Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

We are thrilled to present the latest Weekend edition of Podcast In Brief! And don't worry, our loyal listeners — you'll still get the occasional real-time update!

Thank you to all our free and paid subscribers for continuing to support us. As an independent media organisation, we can only continue our work with the support of readers like you, unlike others who are supported by well-funded organisations.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today's reading time is 5 minutes. - Miko Santos (31 October 2025)

🎙️Today, we've got the inside scoop on:

The Billion Dollar Measurement Problem

Acast’s 41% Growth Shows What’s Possible When You Actually Execute

The Slow Death of Free Streaming Music

The $10-49 Sweet Spot: What Free Podcasts Tell Us About the Industry

Bonus: TV/Film Podcasts: The Gateway Drug We’re Not Using Enough

Elsewhere: Audacy announces strategic partnership with NBA superstar Draymond Green.

Podwires Job Board : Spotify - Associate Manager, Creative Operations

The Billion Dollar Measurement Problem

The Podwires Rundown : Here’s a fun fact: the podcasting industry is leaving a billion dollars on the table. Not because brands don’t want to spend it. Not because the content isn’t there. But because we can’t measure things consistently.

Oxford Road just dropped their “What Brands Want 2025” report, and it’s a wake-up call. They surveyed the people who actually write the checks – including six of the top 10 podcast advertisers, representing roughly 15% of total U.S. podcast ad spend. And what did these brands say? Fix measurement, and we’ll spend more. A lot more.

The kicker: 76% of brands would increase podcast investment if YouTube podcast attribution matched what’s available for audio. Nearly a quarter would boost spending by 50% or more. Do the math. That’s roughly a billion dollars in additional spend just sitting there, waiting for the industry to get its act together. Dan Granger, CEO of Oxford Road, put it plainly: “If the industry can deliver on measurement, advertisers have signaled they are ready to scale their investment.”

The Key Points:

Measurement is the #1 barrier to growth – 50% of respondents cite limitations in performance data as the main constraint on podcast ad spend

YouTube attribution gap costs the industry dearly – 76% of brands would increase investment if YouTube podcast attribution matched audio podcast attribution

Potential billion-dollar unlock – Nearly 25% of advertisers willing to grow spend by 50%+ suggests up to $1B in additional revenue available with standardized video attribution

AI host reads face trust issues – Brands remain skeptical without stronger disclosure and industry standards

Rising ad clutter concerns – Respondents increasingly worried about oversaturation threatening ad effectiveness

Why It Matters: This isn’t about technology limitations or creative differences. It’s about money walking away because we can’t agree on how to count things. When a brand runs a campaign across audio podcasts and YouTube podcasts, they want apples-to-apples comparison. Right now, they’re getting apples and oranges. That confusion creates friction. Friction creates hesitation. And hesitation means budgets go elsewhere – to platforms that have their measurement story straight. The industry has the content, the audiences, and the advertiser interest. What we’re missing is the measurement infrastructure to capture the opportunity.

The Big Picture: For podcasters and producers, this report should be required reading. The good news: brands want to spend more money in podcasting. The bad news: you can’t access that money until the industry solves attribution. Practically, this means a few things. First, if you’re creating video podcasts on YouTube, understand that advertisers see that inventory differently than your RSS feed – and not in a good way. They can’t measure it consistently, so they discount it or skip it entirely.

Second, the rise of programmatic is accelerating. That means more automated buying, which requires better measurement standards. Get ahead of this by ensuring your shows work with measurement partners and attribution tools. Third, the report confirms brands are nervous about AI-generated host reads without proper disclosure. If you’re experimenting with AI, transparency isn’t optional – it’s essential for maintaining advertiser trust. The industry isn’t short on content or creativity. We’re short on trust, transparency, and accountability in measurement. Fix that, and the money follows. The Oxford Road report proves brands are ready. The question is whether podcasting can deliver the measurement infrastructure fast enough to capture it.

