🎙Spotify Expands Partner Program to Nordic Markets, Boosts Creator Payouts Above $100M Quarterly

Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

We are thrilled to present the latest Weekend edition of Podcast In Brief! And don’t worry, our loyal listeners — you’ll still get the occasional real-time update!

Thank you to all our free and paid subscribers for continuing to support us. As an independent media organisation, we can only continue our work with the support of readers like you, unlike others who are supported by well-funded organisations.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (15 November 2025)

🎙️Today, we’ve got the inside scoop on:

Spotify Expands Partner Program to Nordic Markets, Boosts Creator Payouts Above $100M Quarterly

iHeartMedia Courts TikTok Creators With 25-Show Network as Threads Tests Podcast Features.

Indie Podcasters Reject Profit Obsession as Survey Reveals 85% Don’t Monetize—And Don’t Care

Podcast Insight: Australian Podcast Ad Spending Climbs as Brands Get Smarter About Native Creative

PodBusiness : WPP Media Study Reveals Digital Audio and AM/FM Radio Deliver Top ROI Performance Among 11 Media Channels in $2.2 Billion Analysis.

Job Board :

Today’s issue takes 5 minutes to read.

SPOTIFY

Spotify Expands Partner Program to Nordic Markets, Boosts Creator Payouts Above $100M Quarterly

Podwires Rundown: Spotify just quietly made podcasting’s monetization problem everyone else’s problem. While the industry debates whether creators can actually make money, Spotify dropped $100M+ in Q1 2025 to podcast publishers globally and expanded their Partner Program to the Nordics.

Spotify announced the expansion of the Spotify Partner Program (SPP) to Sweden, Denmark, Finland, Iceland, and Monaco, effective November 18, 2025. The program, which provides creators dual revenue streams from Premium video engagement and ad monetization, has already paid out more than $100 million to creators globally in Q1 2025. The expansion builds on Spotify’s video podcast ecosystem, which has grown to nearly 500,000 shows with over 390 million users engaging with video content—a 50%+ year-over-year increase. [Source: Spotify for Creators blog]

The Key Points:

Spotify paid $100M+ to podcast creators globally in Q1 2025 alone, with hundreds earning over $10,000 monthly and top performers exceeding six-figure annual revenues through the Partner Program.

The Nordic expansion brings dual monetization to eligible creators: audience-driven payouts from Spotify Premium video engagement plus ad revenue share from Spotify Free and all other platforms, while creators keep 100% of baked-in sponsorships.

Video podcast consumption jumped 80%+ since SPP launched in January, with Spotify’s catalog expanding to nearly half a million video shows and more than 390 million users streaming video podcasts (up 50%+ YoY).

Sweden shows explosive growth with video podcast listeners up nearly 60% YoY and consumption hours up over 50%, demonstrating strong Nordic market appetite for video podcast content before official monetization launched.

SPP earnings grew 23% month-over-month (January-February) and 29% (February-March), with the top 20 video podcasts growing consumption by 24%+ since December 2024, showing accelerating momentum.

Why It Matters: While most platforms still treat podcast monetization as a future promise, Spotify is writing checks now—real money, at scale, consistently. This isn’t a pilot program or beta test. The company is systematically building a global creator economy that rewards video podcast production with actual revenue, not theoretical CPMs or “when you hit X downloads” promises. For creators choosing where to invest production resources, Spotify just made the math considerably simpler: they’re paying hundreds of creators five figures monthly while competitors are still figuring out their monetization roadmaps.

The Big Picture: For podcasters and producers, Spotify’s expansion creates a clear strategic imperative: video podcast production is no longer optional for revenue maximization. The dual-revenue model means creators earn from Premium viewers while still monetizing audio-only listeners—eliminating the false choice between formats. Producers must develop workflows that efficiently create video-ready content, but the payoff is immediate access to Spotify’s payment infrastructure that’s already proven at scale.

The industry benefits from having a major platform that’s actually moving money rather than moving goalposts. With nearly 500,000 video shows on platform and consumption growing 80%+, Spotify is demonstrating that sustainable creator economics work when platforms commit financial muscle. Fair play. The Nordic expansion proves this isn’t US-centric—Spotify is building global infrastructure for podcast monetization.

