🎙Spotify's video podcast push drives 500% growth, reshapes independent creator economics

Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

We are thrilled to present the latest edition of Podcast In Brief! And don’t worry, our loyal listeners — you’ll still get the occasional real-time update!

Spotify Wrapped just shattered records with 200 million users in under 24 hours, and the podcast industry is treating platform consolidation like a participation trophy. Here’s what those celebration posts aren’t mentioning: when one company controls how an entire medium defines its annual success, you’re not witnessing growth – you’re watching a monoculture take root.

Thank you to all our free and paid subscribers for continuing to support us. As an independent media organisation, we can only continue our work with the support of readers like you, unlike others who are supported by well-funded organisations.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (5 Decemvber 2025)

🎙️Today, we’ve got the inside scoop on:

Spotify’s video podcast push drives 500% growth, reshapes independent creator economics

DoubleVerify finds AI bots generate 15% of ad clicks, podcast advertisers pay for phantom engagement

Podcast Insight: YouTube unveils podcast rankings as video platform claims Joe Rogan, KILL TONY dominate watch time

PodBusiness : Sounds Profitable data reveals one-third of podcast creators quit entirely, exposing retention crisis

Job Board : Morning Brew Inc - Senior Podcast Campaign Manager

SPOTIFY

Spotify’s video podcast push drives 500% growth, reshapes independent creator economics

Podwires Rundown : Spotify just dropped their Wrapped numbers, and the podcast industry is celebrating platform dominance like it’s a victory for creators. 200 million engaged users in the first 24 hours – a 19% year-over-year jump that makes this the fastest Wrapped ever to hit that milestone. But here’s what nobody’s saying out loud: when one platform controls the narrative of an entire year in podcasting, that’s not just impressive data. That’s a warning shot.

Spotify released their 2025 Wrapped results, revealing record-breaking engagement across music, podcasts, and audiobooks. The data comes from Spotify’s internal analytics and announcements from Marc Hazan (SVP Marketing and Partnerships) and Grace Cutler (Analyst, TrailRunner International), showcasing both consumer behavior patterns and creator insights that dominated the platform throughout the year.

The Key Points:

Spotify Wrapped 2025 hit 200 million engaged users within ~24 hours (compared to 62 hours in 2024), representing a 19% year-over-year increase, with over 500 million shares marking a 41% YOY jump

More than 80% of the Top 50 U.S. podcasts now feature video episodes, while total video podcasts in the U.S. Top 50 increased nearly 500% from 2023 to 2025

Top 20 video podcasts on Spotify grew consumption by 24%+ since December 2024, with nearly half a million video shows now available on the platform

The Joe Rogan Experience topped the global podcast charts, followed by The Diary Of A CEO and The Mel Robbins Podcast, while comedy and culture commentary continue dominating listenership

For the first time, Spotify integrated podcast and audiobook listening habits into consumer Wrapped experiences, giving fans personalized insights and direct messages from their top creators.

Why It Matters: Spotify’s Wrapped data reveals how completely one platform has captured the podcast discovery and consumption experience – which fundamentally changes leverage dynamics between creators and distributors. The explosive growth in video podcast adoption (500% increase in two years) isn’t happening because audiences demanded it; it’s happening because Spotify’s algorithm and features reward it. When 80% of top shows now include video, that’s not organic evolution. That’s platform pressure creating a new baseline expectation that independent creators must meet to compete, regardless of whether video actually serves their content or audience.

The Big Picture : For podcasters and producers, this data exposes an uncomfortable reality: you’re building on rented land, and the landlord just changed the lease terms. The shift to video podcasting isn’t about what works best for your show – it’s about what Spotify’s infrastructure prioritizes. Top 20 video podcasts growing 24% since December tells you exactly what gets algorithmic advantage. Fair play to those shows, but here’s the part nobody wants to admit: adding cameras, lighting, and video editing workflows doesn’t just increase production costs. It fundamentally changes what you’re making and who can compete.

Independent audio creators face a choice: invest thousands in video production to chase platform favorability, or accept diminished discovery on the platform that just demonstrated it controls year-end cultural moments for 200 million users. The Golden Globes introducing a Best Podcast category sounds like validation for the medium, but which shows do you think will get nominated? The ones with pristine video production that Spotify’s algorithm already surfaces.