🛑 BE PODWIRES PAID SUBSCRIBER

As a paid subscriber, you will get all of the following for only $8 a month or $80 a year (or the equivalent in your local currency):

📰 Podwires Job Board - Get the latest Podcast job around the world

🎙️ Podcast Marketplace - 1000 + Independent Podcast Producers ready to help you.

Podwires Superfan - We can keep doing our work with the help of readers like you, unlike other media organisations that get money from big companies.

Acast’s 41% Growth Shows What’s Possible When You Actually Execute

The Podwires Rundown: While the podcasting industry spends a lot of time wringing its hands about measurement problems and platform fragmentation, Acast just quietly posted 41% organic growth in Q3 2025. Not total growth – organic growth. The kind that comes from actually running a business well.

Here’s what matters: their Average Revenue Per Listen jumped 33% to SEK 0.58 (about $0.06 USD). That’s not audience growth driving revenue. That’s monetization improvement. CEO Greg Glenday and team aren’t just adding listens – they’re making each listen worth more. North America led the charge with 58% net sales growth, while Europe added 27%. And they’re not burning cash to get there. EBITDA margin hit 6%, up from 3% last year.

But the real story is their updated financial targets. Acast is now publicly committing to 10% EBIT margin by 2028, with organic sales growth exceeding 15% annually through that period. Glenday’s framing it as “a milestone, not the final destination.” Translation: we’re just getting started. They’re also bringing on Anders Hägg as CFO in January 2026 to help execute this next phase. This is what confidence looks like.

The Key Points:

Explosive organic growth continues – 41% organic net sales growth and 35% total revenue growth in Q3 2025, reaching SEK 642.1m (USD 67.4m)

Monetization improving faster than audience – Average Revenue Per Listen increased 33% to SEK 0.58 while listens grew only 1%, showing pricing power and efficiency gains

North American expansion accelerating – 58% net sales increase in North America led regional growth, with Europe contributing 27%

Profitability targets raised – New financial framework targets 10% EBIT margin by 2028 and organic sales CAGR exceeding 15% through 2025-2028

Strategic partnerships expanding reach – New collaboration with Magnite brings Acast’s 1 billion quarterly listens to wider programmatic demand sources

Why It Matters : Most podcast companies talk about growth. Acast is demonstrating it with receipts. The 33% increase in revenue per listen shows they’re solving the monetization puzzle that plagues the industry – getting more value from existing audiences rather than just chasing raw download numbers. Their ability to grow revenue faster than their audience while improving margins proves the podcast advertising market isn’t saturated; it’s undermonetized. When a major player can publicly commit to 10% EBIT margins by 2028, it sends a signal to the entire industry and potential investors: podcasting isn’t just a content play anymore. It’s a real business with real margins.

The Big Picture : For podcasters, Acast’s performance demonstrates that premium monetization is achievable at scale. If you’re working with networks or platforms, these numbers should inform your conversations about revenue share and performance expectations. The 33% jump in ARPL suggests there’s real money available for quality inventory – but you need to be working with partners who have the sales infrastructure and advertiser relationships to capture it.

For producers, the operational story matters more than the revenue headline. Acast improved EBITDA margin by 3 percentage points while growing operating expenses only 19% against 35% revenue growth. That’s operational leverage, and it comes from disciplined resource allocation – they’re investing in sales and marketing, not just content production costs. Learn from this: growth without operational discipline is just expensive. Their partnership with Magnite also signals where the puck is going – programmatic podcast advertising is accelerating, and producers need to ensure their shows are technically capable of serving programmatically sold ads.

For the industry, Acast’s trajectory proves that global scale matters in podcasting. Their strength in UK and Nordics combined with growth potential in US and Continental Europe creates geographic diversification that smaller players can’t match. The updated financial targets aren’t just corporate goals – they’re a benchmark for where the industry needs to head. If Acast can hit 10% EBIT margins, other major players have no excuse for continued unprofitability. The market is there. The question is execution.

