Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

If you love travel, check out our sister publication “Mencari’s Travel Wire”

👋 Hi, Podsky!

We’re asking our readers: continue supporting independent podcast creators. Subscribe, share their work, and help ensure vital community spaces like this one can thrive.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (February 15 2026)

🎙️Today, we’ve got the inside scoop on:

Acast Reports First Profit as Revenue Per Listen Jumps 21%

Podscribe Launches Ranking Tools to Track Emerging Podcast Shows, Advertisers

Celebrity Privilege and the Myth of Podcast Discovery: What Edison's Top 10 Really Tells Us

Podcast Insight: Spotify Reports Record Quarter, Omits Podcasting From Earnings Announcement

PodBusiness : Audacy Reports Sports Radio Surpasses TV in Fan Engagement Study

Job Board : ARN - Group Digital Director

ACAST

Acast Reports First Profit as Revenue Per Listen Jumps 21%

Podwires Rundown : Acast just announced their first profitable year ever. The celebration masks an uncomfortable reality about how podcast platforms actually make money.

The Swedish podcast hosting and advertising giant reported Q4 2025 results showing 27% revenue growth driven almost entirely by North America, where sales jumped 50%. Sounds impressive until you examine how they got there. Listens increased just 5% while Average Revenue Per Listen (ARPL) surged 21% to SEK 0.66. CEO Greg Glenday credited “upstream engagement” - influencing advertiser budgets earlier in the planning cycle. The company also acquired German studio Wake Word Studios and reported positive adjusted operating profit and cash flow for the first time in its history.

The Key Points:

Acast’s revenue grew 27% in Q4 2025, but total listens increased only 5% year-over-year

Average Revenue Per Listen jumped 21% to SEK 0.66, explaining the revenue growth despite flat audience numbers

North America drove 50% revenue growth and now represents 32% of total revenue, while European markets grew just 16%

Acast achieved first-ever profitable year with adjusted EBIT margin of 1% and positive operating cash flow of SEK 62m

The company’s “upstream engagement” strategy targets advertiser budgets earlier, combined with acquisitions of Wonder Media Network and Wake Word Studios

Why It Matters

Acast’s profitability blueprint reveals the podcast platform playbook: growth comes from extracting more revenue per listen, not expanding audiences. This 21% increase in what advertisers pay per listen didn’t materialize because your podcast suddenly became more valuable - it came from Acast positioning itself earlier in advertiser planning cycles and consolidating production capabilities through acquisitions. When platforms celebrate squeezing more money from the same audience size, creators need to ask the uncomfortable question: where’s my cut of that 21% increase?

The Big Picture

For podcasters, Acast’s results expose the economics of platform dependency. Your show’s download numbers stayed flat, but the platform increased revenue per listen by 21%. Fair play to Acast for finding efficiency, but this creates a fundamental misalignment - platforms profit by maximizing advertiser spending while creators compete for scraps of that growing pie. The “upstream engagement” strategy is particularly revealing: Acast is positioning itself as the primary relationship holder with advertisers, not you.

Producers should recognize this as the inevitable evolution of platform economics. Once a hosting company reaches scale, growth shifts from audience expansion to revenue optimization. Acast’s 5% listen growth versus 21% ARPL increase isn’t a bug - it’s the feature. The German acquisition of Wake Word Studios signals vertical integration: controlling content production, distribution, and ad sales. This gives Acast more leverage with advertisers but potentially less urgency to grow individual show audiences.

Here’s the uncomfortable part: Acast’s first profitable year validates a business model built on increasing what advertisers pay while audience growth stagnates. Let that sink in. The industry celebrates platform profitability, but creators should ask whether their CPMs increased 21% last year. The answer reveals who’s really capturing value in this ecosystem.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

SPOTIFY

Spotify Reports Record Quarter, Omits Podcasting From Earnings Announcement

Podwires Rundown : Spotify just reported its best quarter ever. Notice what they didn’t mention? Podcasting.