The actionable reality: if you’re producing audio-only content, you need distribution diversification yesterday. Spotify’s Wrapped dominance proves they own the discovery experience, but they don’t own your audience relationship. Focus on owned channels – email lists, SMS, Discord communities – where you control access. Yes, stay on Spotify, but stop treating platform metrics as the measure of your show’s value. The 41% of Gen Z who still primarily listen to audio? They exist. They’re just invisible in Spotify’s video-first marketing narrative.

Let that sink in.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

DOUBLEVERIFY

DoubleVerify finds AI bots generate 15% of ad clicks, podcast advertisers pay for phantom engagement

Podwires Rundown : DoubleVerify’s Fraud Lab just published research that should make every podcast advertiser question their last campaign report. In unprotected media, AI bots account for up to 15% of all ad clicks – and in certain testing scenarios, an ad click was 10 times more likely to come from an AI bot than a human. These aren’t malicious fraud schemes. They’re crawlers, scrapers, and AI agents doing exactly what they’re programmed to do: learning, testing, gathering data. But here’s the part nobody in the measurement industry wants to say out loud: you’re paying for engagement that will never convert, and your attribution models are treating bot clicks like validated consumer interest.

DoubleVerify released findings from their Fraud Lab team examining AI bot activity in digital advertising, coinciding with the launch of their DV AI Verification™ tools announced in November 2024. The research, detailed in technical commentary by Lead Fraud Analyst Lia Bader, analyzed nearly two billion AI-driven interactions monthly to assess how automated traffic affects ad campaign performance and measurement accuracy across programmatic platforms.

The Key Points:

AI bots generate up to 15% of all clicks on unprotected media, with certain research studies showing ad clicks were 10X more likely to come from AI bots than humans, creating general invalid traffic (GIVT) that distorts campaign metrics

DoubleVerify tracks nearly two billion AI-driven interactions monthly, detecting both declared AI activity and evasive bots that manipulate credentials to masquerade as human engagement across multiple platforms

Highly evasive mobile scrapers generate over 10 million invalid impressions daily, with one bot variant observed “hopping” between 40 different local news sites in a single day while scraping content without conversion potential

AI-powered browsers like Perplexity’s Comet produce dozens of “clicking” and “searching” interactions while shopping autonomously, creating engagement metrics that may have business value but inflate click counts without human involvement

While some AI bots declare themselves transparently enough for exclusion from impression metrics, others alter credentials or mix different bot activity types requiring sophisticated detection to prevent massive distortion of engagement measurement and campaign optimization

Why It Matters: Podcast advertisers operate in an ecosystem where programmatic buying, dynamic ad insertion, and performance attribution depend entirely on accurate engagement data. When 15% of your clicks come from bots scraping content for AI training or testing user journeys 24/7, your cost-per-click calculations are fiction. Your attribution models are crediting conversions to traffic sources that never had conversion potential. Your optimization algorithms are chasing engagement patterns from entities that will never buy podcast subscriptions, mattresses, or meal kits. This fundamentally breaks the value exchange between podcasters, advertisers, and measurement providers – because everyone’s reporting success based on contaminated data.

The Big Picture: For podcasters and producers working with programmatic advertising or performance-based deals, this research exposes why your CPMs remain stubbornly low despite “strong engagement.” Advertisers are paying for bot clicks, getting burned on ROI, and then devaluing podcast inventory across the board. Fair play to DoubleVerify for building detection tools, but here’s the uncomfortable part: most podcast ad tech stacks don’t have sophisticated invalid traffic filtering. Your hosting platform reports downloads. Your ad server reports impressions. Your attribution partner reports clicks. None of them are screening for the AI bots that DoubleVerify found scraping 40 news sites in a single day.

The actionable reality for podcasters: demand transparency on invalid traffic filtering from every partner in your ad tech stack. If your programmatic provider can’t tell you their GIVT and SIVT detection methodology, you’re selling contaminated inventory. If your attribution partner isn’t screening for AI agent activity, your performance reports are fantasy novels. The 10X bot-to-human click ratio didn’t happen overnight – it’s been building while the industry celebrated “programmatic growth.”

For podcast producers working with direct-sold sponsorships, this is your competitive advantage. Host-read ads with promo codes and dedicated landing pages create attribution clarity that programmatic can’t match when 15% of its engagement is artificial. Use this data in your pitch decks. Brands are getting destroyed by bot clicks in programmatic – show them how your direct relationship and conversion tracking eliminates the bot tax they’re paying everywhere else.