Full report available at: https://investors.acast.com/investors/reports

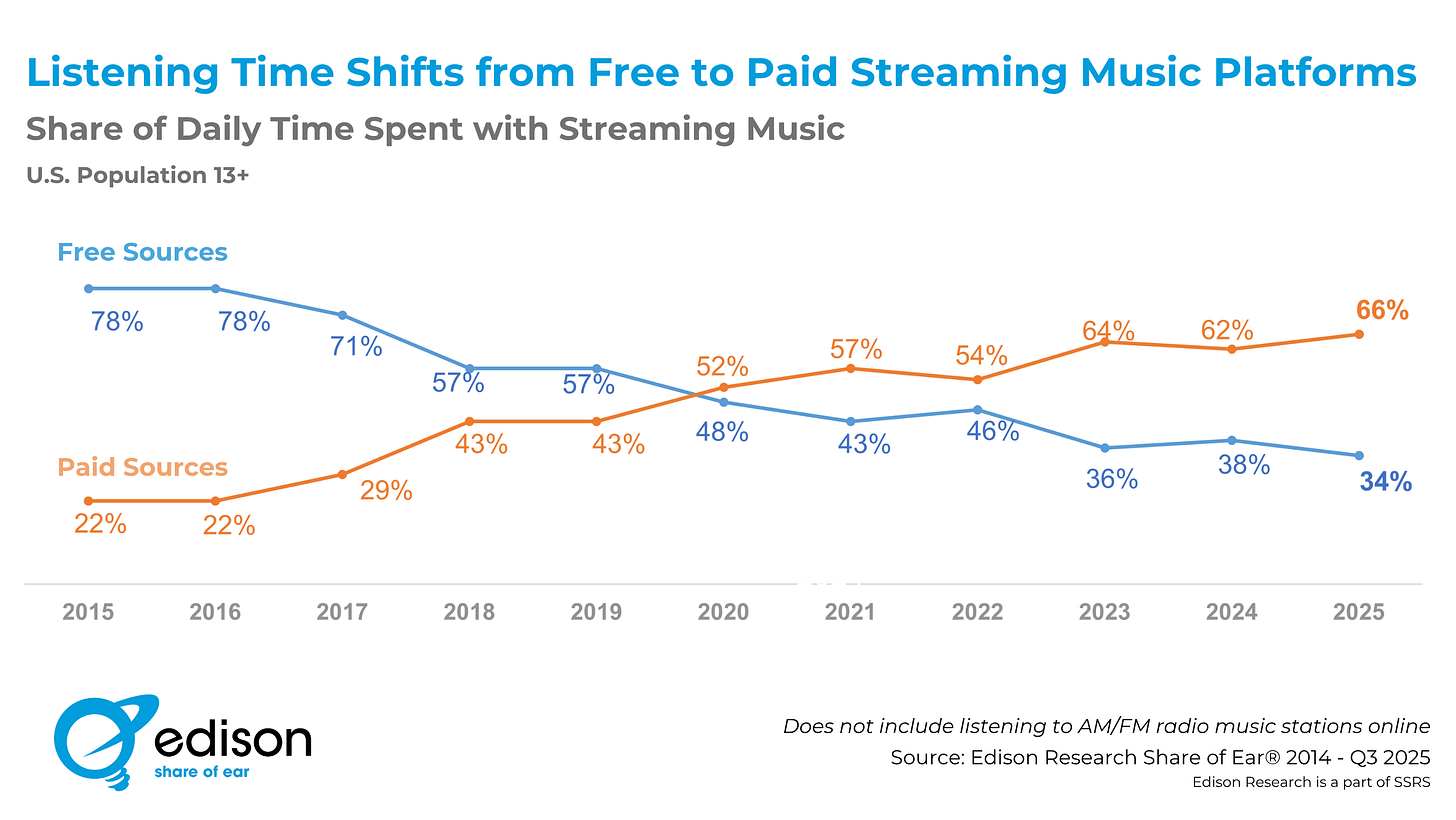

The Slow Death of Free Streaming Music

The Podwires Rundown : Remember when “free” was the killer feature? When Spotify’s whole value proposition was that you could listen to anything without paying, you just had to tolerate some ads?

Those days are over.