Action items: Video podcast production should be part of your 2025 roadmap. Study what’s working for those top-20 shows growing 24%+ consumption. Understand the dual-revenue model before your competitors do. And if you’re in the Nordics? November 18 just became your launch date.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

IHEART | THREADS

iHeartMedia Courts TikTok Creators With 25-Show Network as Threads Tests Podcast Features

Here’s what nobody’s saying out loud: iHeartMedia, America’s largest audio company with 860+ broadcast stations and the iHeartRadio app reaching 160 million monthly users, just admitted it can’t build stars anymore without TikTok’s algorithm doing the heavy lifting first. The newly announced partnership launching the “TikTok Podcast Network” with up to 25 creator-hosted shows, co-branded studios in LA, New York and Atlanta, plus a national “TikTok Radio” format isn’t a podcasting story – it’s a capitulation story.

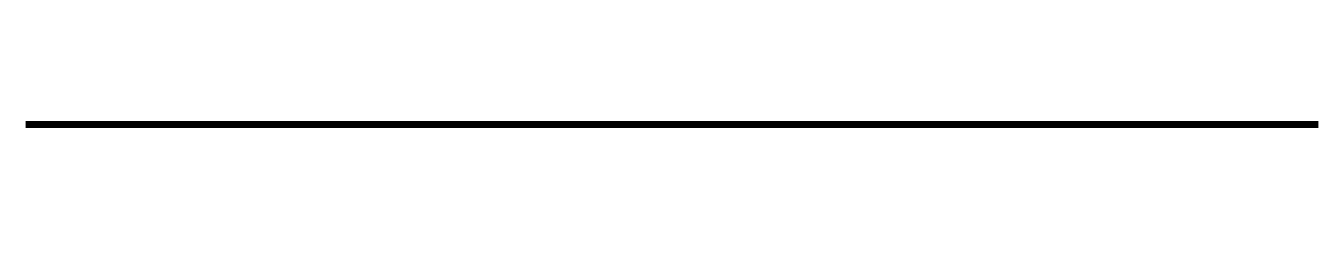

Meanwhile, Threads is testing podcast preview features that let creators add show links to profiles and display enhanced previews in-feed, because apparently every platform now needs podcasting features to compete for creator attention. Podcasting isn’t winning. Podcasting is being strip-mined for parts.

The iHeartMedia and TikTok partnership was announced jointly by the companies, with iHeartMedia President/COO/CFO Rich Bressler and TikTok’s Global Head of Media and Licensing Partnerships Dan Page providing statements.

The Threads podcast feature test was announced via the platform’s official account, revealing profile integration and enhanced link previews rolling out to select users first before broader expansion.

The Key Points:

iHeartMedia is building 25 TikTok creator-hosted podcasts with co-branded studios in three major cities, featuring “advanced audio and video infrastructure” to help creators “build a stronger bridge between their video and audio content” – translation: iHeart needs TikTok’s audience more than TikTok needs iHeart’s microphones.

The partnership includes “TikTok Radio,” a national broadcast and digital format described as making “listeners feel like they are scrolling on TikTok, but with their ears” – built on the architecture of major stations like KIIS FM and Z100, featuring music, trend-driven storytelling, and segments like “Behind-the-Charts” and “New Music Fridays.”

iHeart and TikTok will leverage combined sales teams for “meaningful sponsorships and a new line of business overall” for creators – the podcasts distribute via iHeartPodcasts everywhere, with “best highlights and clips” returning to TikTok, creating a content recycling loop.

Threads is testing podcast profile links and enhanced in-feed previews, allowing creators to add one podcast to their profile via “Edit profile” and displaying rich previews when show or episode links are shared in posts – currently limited to select users with broader rollout planned.

Both announcements position podcasting as platform ammunition in broader creator wars – iHeart competing with Spotify and YouTube for creator talent, Meta competing with X/Twitter for creator distribution, with podcasting serving as the contested territory rather than the prize itself.

Why It Matters: These parallel announcements expose podcasting’s uncomfortable position in the media ecosystem: it’s become a feature, not a destination. When America’s largest audio company needs to partner with a short-form video platform to launch 25 shows, that’s not podcasting’s strength – that’s iHeart acknowledging it can no longer develop talent organically at scale. TikTok creators already have audiences; iHeart is offering infrastructure and monetization in exchange for content to fill its pipes. And when Threads adds podcast features three years after launch, that’s not Meta suddenly believing in podcasting – that’s Meta needing every possible hook to keep creators posting on Threads instead of X. Podcasting is being used as a retention tool in platform wars it didn’t start and can’t win.