The industry keeps pushing “data-driven advertising” like it’s an innovation. But data-driven decisions made on bot-contaminated data aren’t strategic – they’re expensive mistakes with impressive dashboards. Podcast advertising’s value proposition has always been authentic human connection. Turns out that’s not just compelling creative positioning. It’s the last refuge from an ad ecosystem where algorithms are literally talking to themselves.

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

YOUTUBE

YouTube unveils podcast rankings as video platform claims Joe Rogan, KILL TONY dominate watch time

Podwires Rundown : YouTube released their 2025 trending lists to celebrate the platform’s 20th anniversary, and the podcast rankings should make every industry executive question what “success” even means anymore. Joe Rogan topped YouTube’s U.S. podcast chart based on total watch time, followed by KILL TONY in second place and Good Mythical Morning in third. But here’s where it gets messy: Spotify dropped their Wrapped data days earlier showing Steven Bartlett beating Rogan in the UK, while KILL TONY – YouTube’s #2 show – doesn’t appear anywhere in Spotify’s global top 10. We’re not measuring the same medium anymore. We’re measuring which platform’s algorithm surfaced which content most effectively, and calling it industry achievement.

YouTube announced their End Of Year Trending Lists alongside the launch of YouTube Recap, their first-ever personalized viewing summary feature, with podcast rankings compiled by Kevin Allocca (Global Director of YouTube Culture & Trends) and the YouTube Culture & Trends team. The data, released via PR from Mackensie (YouTube team), ranks podcasts based on total watch time in the U.S. throughout 2025, excluding clips and Shorts, revealing significant platform-specific differences in podcast consumption patterns.

The Key Points:

The Joe Rogan Experience topped YouTube’s U.S. podcast rankings based on total watch time, followed by KILL TONY in second place and Good Mythical Morning in third, with rankings measured exclusively through full-length video playlist consumption

KILL TONY’s #2 position on YouTube contrasts sharply with its complete absence from Spotify’s global top 10, while The Diary of a CEO ranked #10 on YouTube but topped Spotify’s UK charts, demonstrating platform-specific audience fragmentation

YouTube launched YouTube Recap for the first time, providing users with personalized viewing summaries including up to 12 cards spotlighting top channels, interests, viewing habits, and personality types, directly competing with Spotify’s established Wrapped experience

The rankings methodology excludes clips and Shorts, measuring only full podcast playlist watch time, creating fundamentally different success metrics than Spotify’s approach which counts streams across audio and video

YouTube’s 20th anniversary positioning emphasizes the platform as “the ultimate engine for shared pop culture experiences,” with Kevin Allocca highlighting how creators “propel” content “into global phenomena” through the platform’s distribution infrastructure

Why It Matters: The podcasting industry now has competing definitions of success from the two platforms that control most podcast video distribution, and there’s no reconciliation between them. YouTube measures watch time of full episodes, Spotify measures streams and engaged users across formats, and neither metric captures the open RSS ecosystem where millions of listeners consume content through independent apps. When KILL TONY ranks #2 on one platform and doesn’t crack the top 50 on another, that’s not just measurement variance – it’s proof that “podcast charts” have become platform scorecards rather than industry benchmarks. Advertisers making budget decisions and creators evaluating performance are comparing incompatible data sets while pretending they measure the same success.

The Big Picture: For podcasters and producers, this data exposes the uncomfortable reality of platform balkanization disguised as industry growth. You don’t have one show anymore – you have multiple shows with different performance profiles across different platforms. KILL TONY’s #2 YouTube ranking proves that live comedy podcasts with visual elements dominate video consumption, but that same show’s Spotify absence suggests their audience lives exclusively on YouTube. Fair play to Tony Hinchcliffe for building something that works in YouTube’s ecosystem, but here’s the part nobody wants to admit: optimizing for YouTube watch time requires completely different content strategies than optimizing for Spotify streams.

The Diary of a CEO appearing at #10 on YouTube but #1 on Spotify UK tells you exactly what each platform prioritizes. YouTube rewards visual engagement and watch time – the algorithm surfaces content that keeps people on the platform. Spotify rewards streams and repeat listening – the algorithm surfaces content that drives habitual consumption. Same show, radically different platform strategies, completely incompatible success metrics.

The actionable reality for podcasters: you need to decide which platform you’re actually optimizing for, because trying to serve both equally is burning resources. If your content naturally includes strong visual elements, compelling on-camera presence, or live audience dynamics, YouTube’s watch time methodology favors you. If your content works better as background audio with high replay value, Spotify’s streaming model rewards you. Trying to split the difference – adding cameras to an audio-first show just for “distribution optionality” – often results in mediocre performance on both platforms.