The streaming giant announced Q4 2025 earnings showing 751 million monthly active users and €4.5 billion in revenue, hitting operating income of €701 million. CEO Daniel Ek framed Spotify as “a technology platform for audio—and increasingly, for all the ways creators connect with audiences,” emphasizing AI, wearables, and new interfaces.

Co-CEO Alex Norström declared 2026 “the Year of Raising Ambition.” The earnings release devoted extensive sections to music videos, audiobooks, Wrapped statistics, and a partnership with Bookshop.org. Podcasting? Mentioned exactly zero times in the announcement, beyond a passing reference to the Spotify Partner Program expanding to Nordic countries.

The Key Points:

Spotify reached 751 million monthly active users (11% growth) and 290 million premium subscribers, with Q4 delivering the highest MAU net additions in company history

The company paid $11 billion to the music industry in 2025, the largest annual payment from any retailer, with independent artists accounting for half of all royalties

Spotify’s Q4 earnings announcement mentioned podcasting zero times, focusing instead on music videos, audiobooks, Wrapped, and “technology platform” positioning

Music videos expanded to Premium users in the U.S. and Canada, while audiobooks in Premium launched in five new countries with features like Page Match connecting physical books to audio

Leadership framed 2026 as the “Year of Raising Ambition,” emphasizing AI, new interfaces, and solving “hard problems” across music, books, video, and live events

Why It Matters

When the world’s largest podcast platform reports record earnings without mentioning podcasting, it tells you exactly where podcasts rank in their strategic priorities. Spotify spent years convincing the industry that exclusive content and hundred-million-dollar creator deals represented the future of podcasting. Now they’re pivoting to music videos, audiobook features that scan physical pages, and positioning themselves as a generalist technology platform. For podcasters who built audiences on Spotify expecting platform investment and promotion, this earnings call is your wake-up notification: you’re a footnote in someone else’s growth story.

The Big Picture

For podcasters, Spotify’s silence speaks volumes about platform dependency risk. The company that spent billions acquiring podcast studios and exclusives now frames its future around AI interfaces, music video catalogs, and connecting Bookshop.org to audiobooks. Fair play—they’re a business optimizing for growth. But if you’re a podcast creator banking on Spotify’s continued investment in discovery, promotion, or creator tools, this earnings release shows you where you actually sit in the priority queue. Below music videos. Below audiobook page-matching features. Below venue search functionality.

Producers need to recognize this platform evolution pattern. Spotify entered podcasting through aggressive acquisition, claimed they were building infrastructure for creators, then quietly de-prioritized the medium once it became clear the unit economics didn’t match music streaming. The $11 billion paid to the music industry in 2025 towers over whatever podcasters collectively earned on the platform. The Spotify Partner Program expansion to Nordic countries got one sentence. Music videos got three paragraphs.

Here’s the uncomfortable part: Spotify’s “technology platform for audio” vision positions podcasting as just another content format competing for attention alongside music, audiobooks, videos, and whatever else generates engagement metrics. Your podcast isn’t special to them—it’s inventory. The platform celebrated paying out $11 billion to music while remaining strategically silent about podcast creator earnings. Let that sink in.

The earnings call reveals Spotify’s actual 2026 ambitions, and podcast-specific innovation isn’t among them. Podcasters should plan accordingly, diversifying distribution and building direct audience relationships rather than depending on a platform that just told you—through conspicuous silence—exactly how much your medium matters to their future.

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

AUDACY

Audacy Reports Sports Radio Surpasses TV in Fan Engagement Study

Podwires Rundown : Audacy just released research proving sports radio beats TV for fan engagement. The data comes from Audacy studying Audacy markets to sell Audacy advertising. Let that sink in.

The bankrupt broadcaster’s “2026 State of Audio: Sports Fandom” report claims diehard fans are 1.4 times more likely to tune into pre- and post-game shows on radio than TV, with 79% saying sports make them feel part of a community. Audacy now ranks #1 in sports talk reach across radio and TV, surpassing ESPN and FS1, according to Nielsen-Scarborough data cited in the report.