Edison Research’s Share of Ear data tells a story that snuck up on the industry. In 2015, 78% of streaming music time was spent on free platforms. Americans tolerated the ads because, well, it was free. But something changed. Starting in 2017, that percentage started sliding. By 2020, paid streaming music time surpassed free for the first time. And now, in 2025, the split is 66% paid to 34% free.

That’s not a marginal shift. That’s a complete reversal in how Americans consume streaming music. Two-thirds of streaming music listening now happens on paid platforms. The free-with-ads model isn’t dead, but it’s been relegated to minority status in just a decade.

Why does this matter for podcasting? Because we’re walking the same path, just a few years behind. YouTube is training podcast audiences to expect visual content. Spotify is training them to expect seamless cross-platform experiences. And both are demonstrating that consumers will pay for premium experiences if the value is there. The question isn’t whether podcasting will follow music’s trajectory from free-to-paid. The question is how fast, and whether open podcasting can compete when it happens.

The Key Points:

Free streaming dominance has reversed – In 2015, 78% of streaming music time was free; by 2025, 66% is now paid subscription services

Tipping point occurred in 2020 – First year paid streaming music time surpassed free, marking a fundamental shift in consumer behavior

Consistent trend across platforms – All major providers (Spotify, iHeart, YouTube Music, Amazon, Pandora) now offer both tiers, with paid gaining share

Ad tolerance declining – Americans increasingly unwilling to tolerate advertisements in audio listening experiences

Subscription services normalized – Competitive pricing and prevalence of subscriptions in other media made paid audio mainstream

Why It Matters: This isn’t just about music. It’s about audio consumption habits. When consumers demonstrate they’ll pay for ad-free audio experiences at scale, it changes the economics for every audio platform – including podcasting. The shift from 78% free to 66% paid over ten years shows that “free with ads” isn’t the inevitable end state for digital audio. Consumers have proven they value their listening experience enough to pay for it. This creates both opportunity and risk for podcasting: opportunity for premium subscription models, risk for ad-supported shows if listener patience for advertising continues to erode.

The Big Picture : For podcasters, the Share of Ear data suggests your audience’s relationship with ads is changing underneath you. They’re increasingly willing to pay for ad-free experiences in other audio contexts. If you’re building a podcast solely on the ad-supported model, understand that you’re swimming against a tide that’s been shifting for nearly a decade. This doesn’t mean ads are dead in podcasting – far from it. But it does mean diversification matters. Consider what premium, subscriber-only content might look like for your show.

For producers, the music industry’s migration to paid streaming offers a blueprint. Competitive pricing worked – consumers didn’t need to pay $15/month for every service. They picked one or two and paid reasonable rates. The podcast industry needs to learn from this. If you’re building subscription offerings, pricing discipline matters. Don’t overprice your way out of the market before it develops. Also, note that all major platforms maintained both free and paid tiers. The answer wasn’t abandoning one model for another – it was serving both audiences while making the paid experience compelling enough to convert free users over time.

For the industry, this data should inform strategic planning around monetization. We spend enormous energy optimizing ad loads, fighting about dynamic ad insertion, and debating programmatic versus host-read ads. Meanwhile, the audio audience is demonstrating that they’ll increasingly pay to avoid ads altogether. The podcasting industry needs to develop robust, user-friendly subscription infrastructure before platform giants build it for us. Because if music’s trajectory is any indication, the audience is ready. The question is whether podcasting’s infrastructure will be.