For podcast producers, notice what’s NOT in either chart: independent shows without video infrastructure, audio-only creators, regional podcasts serving specific communities. Good Mythical Morning ranking #3 on YouTube isn’t surprising – it’s a highly produced, video-native show with years of YouTube optimization. But calling it a “podcast” stretches the definition to include any long-form video content with episodic structure. At what point does the word “podcast” just mean “serialized video content” on YouTube while meaning “on-demand audio” on Spotify?

Here’s the part that should concern anyone invested in open podcasting: both platforms launched competing “Recap” experiences this year, directly copying each other’s year-end personalization features. YouTube Recap gives users personalized viewing summaries with “personality types” based on watch history. Spotify Wrapped shows listening habits and top creators. Neither platform surfaces data about RSS consumption, cross-platform listening, or the broader podcast ecosystem. They’re training audiences to measure their podcast year through proprietary platform metrics, not through the medium itself.

The fragmentation creates strategic confusion. An advertiser seeing KILL TONY at #2 on YouTube might allocate significant budget, only to discover that show’s audience doesn’t exist on Spotify where their attribution tracking lives. A creator celebrating top 10 placement on Spotify UK might miss that their YouTube performance is weak, limiting video sponsorship opportunities. The industry keeps talking about “multi-platform strategies” like it’s sophisticated distribution, but we’re really just admitting that no single measurement standard exists for podcasting anymore.

For advertisers reading this: when you see “top podcast” claims, immediately ask “on which platform, using what methodology?” YouTube’s watch time rankings favor different content than Spotify’s stream counts, and neither captures the millions of listeners using Apple Podcasts, Overcast, Pocket Casts, or other RSS clients. The show ranked #2 on one platform might not register on another – which means your CPM calculations and attribution models need platform-specific strategies, not universal “podcast advertising” approaches.

The uncomfortable truth? Podcasting didn’t become mainstream in 2025. Two closed platforms competing for video-forward content distribution became mainstream, and we’re calling it podcasting because the shows happen to release episodically and sometimes include conversation. YouTube’s 20th anniversary positioning as “the ultimate engine for shared pop culture experiences” isn’t wrong, but it’s sure as hell not open podcasting. It’s YouTube celebrating YouTube’s distribution power, exactly like Spotify Wrapped celebrates Spotify’s platform dominance.

When Kevin Allocca says creators “propel content into global phenomena,” what he means is: YouTube’s algorithm propels content that serves YouTube’s business model into YouTube’s user base. Same thing Spotify does with their algorithmic recommendations and editorial curation. Nothing wrong with that – they’re platforms, not charities. But let’s stop pretending platform-specific charts measure podcasting success when they really measure platform lock-in effectiveness.

The industry wanted mainstream acceptance. We got platform fragmentation with competing measurement standards and no universal truth about what constitutes success.

SOUNDS PROFITABLE

Sounds Profitable data reveals one-third of podcast creators quit entirely, exposing retention crisis

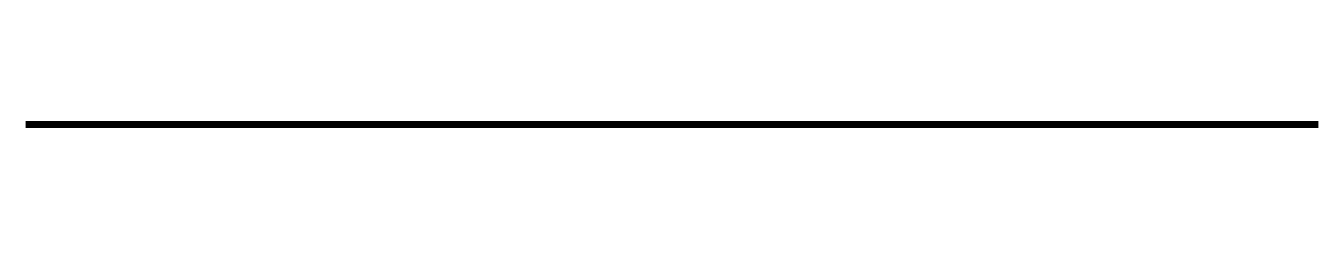

Podwires Rundown: Tom Webster from Sounds Profitable just published something that should make every podcast network and platform executive deeply uncomfortable. Nearly one in six podcast consumers have tried making a podcast – genuine mainstream adoption of creation tools – but a third of everyone who’s ever created has completely churned out of being a creator. Not stopped one show to start another. Stopped creating entirely.