The company operates 40 all-sports stations and claims 43 million monthly listeners across its sports portfolio. Eight of the top 10 most sports-obsessed markets are Audacy markets. The report, sourced from Nielsen-Scarborough, Edison Research’s “Share of Ear,” and Crowd React Media’s “State of Sports Media,” demonstrates that sports audio drives measurable web traffic lifts ranging from 10% for automotive to 105% for financial services on air days versus off-air days.

The Key Points:

Diehard sports fans are 1.4x more likely to tune into pre- and post-game shows on radio than TV, with many muting national broadcasts to follow local radio calls

81% of avid NFL fans are sports talk radio listeners, and 79% say sports make them feel part of a community

Audacy claims #1 sports talk reach across radio and TV, surpassing ESPN and FS1, according to Nielsen-Scarborough data

Sports audio drives web traffic lifts on air days: +105% for financial services, +42% home improvement, +22% grocery, +10% automotive

Eight of the top 10 most sports-obsessed markets are Audacy markets, with the company operating 40 all-sports stations reaching 43 million monthly listeners

Why It Matters

When a company that filed for Chapter 11 bankruptcy in 2024 releases research proving its own product’s superiority, advertisers should read the methodology carefully. Audacy’s report measures engagement in markets where Audacy dominates sports radio, using metrics that favor audio consumption over video viewership. The findings aren’t wrong—passionate fans do engage deeply with sports audio—but the framing conveniently ignores the structural challenges facing traditional sports radio: fragmenting audiences, declining ad revenues, and the reality that Audacy needed bankruptcy protection to restructure $1.6 billion in debt while making these claims about market leadership.

The Big Picture

For podcasters, Audacy’s research reveals the desperation of legacy broadcast defending territory against digital fragmentation. Fair play—the data about fan engagement and community connection is real. Sports fans do build emotional relationships with local voices, and audio does provide unique intimacy during game coverage. But notice what the report doesn’t measure: year-over-year audience trends, the percentage of fans under 35 choosing audio over video, or how many “avid fans” now get their sports content from YouTube personalities and podcast networks instead of broadcast stations.

Producers should recognize this playbook: legacy media commissioning research that proves legacy media still works. The 105% web traffic lift for financial services sounds impressive until you ask whether those conversions justify the CPMs Audacy needs to service its restructured debt. The claim about surpassing ESPN and FS1 in sports talk reach conflates broadcast radio’s broad distribution with actual influence and monetization potential.

Here’s the uncomfortable part: Audacy operates in eight of the top 10 sports-obsessed markets and still needed bankruptcy protection. The research proves fans love sports audio—it doesn’t prove sports radio stations can build sustainable business models around that passion. The report’s timing, released during a massive sports calendar year (World Cup, Winter Olympics, World Baseball Classic), positions Audacy for upfront advertising negotiations while obscuring long-term structural decline.

Podcasters creating sports content should extract the genuine insights—local voices matter, fans crave community, audio provides intimacy—while ignoring the self-serving framing. The future of sports audio isn’t Audacy’s 40 all-sports stations. It’s independent creators building direct audience relationships without $1.6 billion debt structures requiring constant revenue justification.