The Big Picture: For podcasters and producers, these moves reveal where the power actually sits. Actionable reality check: If you’re building a podcast hoping for “discovery,” understand that major platforms now expect you to bring your own audience FROM somewhere else. iHeart isn’t scouting unknown podcast talent – they’re converting TikTok stars who’ve already proven audience-building capability on a different platform. The studios they’re building aren’t for podcast development; they’re audience conversion factories.

The “TikTok Radio” concept is particularly revealing. Describing a radio station as “scrolling on TikTok, but with your ears” means radio is now formatting around social media consumption patterns, not the reverse. Podcasters watching this should understand: the medium is adapting to platform behaviors, and if your show doesn’t work in a “scroll-like” attention economy with “Behind-the-Charts” segmentation, you’re swimming against the current.

For independent podcasters, the Threads feature is simultaneously encouraging and depressing. Actionable step: Add your podcast link when the feature becomes available – any distribution expansion helps. But recognize what’s actually happening: Meta is using podcast linking as a feature to compete with X, the same way X uses Spaces. Your podcast is the ammunition in someone else’s platform war. You’ll get some traffic, but you’re not the protagonist in this story.

The combined sales team pitch from iHeart/TikTok is where this gets interesting for monetization. If brands can buy across 25 creator-hosted shows with unified sales infrastructure, that’s the kind of efficiency advertisers actually want. But here’s the uncomfortable part: this only works if you’re inside these walled partnerships. Independent podcasters watching 25 TikTok creators get co-branded studios and unified sales support should ask themselves: what’s my path to similar infrastructure? The answer is increasingly “become part of a network or platform deal,” which means more consolidation, less independence.

The broader industry should see both announcements as wake-up calls about platform dependency. iHeart, with its massive broadcast reach, couldn’t build this without TikTok. Meta, with billions of users, is adding podcasting as table stakes for creator competition. YouTube has creators making video podcasts. Spotify has creators making podcast playlists. Everyone is using podcasting for something other than podcasting itself.

What does this mean practically? Producers should be building content that works across platforms from day one – not just audio, but video, clips, segments that function independently, and formats that survive the platform wars. The “pure podcast” is becoming as rare as the “pure radio show” – everything is content chunks optimized for wherever audiences actually are, which is increasingly NOT dedicated podcast apps.

And for executives watching this unfold: when the largest audio company in America needs to partner with a video platform to launch podcasts, and when social platforms add podcast features as retention tactics, that tells you exactly where podcasting sits in the media hierarchy. We’re useful. We’re versatile. We’re everywhere.

We’re just not in control.