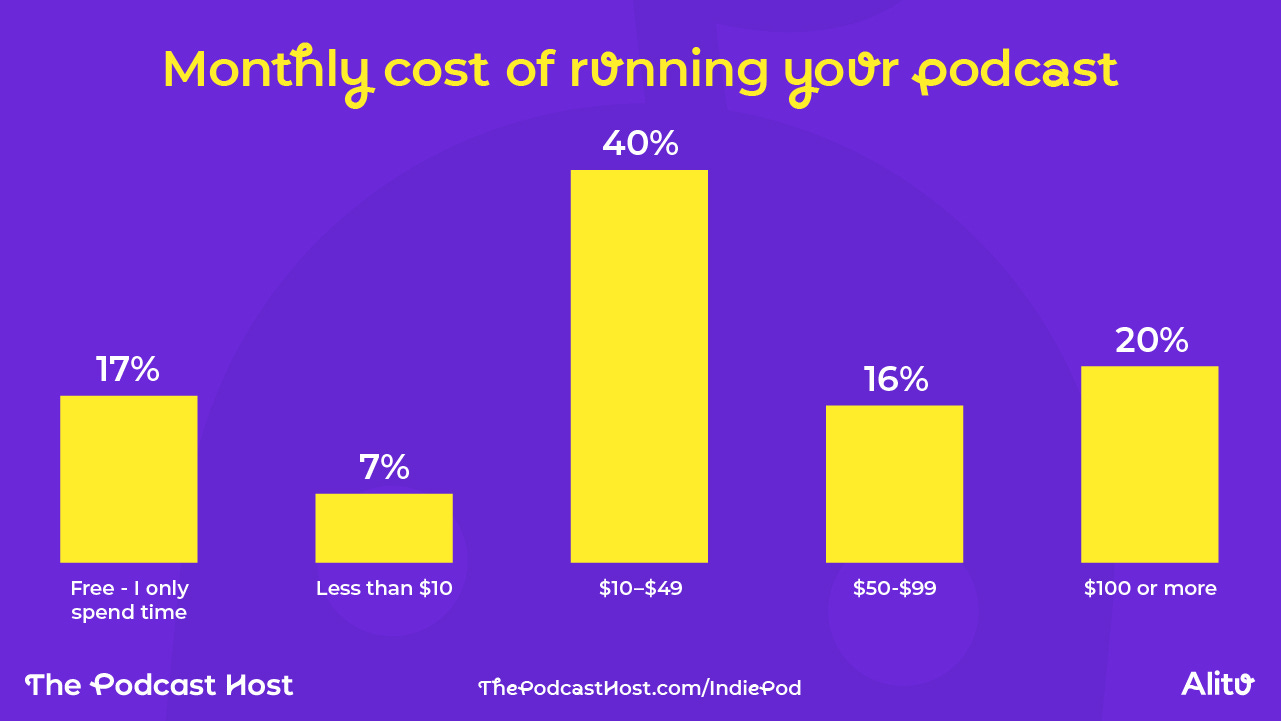

The $10-49 Sweet Spot: What Free Podcasts Tell Us About the Industry

The Podwires Rundown:The Podcast Host just released survey data that should make the industry uncomfortable. 17% of independent podcasters run their shows on exactly zero dollars per month. They’re not spending money – just time.

That’s not a small number. Nearly one in five indie podcasters has figured out how to produce content without spending anything. And here’s the kicker: 71% of them say they’re achieving at least some of their podcast goals. Before you start thinking this proves podcasting doesn’t need investment, let’s look at what those goals actually are and what “success” means when you’re not spending money.

The data from Katie Paterson and The Podcast Host team reveals something we all suspected but rarely say out loud: you can run a podcast on no budget, but only a specific kind of podcast. It’s likely a solo show (53% of free podcasts are). It’s probably driven by altruistic goals like “supporting others” or “personal enjoyment” rather than revenue. And critically, 68% of these shows get under 50 downloads per episode in the first week. There’s nothing wrong with that number – but it’s also not building a business or reaching meaningful scale.

The Key Points:

17% of indie podcasters spend zero dollars monthly – They invest time rather than money, with 65% getting no help running their shows

Free podcasts face growth limitations – 68% of zero-budget shows get under 50 downloads per episode in first week, compared to just 24% of shows spending $100+

Goals differ by spending level – Free podcasters prioritize support, enjoyment, and awareness; revenue-focused creators spend more monthly on production

Financial investment correlates with sustainability – 44% of free podcasts are less than a year old; only 22% of shows spending $50+ are that new

The $10-49 bracket is most popular – 40% of survey respondents spend in this range, representing a “sweet spot” for accountability without breaking the bank

Why It Matters: This data exposes podcasting’s fundamental tension: the barrier to entry is incredibly low, but the barrier to growth is high. You can absolutely start a podcast for free, but scaling it requires investment. The survey shows that only 5% of free podcasters make any money from their shows, compared to 26% of those spending $100+ monthly. This creates a trap for new creators who think podcasting’s accessibility means it’s easy. Starting is easy. Growing is expensive. The industry celebrates the low barrier to entry while quietly acknowledging that most shows never escape hobbyist status – and the data suggests financial investment is a key differentiator.