PODSCRIBE

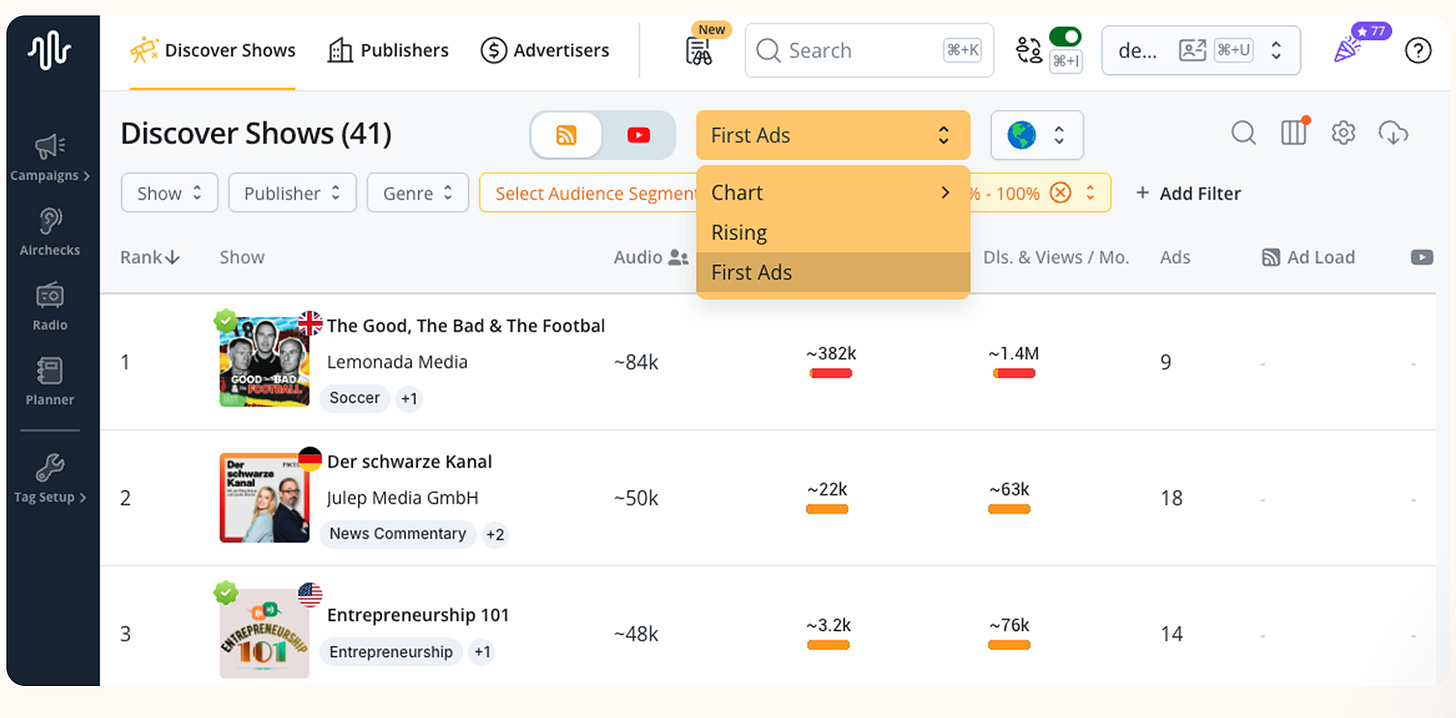

Podscribe Launches Ranking Tools to Track Emerging Podcast Shows, Advertisers

Podwires Rundown: Podscribe just launched tools to help you spot breakout shows early. Everyone now has the same data at the same time. Your competitive advantage just evaporated.

The podcast measurement company released new ranking features designed to identify momentum before the market saturates opportunities. The “First Ads” ranker surfaces shows that ran their first advertisement in the past three months, while the “Rising” show ranker highlights podcasts with 30% or greater reach increases over the same period. On the advertiser side, “New” identifies brands Podscribe hasn’t detected in three months, and “Rising” flags advertisers increasing spend by 50% or more compared to the prior quarter. According to Podscribe’s February 12 announcement, these tools help brands, agencies, and networks “spot momentum early” and identify opportunities “right when they emerge.”