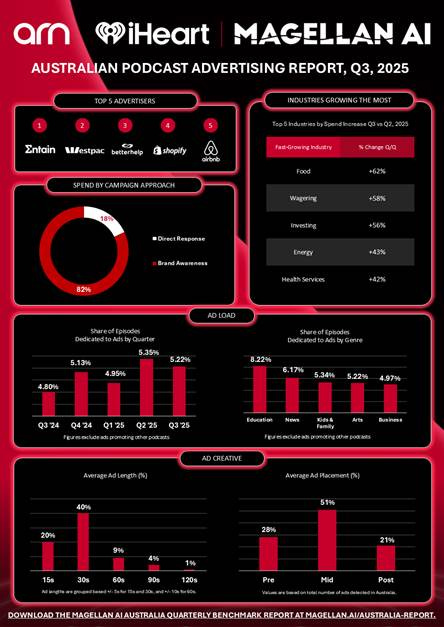

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

MAGELLAN AI

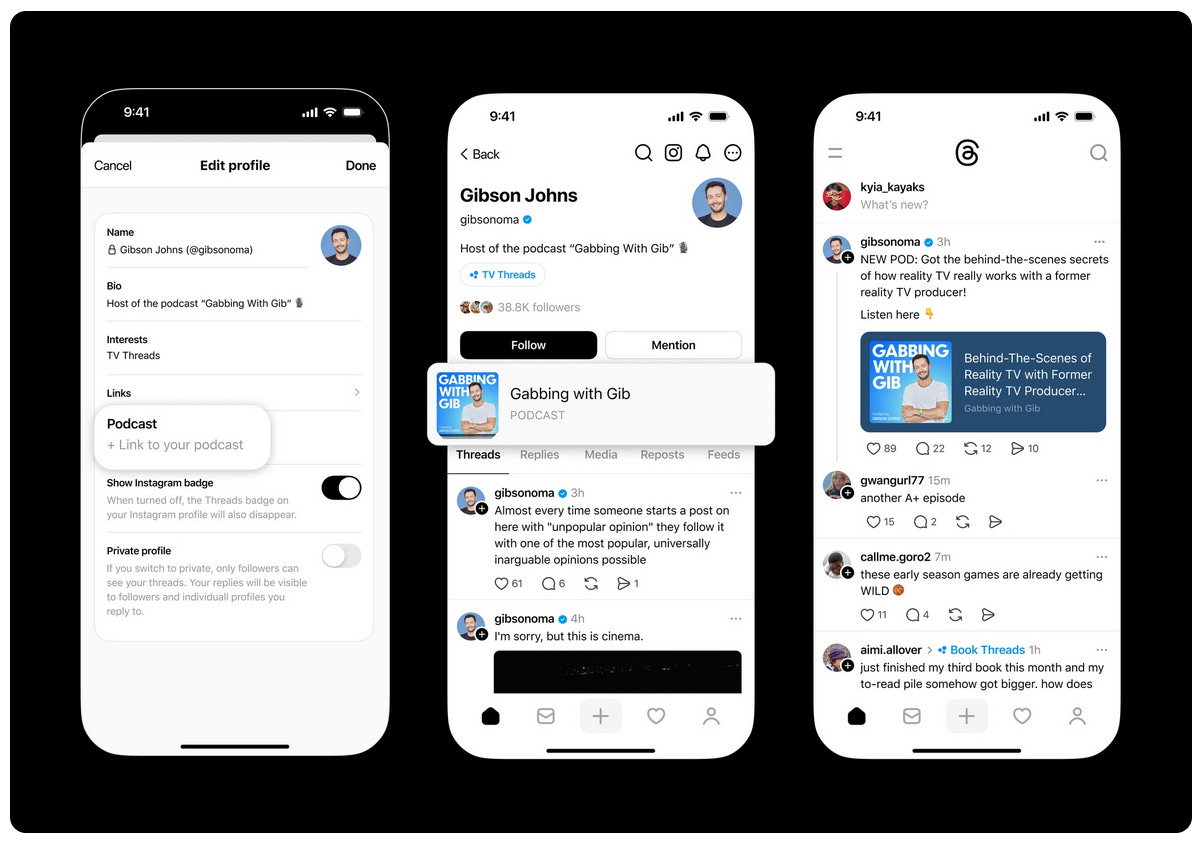

Australian Podcast Ad Spending Climbs as Brands Get Smarter About Native Creative

Podwires Rundown: While American podcasters obsess over video strategy and Spotify’s latest mood swing, Australian advertisers are quietly demonstrating what sustainable podcast growth actually looks like: consistent investment, sophisticated creative, and brands that understand the medium isn’t just “radio but digital.”

According to ARN’s iHeart and Magellan AI Q3 2025 report analyzing 600+ top Australian podcasts, investment continues climbing across Food, Wagering, Investing, Energy, and Health Services sectors – with ad loads up year-over-year and brands increasingly crafting campaigns that “sound native to the content.” Let that sink in.

The quarterly report from ARN’s iHeart and Magellan AI tracks podcast advertising trends in Australia by analyzing audio from 600+ of the country’s most popular podcasts. The research identifies ad placements, creative content, and spend estimates across multiple industries and formats.

The Key Points:

Investment is diversifying beyond traditional podcast advertiser categories – Food, Wagering, Investing, Energy, and Health Services brands are all increasing podcast spending, suggesting the medium is maturing beyond direct-to-consumer supplement companies and mattress brands.

Advertisers are standardizing around 15-30 second creative in mid-roll positions with brand awareness goals – the industry is developing playbook consensus around what works, rather than throwing everything at the wall.

Educational, News, and Kids & Family podcasts commanded the highest share of ad airtime in Q3 – genres that deliver engaged, attentive audiences are winning advertiser dollars over pure scale plays.