The Big Picture: For podcasters, this survey is a reality check. If you’re running a free show and wondering why growth is slow, the answer is in the data. Free shows are harder to grow, harder to sustain, and less likely to generate revenue. That doesn’t mean you need to immediately start spending money, but it does mean you should be honest about your goals. If you want a hobby that reaches a few dozen people, free podcasting works. If you want to build an audience at scale or generate revenue, you need to invest. The sweet spot appears to be $10-49 monthly – enough to access better tools and hold yourself accountable without breaking the bank.

For producers, this data should inform how you talk to clients about budgets. When someone says they want to “start a podcast,” the conversation needs to immediately shift to goals. Are they building a brand? Supporting a business? Creating a revenue stream? Each requires different investment levels. The survey shows that 79% of new creators prefer investing time over money, but the data also shows that time-only investment produces limited results. Your job is helping clients understand that trade-off upfront rather than letting them discover it six months in when they’re frustrated by lack of growth.

For the industry, these numbers reveal our biggest weakness: we’ve made podcasting too easy to start and too hard to succeed at. 85% of survey respondents don’t make money from their podcasts. That’s not a sustainable ecosystem. The $10-49 sweet spot suggests there’s a middle path – affordable investment that increases likelihood of success without requiring professional production budgets. The industry should focus on building tools and services at this price point rather than continuing to celebrate how “anyone can podcast” without acknowledging that “anyone can succeed” requires more than a microphone and an idea.

Full Independent Podcaster Survey report available soon at: https://www.thepodcasthost.com

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand's voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

Bonus : TV/Film Podcasts: The Gateway Drug We’re Not Using Enough

The Podwires Rundown: Sounds Profitable just released research on TV and Film podcasts that should change how we think about audience development. Not because it reveals some shocking new behavior, but because it proves something we suspected but rarely act on: companion content works.

Here are the numbers that matter. Among TV/Film podcast consumers, 44% have talked to friends about a TV show after consuming a podcast about it. 43% rewatched the show. 16% purchased a streaming subscription to watch the show. That’s not passive consumption. That’s evangelism. And we’re leaving it on the table.

The study, conducted with Signal Hill Insights and sponsored by True Companions, surveyed 5,034 Americans 18+ in June 2025 – the largest public study of podcasting in America. While TV/Film podcasts currently reach 19% of monthly podcast consumers, the potential audience is dramatically larger. Over 50% of Americans 18+ say they’d be interested in this kind of content. That gap between current and potential audience? That’s opportunity.

The Key Points:

TV/Film podcasts reach 19% of monthly podcast consumers – But 53% of Americans say they’d be likely to listen to a podcast about a favorite TV show or movie

Audience skews male and young – 56% male (vs 49% general population) and 43% ages 18-34 (vs 29% general population), revealing untapped potential among women and older demographics

Audio expectations remain strong – TV/Film podcast consumers expect podcasts to be audio or usually audio at the same rate as general podcast consumers; video isn’t required to reach this audience

High propensity for action – 16% purchased streaming subscriptions to watch shows after consuming related podcasts; 44% talked to friends about the show

Evangelists for podcasting – 79% of TV/Film podcast consumers recommend podcasts to their social circle (vs 68% of general podcast consumers)

Why It Matters: This research proves that podcasts can drive behavior beyond just listening. When 16% of TV/Film podcast consumers purchase streaming subscriptions after hearing about a show, that’s measurable ROI for streaming platforms. When 44% talk to friends about the show, that’s organic marketing that money can’t buy. The industry spends enormous resources on paid acquisition while ignoring companion content as a growth lever. TV/Film podcasts aren’t just content – they’re conversion tools. And right now, most streaming platforms aren’t using them strategically.