The Key Points:

First Ads ranker surfaces shows running their first advertisement in the past 90 days, signaling new monetization opportunities with potentially flexible rates and limited advertiser competition

Rising show ranker identifies podcasts with 30% or greater reach increases over three months, indicating accelerating audience growth and potential breakout status

New advertiser ranker tracks brands entering podcast advertising for the first time in three months, helping identify market entry and channel expansion strategies

Rising advertiser ranker flags brands increasing spend by 50% or more versus the prior quarter, signaling strong channel performance and scaling momentum

The features integrate with Podscribe’s Watchlists dashboard, providing real-time visibility into market movement across shows and advertisers

Why It Matters

Market intelligence only creates advantage when it’s asymmetric. Podscribe’s new rankers democratize the ability to identify emerging opportunities—shows just opening to brand partnerships, podcasts experiencing growth surges, advertisers testing the channel, brands doubling down on successful campaigns. This information used to require manual monitoring, agency relationships, or expensive data subscriptions. Now everyone with Podscribe access sees the same “First Ads” list simultaneously. When a show runs its first advertisement, every subscriber gets the alert. The early-mover advantage compresses from weeks to hours, and the window for “flexible rates and limited competition” closes faster than Podscribe’s three-month lookback period.

The Big Picture

For podcasters, these rankers reveal uncomfortable truths about monetization timing. Your show appears on the “First Ads” list the moment you run that first campaign—signaling to every agency and brand that you’re now open for business. Fair play, visibility helps. But it also means you’re immediately comparable to every other show on that same list, and buyers can now systematically evaluate “shows just entering the ad market” as a category rather than discovering you organically. The negotiating leverage from being an undiscovered opportunity disappears when discovery becomes systematized.

Producers should recognize this as the inevitable evolution of market transparency. The “Rising” ranker’s 30% reach threshold creates a visible benchmark—shows growing faster become targets for advertiser outreach, while shows growing slower risk getting overlooked entirely. This accelerates the concentration of advertising dollars around measurable momentum signals rather than editorial quality or audience engagement depth. Your show’s growth rate becomes as important as your content.

Here’s the uncomfortable part: Podscribe’s tools help you find opportunities before saturation, but they also ensure saturation happens faster. When the “Rising Advertiser” ranker shows a brand increasing spend by 50%, every publisher sees that signal and pitches them simultaneously. The brand gets flooded with inventory options, driving CPMs down through increased competition. The efficiency Podscribe creates for advertisers—easy identification of scaling budgets—directly undermines the pricing power of individual shows.

The podcast advertising market is becoming more efficient. Let that sink in. Efficiency benefits buyers by reducing information asymmetry and transaction costs. It rarely benefits sellers, who lose the ability to extract value from unique market knowledge. Podscribe’s rankers are excellent tools for understanding market dynamics. Just don’t confuse understanding the game with winning it..

IAB

Celebrity Privilege and the Myth of Podcast Discovery: What Edison's Top 10 Really Tells Us

Podwires Rundown: Edison Research just dropped their list of the top ten new podcasts of 2025. Let’s talk about what they’re not saying.

Every single show on this list comes from someone with an existing platform. Golden Globe winner Amy Poehler. Hip-hop legends Fat Joe and Jadakiss. MSNBC’s Nicolle Wallace. California Governor Gavin Newsom. Smashing Pumpkins frontman Billy Corgan. Notice a pattern? These aren’t scrappy independents building audiences from zero. They’re established celebrities migrating existing fanbases to a new format.

Source: Edison Research’s Weekly Insights, published February 11, 2026, analyzing Edison Podcast Metrics data on U.S. weekly podcast consumption throughout 2025.

The Key Points:

All ten shows leverage pre-existing celebrity or platform power — from Amy Poehler’s Golden Globe-winning “Good Hang” to Governor Gavin Newsom’s politically-positioned show, not a single breakout came from an unknown creator

Network backing dominates — iHeartPodcasts appears on multiple shows (Joe and Jada, Crook County, This is Gavin Newsom), while other top performers connect to established media entities like The Daily Wire, Tenderfoot TV, and MK Media Network

Social media followings convert directly to podcast audiences — Keith Edwards built over a million YouTube subscribers before launching his daily podcast, proving distribution matters more than format

