry learned this lesson with display advertising—massive reach, terrible conversion rates. We’re about to learn it again with video podcasts, except this time creators are paying triple the production costs for the privilege of delivering worse advertiser results.

The platforms won’t fix this. YouTube benefits from creators producing expensive video content that feeds its algorithm. Spotify wants to compete for video attention share. The people who suffer are independent creators caught between expensive video production mandates and advertiser ROI that doesn’t justify the costs. REALLY? Yes. Really.

SIGNAL HILL INSIGHTS

Video Podcast Boom Collides with 25% Conversion Gap as Industry Doubles Down on Unproven Format

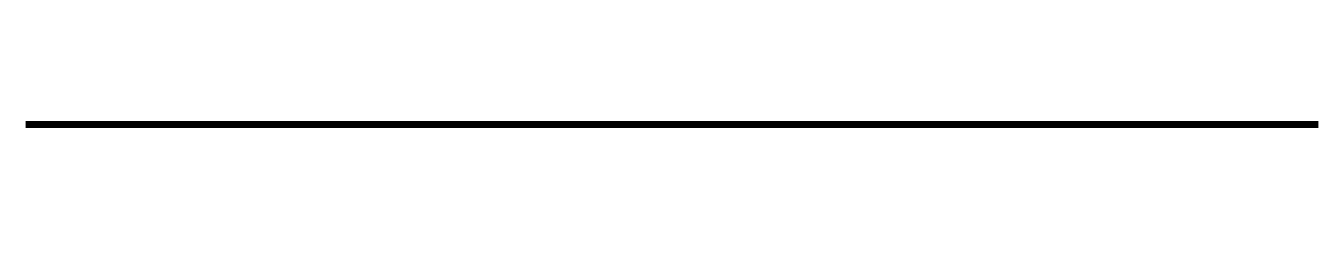

Podwires Rundown: Remember when YouTube as a podcast platform was “controversial”? When industry veterans insisted listeners didn’t understand the difference between podcasts and YouTubers like Mr. Beast? Signal Hill Insights does. Back in April 2022, they caught heat for reporting YouTube had become the most-used podcast platform in the US.

The skeptics said audiences were confused. The data said otherwise. Now, three years later, YouTube is the primary platform for 42% of weekly podcast consumers—nearly three times Spotify’s share. And here’s the kicker: in 2023, exactly zero percent of Signal Hill’s brand lift studies included video podcasts. In 2025? 61% included video. Let that sink in.

This comes from Signal Hill Insights’ analysis of 66,000 monthly podcast consumers surveyed in 2025—a 45% increase over their 2024 research. President Paul Riismandel and his team didn’t just track platform preferences; they measured what brands actually buy, revealing a “radical shift in brand priorities” around video podcast advertising effectiveness.

The Key Points:

YouTube dominates podcast consumption: 42% of weekly podcast consumers use YouTube as their primary platform, nearly 3x Spotify’s share, confirming a trend Signal Hill first reported in 2022 despite industry skepticism

Brands have shifted dramatically to video: 61% of Signal Hill’s 2025 brand lift studies included video podcasts, up from 0% in 2023, demonstrating that advertisers take video podcasts seriously and want measurable ROI

Narrative podcasts remain strong despite rumors: Weekly podcast consumers spend 54% of their time with narrative podcasts, contradicting reports of their “demise”—even among audiences who prefer actively watching video

Smart TVs became the second most-used podcast device: The combination of video growth and TV ubiquity created an overlooked consumption pattern that challenges assumptions about how audiences engage with podcasts

Political composition of news podcast audiences completely flipped: In Q2 2024, 41% of monthly news podcast consumers were Democrats vs 28% Republicans; by late 2025, it reversed to 39% Republican and 32% Democrat

Why It Matters:

The video podcast debate is over—the audience already voted with their viewing habits, and brands followed with their budgets. Understanding this isn’t about choosing sides in format wars; it’s about recognizing that executive decisions about production, distribution, and advertising must account for platform realities, not industry nostalgia. When brand lift studies shift from 0% to 61% video in two years, that’s not a trend—that’s a market transformation that affects every production budget, advertising proposal, and audience growth strategy.

The Big Picture

Here’s the uncomfortable part: if you’re still debating whether video podcasts are “real podcasts,” you’re having the wrong conversation while your competitors capture younger audiences and video-focused ad dollars. The actionable insight isn’t “add cameras”—it’s understanding that successful podcast strategies now require multi-format thinking from day one.

For podcast producers, this means building workflows that efficiently create compelling content for both audio and visual consumption without doubling production costs. The narrative podcast data offers relief: storytelling still works, but you need to reconsider what qualifies as “narrative.” Crime Junkie’s conversational approach reaches the second-largest audience despite purists dismissing it as less documentary than Serial. The lesson? Format orthodoxy is expensive—audiences consume true crime, history, and storytelling across formats, and rigid definitions only limit your reach.

The smart TV revelation exposes another strategic gap: most podcasters optimize for mobile and ignore the second most-used device category. Fair play if you don’t watch podcasts on TV, but consumers vote with behavior, not your preferences. And that political flip in news podcast audiences? New listeners arrive daily with different profiles than existing fans—don’t build audience strategies assuming tomorrow’s listeners mirror yesterday’s.

For the industry overall, these surprises underscore why research matters more than assumptions. Signal Hill surveyed nine times more video podcast consumers in 2025 than 2024 because that’s where the audience went. The companies that recognized this shift early—and measured its impact—are now positioned to capture both audience growth and advertiser demand. The ones still arguing about definitions are getting lapped by closed platforms that solved format flexibility years ago.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

SiriusXM - Senior Specialist, Content Marketing and Partnerships

ARN - The Christian O’connell Breakfast Show – Audio Producer

ACAST - Key Account Director

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.