The industry keeps obsessing over “podfade” like individual shows ending represents failure, when the actual crisis is creator fade: people leaving podcasting altogether after discovering the fantasy was better than the reality.

Tom Webster, Partner at Sounds Profitable, published analysis from the upcoming “The Creators 2025” study examining podcast creator behavior and retention patterns. The research, scheduled for full release December 10th at 2PM Eastern, provides data on creator adoption rates, current activity levels, and churn patterns among people who have attempted podcast creation, revealing significant retention challenges beyond individual show endings.

The Key Points:

Nearly 1 in 6 podcast consumers have tried creating a podcast, demonstrating genuine mainstream adoption of creation tools beyond the early era when podcast production was limited to tech enthusiasts and radio refugees

Of those who have created podcasts, 12% are currently active creators while 6% are “lapsed creators” who have stopped creating entirely, meaning roughly one-third of everyone who has ever created a podcast has churned out of the ecosystem

The distinction between ending a show versus leaving creation entirely matters enormously – creators who end Show A and start Show B remain in the ecosystem developing skills and advocating for the medium, while lapsed creators represent lost voices and evangelists

Current active creators split roughly evenly across formats: 3% audio-only, 4% video-only, and 4% multi-format, suggesting the market hasn’t decided which approach succeeds and multiple strategies remain viable

The data challenges the industry’s focus on “podfade” (individual shows ending) by reframing the conversation around creator retention and understanding why people walk away from podcast creation altogether despite lowered technical barriers

Why It Matters: The podcasting industry measures success through listener growth, download numbers, and platform adoption – but completely ignores creator retention as a strategic priority. When a third of people who try making podcasts quit entirely, that’s not just a content supply issue. It’s proof that the industry’s “democratized creation tools” narrative is a lie. The barriers haven’t actually fallen. They’ve just shifted from technical complexity to audience discovery, monetization viability, and the grinding reality that most creators will spend months producing content for dozens of listeners while platforms celebrate billions of streams going to the top 50 shows. The churn rate exposes what nobody wants to admit: podcasting sold people a dream about accessible creative expression, then failed to provide the infrastructure that makes sustainable creation possible.

The Big Picture: For podcasters and producers still actively creating, this data explains why your “community” feels smaller every year despite the industry’s growth narratives. A third of the people who started this journey with you have quit. Fair play to Tom Webster for actually measuring this, but here’s the uncomfortable part: the industry created this churn through systematic neglect of creator needs while obsessing over listener acquisition.

Think about what pushes creators out. The 3% audio-only / 4% video-only / 4% multi-format split tells you the industry hasn’t provided clear guidance on what actually works – everyone’s experimenting, burning resources, and getting conflicting advice from platforms that change distribution priorities every quarter. Spotify pushes video. YouTube rewards watch time. Apple Podcasts prioritizes... what, exactly? Nobody knows anymore, so creators waste months optimizing for the wrong metrics on the wrong platforms while their motivation evaporates.

The discovery problem remains unsolved. Nearly 1 in 6 podcast consumers trying creation means millions of shows launched with zero realistic path to audience. Platforms don’t surface new creators. Algorithms favor established shows. Networks hoard promotion for owned content. Independent creators get told “just be consistent and build your audience” – which is industry code for “suffer in obscurity for years while we monetize the top 1% of shows and call it democratization.”

The monetization failure is particularly brutal. How many of those lapsed creators quit because they realized three years of consistent weekly publishing might generate enough revenue for one coffee per month? The industry celebrates programmatic advertising growth and host-read CPM rates, but 90% of creators never see meaningful monetization. They’re producing free content that generates data for platforms and fills out “long tail” diversity metrics in industry presentations, while burning hundreds of hours for zero financial return.

Here’s what really happened: podcasting sold creation as self-expression, then structured the ecosystem to benefit platforms and established creators exclusively. The tools are free or cheap – sure. But distribution is controlled. Discovery is algorithmic. Monetization requires scale most creators will never achieve. And the industry response to creator churn is... arguing about whether video is mandatory? REALLY? Yes. Really.

The actionable reality for podcast producers: if you’re still creating after the first year, you’ve survived the highest-risk churn period, but that doesn’t mean the industry’s infrastructure improved. The format split (3/4/4% across audio/video/multi-format) shows there’s no consensus winning strategy, which means you’re navigating based on guesswork rather than established best practices. Focus on owned audience channels – email lists, Discord communities, direct supporter relationships – because platform dependency is what kills creator motivation when algorithm changes tank your reach overnight.