Launch timing affects rankings — Edison acknowledges that shows debuting earlier in 2025 benefit from longer audience accumulation periods, similar to year-end rankings in film and music

Genre diversity masks audience concentration — while the list spans true crime, politics, pop culture, and interviews, the common thread is celebrity access and institutional support, not content innovation

Why It Matters

This isn’t a list of the best new podcasts. It’s a list of the most effectively promoted new podcasts by people who already had massive audiences elsewhere. The uncomfortable truth? Organic podcast discovery is broken. If you don’t have celebrity status, network backing, or a million social media followers, your brilliant show isn’t making this list. Period. The industry celebrates these “successes” while independent creators face algorithmic obscurity and platform indifference. We’re not measuring podcast quality or even podcast appeal — we’re measuring pre-existing fame and distribution muscle.

The Big Picture

For independent podcasters and producers, this data should be terrifying. The path to top-tier listenership increasingly requires either (a) being famous before you start, or (b) network relationships that provide promotional firepower. Fair play to Amy Poehler — she’s talented and her show is good. But she didn’t build that audience from scratch in podcasting. She imported it.

Here’s what this means for different groups:

Independent Podcasters: Stop comparing yourself to these shows. You’re not competing on content quality — you’re competing against celebrity and institutional backing. Focus instead on niche dominance, direct audience relationships, and platforms that actually surface new shows. Your growth strategy can’t be “make great content and hope.” It has to be “make great content and aggressively own distribution.”

Podcast Producers: Celebrity-hosted shows will continue dominating discovery because platforms prioritize them algorithmically. If you’re pitching new shows, understand that “great concept” matters less than “who’s attached and what’s their existing reach.” Budget accordingly. The production quality bar is high, but the discovery advantage is about names, not nuance.

The Industry: We need to stop pretending podcast success is meritocratic. These rankings don’t reflect podcast innovation — they reflect fame migration. When a governor, a Golden Globe winner, and a rock legend all launch shows in the same year and they all chart, that’s not proving podcasting’s vitality. That’s proving celebrity always wins. The real question: what happens to the thousands of talented creators without those advantages?

Let that sink in. Platform algorithms and discovery mechanisms increasingly favor established entities. The dream of podcasting as a democratic medium where anyone can build an audience? It’s getting harder to defend when the “top new shows” list reads like a Hollywood call sheet.

The actionable takeaway isn’t “don’t make podcasts if you’re not famous.” It’s “understand the actual dynamics of discovery and plan accordingly.” Network relationships matter. Cross-platform presence matters. Pre-existing audiences matter enormously. If you’re building without those advantages, you need a distribution strategy that’s ten times more sophisticated than your famous competitors need.

Otherwise you’re making great content that no one will ever find.

MAGELLAN AI

The Podcast Ad Market's Growth Story Hides a Consolidation Crisis

Podwires Rundown: Magellan AI just dropped their Q4 2025 benchmark report. The headlines scream growth: 32% year-over-year increase in podcast ad spending. The industry will celebrate this as proof of podcasting’s vitality.

But drill into the actual data, and you’ll find a different story. One about concentration, platform dependency, and the growing divide between haves and have-nots.

Source: Magellan AI’s Q4 2025 Podcast Advertising Benchmark Report, published February 2026, analyzing 94,422 episodes across 50,000+ podcasts in the U.S., Canada, UK, Ireland, Germany, France, Spain, and Australia.