The Big Picture: For podcasters, this data suggests TV/Film content is one of the few guaranteed ways to reach people who don’t currently consume podcasts. Over 50% of Americans express interest in this genre, but only 19% of monthly podcast consumers actually listen to it. That’s a massive addressable audience. If you’re trying to grow a show, companion content to existing TV/Film franchises provides built-in audience interest. The research also shows this audience is significantly more likely to consume limited series and look for more shows when those series finish – creating a natural pipeline for podcasters who can deliver quality episodic content tied to streaming releases.

For producers, the strategic opportunity is clear: TV/Film podcasts are gateway content. The audience they attract becomes evangelists (79% recommend podcasts to their social circle). They’re also more likely to watch premium streaming content, both with and without ads. If you’re working with streaming platforms or entertainment brands, this research should be your pitch deck. The data proves companion podcasts drive subscription purchases, increase engagement with original content, and create word-of-mouth marketing. The production workflow is also more defined than traditional podcasts – you have natural episode breaks, built-in talking points from source material, and existing fan communities to tap into.

For the industry, there’s a glaring demographic opportunity. The current TV/Film podcast audience skews heavily male (56%) and young (43% are 18-34). But women are the majority of moviegoers in the US, and people 55+ are overwhelmingly the audience for network and cable TV. We’re making content for the wrong audience while ignoring the people who actually consume the most TV and film. The research also debunks the assumption that TV/Film content requires video – this audience expects audio at the same rate as general podcast consumers. Stop using video as an excuse for not creating companion content.

MORE FROM PODWIRES:

🎙️ EVERYTHING ELSE IN PODCASTING TODAY

How to Grow Your Podcast Using Your Back Catalog: Automated Content Repurposing Guide. Podcasters can revive audience growth by repurposing their back catalog of old episodes into clips, transcripts, and social media content using automated tools that improve discoverability and engagement across platforms.

Audacy announces strategic partnership with NBA superstar Draymond Green. Audacy has partnered with four-time NBA champion Draymond Green and his production company The New Media to manage sales, distribution, and production for “The Draymond Green Show” podcast, which launches its new season October 28, 2025 with twice-weekly episodes featuring basketball analysis and exclusive sports commentary.

fwd. Network Launches Talk Fifty to Me Podcast with Heidi Clements and Constance Zimmer on Aging. AdLarge and the fwd. network have launched “Talk Fifty to Me,” a new podcast hosted by television writer Heidi Clements and actor Constance Zimmer that explores life in your 50s through honest conversations about aging, menopause, reinvention, and women’s empowerment with celebrity guests including Elizabeth Banks and Ricki Lake.

YouTube Offers Voluntary Employee Buyouts as CEO Restructures Product Division Amid AI Disruption. YouTube CEO Neal Mohan announced voluntary employee buyouts with severance packages and restructured the video platform’s product division into three groups—subscription products, viewer products, and creator products—citing artificial intelligence disruption as the driving force behind organizational changes.

Patreon Launches Enhanced Newsletter Tools with Analytics and Custom Branding for Content Creators. Patreon has upgraded its newsletter system with new features allowing creators to embed multiple videos and audio clips, add custom call-to-action buttons, and track email performance through analytics showing open rates, clicks, and revenue generated from each post.

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

🎧 PODCASTING JOB OPPORTUNITIES

CBC/Radio-Canada - Video Producer (On-Site) (English Services)

Spotify - Associate Manager, Creative Operations

Acast - Account Coordinator - Midwest/ East Coast (Remote)

Acast - Producer, Women’s Sports

Global - Junior Video Content Producer

👀 Hiring? Or looking for a new job

Grow your business through podcasting. Marketplace Podwires connects you with skilled producers who can craft compelling stories that align with your brand. Start your podcast journey today! 👈

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it's newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support The Podwires