For podcast networks and platforms reading this: a 33% creator churn rate is a retention crisis that should terrify you. Every lapsed creator is someone who tried your platform, invested time learning your tools, and concluded the value exchange wasn’t worth it. They’re not coming back. They’re also not recommending podcasting to friends. They’re telling people “I tried that, it didn’t work” – which directly undermines your listener acquisition efforts when potential audience members hear creation stories that end in frustration rather than success.

The industry loves celebrating democratized creation without acknowledging that democratized access to tools is meaningless without democratized access to audience and monetization. You can give everyone a microphone, but if only 1% of creators can actually build sustainable shows, you haven’t democratized the medium – you’ve just created a larger pool of unpaid content generators who eventually burn out and leave.

Tom Webster says he’ll dig into causes in a future piece when the full study releases December 10th. Here’s my prediction: the data will show creators leave because podcasting promised community and delivered isolation, promised creative expression and delivered algorithmic optimization homework, promised opportunity and delivered unpaid labor. The 12% still actively creating aren’t succeeding because they’re better – they’re surviving because they either achieved enough scale to make it sustainable, or they’re willing to treat podcasting as an expensive hobby indefinitely.

The “real” podfade isn’t about shows ending. It’s about an industry that recruited millions of creators with aspirational narratives, then built an ecosystem that systematically fails everyone outside the top percentile. When a third of people who try creating quit entirely, that’s not individual failure – that’s infrastructure failure at industry scale.