The Key Points:

The top 500 podcasts captured 49% of all Q4 advertising spend, averaging $422,000 per month, while shows ranked 501-3,000 generated just $48,000 monthly — a concentration ratio that’s accelerating, not improving

YouTube simulcasts outperform audio-only podcasts across every meaningful metric — 8.34% ad load versus 7.77%, 45% host-read versus 34%, 33% direct response versus 24%, and critically, 43% advertiser renewal rate versus 34% for traditional podcasts

The 1,482 “new brands” entering podcasting spent an average of just $33,000 each — compare that to T-Mobile’s $17.9 million or Toyota’s $17 million, revealing that “growth” increasingly means existing big spenders spending more, not genuine market expansion

Nine of the top ten spenders remained unchanged from Q3, with the top ten collectively spending $142 million — market dominance by repeat players isn’t innovation, it’s oligopoly

Ad loads climbed to 8.82% in Q4, up from 8.33% in Q3 and 8.20% in Q4 2024 — podcasters are stuffing more ads into episodes because they’re competing for the same concentrated pool of advertiser dollars, not because the market is truly expanding

Why It Matters

This isn’t sustainable growth. It’s extraction. When half of all advertising spend goes to just 500 shows out of millions of podcasts, that’s not a healthy marketplace — that’s a winner-take-all collapse. The fact that YouTube simulcasts show 27% higher renewal rates than audio-only podcasts tells you everything about where advertisers see actual value. They’re not betting on the open podcast ecosystem. They’re betting on closed platforms with better attribution and audience data.

Here’s the uncomfortable part: The industry keeps celebrating topline growth numbers while ignoring that the money is concentrating in fewer hands, on fewer shows, increasingly on video platforms that aren’t even primarily about podcasting. Let that sink in. We’re watching platform consolidation disguised as medium expansion.

The Big Picture

For independent podcasters and small producers, this data should be a wake-up call, not a celebration. The path to significant advertising revenue increasingly requires either (a) being in the top 500 shows, (b) simulcasting to YouTube and accepting video platform dependencies, or (c) accepting that you’re fighting for scraps from a shrinking pool of mid-market advertisers.

Independent Podcasters: Stop measuring your success against industry “growth” metrics that don’t reflect your reality. The $33,000 average spend for new advertisers means most brands testing podcasting are doing exactly that — testing with minimal budgets before concentrating spend on proven winners. Your strategy cannot be “build great content and advertisers will come.” It has to be “build direct audience relationships that don’t require advertising at all, or accept that you’re building on platforms that will ultimately extract value from your work.”

Podcast Producers and Networks: The YouTube simulcast data is brutal for audio purists, but it’s real. 43% renewal rates versus 34% means advertisers are finding measurably better performance on video podcasts. You can argue about whether that’s fair or sustainable, but ignoring it won’t change the trajectory. The question isn’t whether to simulcast — it’s whether you can afford the production costs and platform dependency that video requires, and whether doing so undermines the advantages that made podcasting special in the first place.

The Industry: We need to stop pretending that concentrated growth equals healthy growth. When the top 500 shows capture half of all spend and YouTube simulcasts outperform traditional podcasts on every metric, we’re not watching podcasting thrive as an independent medium. We’re watching it get absorbed into larger platform ecosystems that tolerate podcasting as content but don’t prioritize it as a format.

The shaving industry increased spend by 77% — great for Manscaped and Gillette. Sports podcasts attracted 18.6% of new brands — excellent for sports content creators. But notice what’s not in this report: evidence that the long tail of independent creators is capturing meaningful advertising revenue. Notice what is in this report: proof that advertiser dollars flow to celebrity, consolidation, and increasingly to video platforms.

Fair play to Magellan AI for publishing comprehensive data. But let’s be honest about what it reveals. This isn’t a rising tide lifting all boats. This is a few superyachts getting bigger while most podcasters are told to be grateful that the industry’s total water level went up 32% — even if none of that water reached their dock.

The actionable insight isn’t “podcasting is growing, so opportunity is expanding.” It’s “advertising revenue is concentrating rapidly, so if you’re not already positioned in the top tier or willing to accept platform dependency on YouTube, you need alternative monetization strategies immediately.”

Otherwise you’re building content for an advertising market that’s already decided you’re not worth the investment.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

Ark Media - Producer/Editor – Daily News Podcast

ARN - Group Digital Director

CBC/Radio-Canada - Development Advisor, Unscripted Audio

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.