SIGNAL HILL

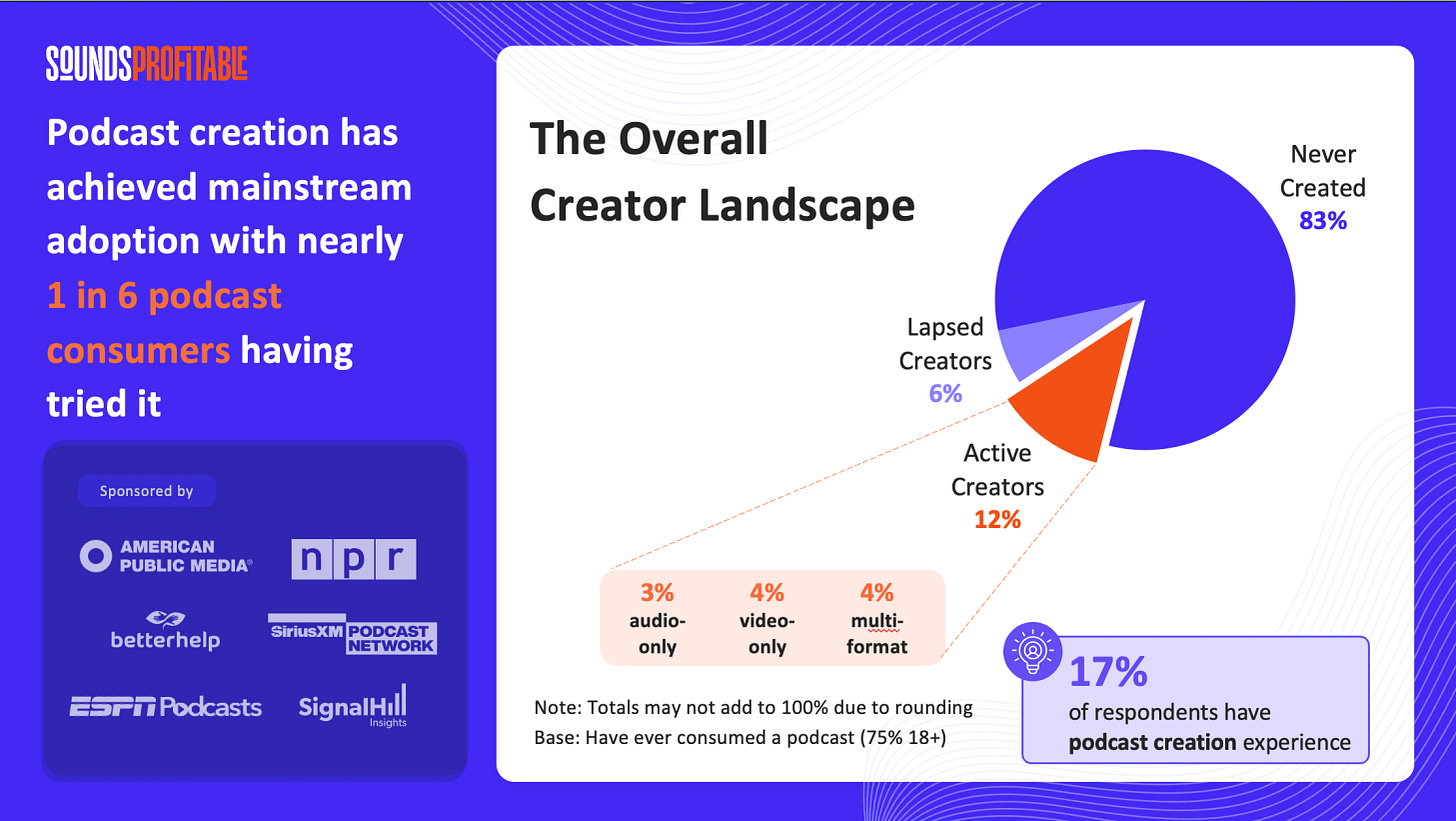

Signal Hill data shows 59% of consumers expect audio-only podcasts, down from 67% in two years as video viewing concentrates at home

Podwires Rundown: Paul Riismandel from Signal Hill Insights just asked a question that sounds absurd until you realize it’s deadly serious: when was the last time you reminded your audience they can listen to just the audio of your show?

In two years, the percentage of podcast consumers who expect podcasts to be primarily audio dropped from 67% to 59% – and among brand-new listeners who started in the past 60 days, only 52% think podcasts are audio-first.

But here’s the part that should terrify every podcaster celebrating video growth: half of weekly podcast consumers now prefer video podcasts “you actively watch,” and 88% of them consumed their last podcast at home. Podcasting was literally named after a portable device, built around the freedom to consume content anywhere. Video is systematically destroying that value proposition, one couch-bound viewer at a time.

Paul Riismandel, President of Signal Hill Insights, published analysis drawing from multiple Signal Hill research studies including The Podcast Landscape (2023-2025 editions conducted with Sounds Profitable) and the Fall 2025 Download on Podcasts (conducted with Cumulus Media). The research tracks shifting consumer expectations about podcast format and consumption contexts, revealing how video podcast growth is changing where and how audiences engage with podcast content.

The Key Points:

The percentage of monthly podcast consumers who expect podcasts to be “audio-only” or “usually audio-only” dropped from 67% in 2023 to 64% in 2024 and 59% in 2025, with brand-new listeners (past 60 days) showing even lower audio expectations at 52% in 2025

Half of weekly podcast consumers now prefer video podcasts “you actively watch,” and 88% of this group consumed their last podcast at home, compared to 79% overall, demonstrating how video preference concentrates consumption in stationary contexts

Podcast consumers who prefer audio-only are nearly twice as likely to have consumed their last podcast in a vehicle (21% vs. 11% overall) and a full third consumed outside the home, while video-preferring listeners and newcomers show significantly lower mobile consumption patterns

Smart TVs have become the second most commonly used device for podcasts among weekly consumers (35% use them, 12% used them for their last podcast), ranking only behind smartphones as video viewing shifts podcast consumption to living room contexts

Among YouTube podcast consumers, 52% listen to the same shows on other platforms specifically to access podcasts in contexts where they can only listen, but the remaining 48% who don’t migrate off YouTube are missing opportunities for on-the-go consumption

Why It Matters :Podcasting’s original value proposition was portability – media you could consume with just your ears while doing literally anything else. Video is fundamentally incompatible with that advantage because you need your eyes on the screen, which rules out driving, walking, household chores, work tasks, exercise, and thousands of other activities where audio podcasts thrived. When 88% of video-preferring podcast consumers (half the weekly audience) are confined to home consumption, that’s not format evolution – that’s behavior regression. The industry is trading podcasting’s unique competitive advantage (accompaniment during daily activities) for direct competition with YouTube and streaming video, where podcasts have no structural edge whatsoever.

The Big Picture : For podcasters and producers, this data exposes a catastrophic strategic mistake disguised as growth. You invested in cameras, lighting, and video production to chase platform algorithms, and the result is an audience that can only consume your content while sitting at home. Fair play to the creators who built video-native shows from the beginning, but here’s the uncomfortable part: most podcasters added video to audio shows without realizing they were fundamentally changing their value proposition.

Think about what made podcasting special. iPods and MP3 players let you take internet content anywhere for the first time – not tethered to a computer, not confined to places with screens. The entire medium was built around liberation from location constraints. You could listen while commuting, exercising, cooking, working, cleaning, shopping, or doing literally any activity that left your ears free but required your eyes for something else. That’s not nostalgia – that’s a massive competitive moat that video systematically destroys.

The 21% of audio-only preferrers who consumed their last podcast in a vehicle versus 11% overall tells you everything. Audio listeners are mobile listeners. They’re consuming more podcasts in more contexts because the format accommodates their lives. Video listeners are stuck at home watching on smart TVs because that’s the only practical consumption context when you need your eyes on the screen.

Here’s what really happened: platforms pushed video because video generates better engagement metrics, commands higher ad rates, and competes directly with their streaming video rivals. YouTube doesn’t care that video kills portability – they’re a video platform. Spotify doesn’t care that video confines consumption to home – they’re competing with YouTube. But podcasters? You should care enormously that half your audience now expects video content that they can only practically consume while stationary at home.

The actionable reality for podcasters: if you’ve invested heavily in video production, you’re not wrong to do it – the platforms reward video and audiences increasingly expect it. But here’s what you’re missing: only 52% of YouTube podcast viewers migrate to other platforms for audio consumption. The other 48% are YouTube-only, which means they’re consuming your content exclusively in contexts where video is practical. You’ve lost them for commutes, workouts, household chores, and every other on-the-go opportunity where audio podcasts build habitual consumption.

Paul Riismandel’s advice is dead simple: tell your audience explicitly that they can find your show “wherever you get your podcasts,” and specifically mention audio-focused platforms that let them take it on-the-go. But let’s be honest about why this advice is necessary: new podcast consumers don’t know podcasts are available as audio because the entire industry has spent three years screaming about video requirements without explaining that audio versions still exist.

The 8-point drop in two years (67% to 59% expecting audio) accelerating among new listeners (52%) shows exactly where this is headed. Every new cohort of podcast consumers enters with less audio expectation and more video preference, which means the next generation of podcast listeners won’t think of podcasts as portable media at all. They’ll think of them as video content you watch at home on your TV or phone, competing directly with Netflix, YouTube, and every other streaming service.

For the industry overall, this represents a strategic disaster hiding behind growth metrics. Yes, video helped expand total podcast consumption. Yes, platforms are celebrating engagement numbers. But you’ve traded podcasting’s unique structural advantage for undifferentiated competition in the crowded streaming video market. When someone’s sitting at home deciding what to watch, why would they choose a podcast over prestige TV, YouTube videos, or movies? Audio podcasts won that battle by not fighting it – they occupied the on-the-go consumption moments that video couldn’t serve.

The smart TV data is particularly revealing. 35% of weekly podcast consumers now use smart TVs, with 12% using it for their last podcast. That’s not podcast evolution – that’s podcasts becoming another streaming video category. Nothing wrong with that strategically if you’re building video-native content from scratch. Everything wrong with it if you’re an audio podcast that added video thinking it was “just expanding distribution options” without realizing you were fundamentally changing consumption behavior.

Here’s the part nobody wants to admit: the industry sold creators on video as additive, when it’s actually substitutive. You didn’t add video viewers while keeping audio listeners – you converted audio listeners into video viewers who can now only consume your content in stationary contexts. The 73% of YouTube podcast viewers who say they use other platforms specifically to access podcasts in audio-only contexts proves they understand audio’s advantages. But the 48% who don’t migrate? They’re the canary in the coal mine showing you what happens when video becomes the expected default.

Riismandel frames this as “promoting the freedom of choice” so fans can “watch at home from their couch, or listen to the same show while walking the dog.” That’s the optimistic version. The pessimistic version is that you’re fighting against three years of industry messaging that told everyone podcasts require video, and now you’re trying to re-educate audiences about capabilities they used to take for granted.

The fundamental question: is podcasting’s future as a portable audio medium that enhances daily activities, or as video content that competes with every other streaming service for couch time? The industry already decided – they chose video. But they forgot to tell creators that this choice means abandoning the competitive advantage that made podcasting viable in the first place. You can’t be the “anywhere, anytime” medium when half your audience can only consume content while sitting at home staring at a screen.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

Acast - CRM Manager

Acast - Praktikum im Bereich Podcast Marketing

Morning Brew Inc - Senior Podcast Campaign Manager

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.