Entain Group led Q3 advertising across local and international shows including Hello Sport, Tradies, and Alpha Blokes during AFL and NRL Finals, demonstrating strategic event-based podcast buying.

Ad loads increased compared to the same period last year – brands are recognizing podcast value enough to accept higher ad density, and listeners aren’t fleeing.

Why It Matters: This Australian data reveals something American podcasters desperately need to understand: sustainable advertising growth comes from brands getting smarter about podcasting, not just bigger budgets. When ARN’s Corey Layton talks about “campaigns that sound native to the content” and “connect emotionally,” he’s describing advertisers who’ve moved past treating podcasts as cheap radio inventory. The diversity of categories investing – from banking (Westpac, Suncorp) to home-sharing (Airbnb) to automotive (Hyundai) – shows podcasting earning its place in sophisticated marketing mixes, not just performance marketing last-chancebudgets.

The Big Picture: For podcasters and producers, the Australian market is writing a playbook worth studying. The standardization around 15-30 second mid-rolls isn’t limiting creativity – it’s creating predictable inventory that agencies can plan around and brands can budget for confidently. Actionable takeaway: If you’re still running 90-second host-read ads because “that’s authentic,” you’re making it harder for brands to buy you at scale. The data suggests shorter, well-crafted creative in mid-roll positions is what sophisticated buyers want.

The dominance of Educational, News, and Kids & Family content in ad airtime share reveals an uncomfortable truth: attention quality beats audience size. These aren’t necessarily the biggest podcasts – they’re the ones delivering audiences that advertisers trust will actually hear their message. For producers, this means doubling down on audience engagement metrics and demonstrating listener attention, not just download numbers.

Most importantly, rising ad loads without listener exodus suggests the market is finding its tolerance threshold. This isn’t a license to stuff shows with eight ads per episode, but it does mean the sky-is-falling warnings about “too many ads killing podcasting” aren’t playing out in markets where brands are crafting native-sounding creative. The sophistication Layton describes – emotionally connected, contextually appropriate advertising – is what makes higher ad loads tolerable.

For the broader industry, Australia’s diverse advertiser base proves podcasting can escape the direct-response ghetto if the medium professionalizes its offering and educates buyers. You want Hyundai and Westpac money? Stop acting like podcasting is some weird niche experiment and start delivering the standardized formats, reliable measurement, and strategic sophistication that established advertisers require.

PODCAST HOST

Indie Podcasters Reject Profit Obsession as Survey Reveals 85% Don’t Monetize—And Don’t Care

While podcasting’s executive class obsesses over CPMs, video pivots, and AI productivity hacks, 558 independent creators just told the industry what actually matters: creative fulfillment beats revenue every single time. Alitu’s 2025 Independent Podcaster Report reveals that 85% of active podcasters make zero money from their shows, with helping others (31%) and personal enjoyment (20%) ranking as top goals—while “establish a main income source” barely cracks 11%. Here’s the uncomfortable part for the growth-at-all-costs crowd: 41% of these creators have never even considered quitting. They’re not failing at podcasting. They’re succeeding at something the industry refuses to measure.

The Independent Podcaster Report 2025 was conducted by Alitu (podcast creation software) in partnership with Podcraft, surveying 558 independent creators through their newsletter of 29,000+ podcaster subscribers, The Podcast Host blog, and industry partners. The research team was led by Matthew McLean and Katie Paterson, with responses collected from both pre-launch (19%) and active podcasters across demographics, though the sample skewed older (47% over 50) and toward Alitu’s existing audience base.

The Key Points:

Growing an audience remains the overwhelming challenge even at scale – 72% of podcasters cite audience growth and discoverability as their biggest struggle, and this doesn’t disappear with success: 58% of shows with 500+ downloads, 56% with 1,000+ downloads, and 47% with 5,000+ downloads still name growth as their primary challenge, revealing that podcast discovery is structurally broken regardless of show size.

Among the 15% who do monetize, traditional sponsorships vastly outperform subscription models – 65% of monetizing podcasters have used sponsorships/advertising with 41% naming it their most profitable revenue stream, while paid subscriptions (Patreon, Substack) lag at 23% profitability despite being easier to set up, suggesting niche sponsor deals with relevant businesses deliver better returns than asking audiences to subscribe.

AI tools don’t guarantee time savings despite widespread adoption – 38% use AI-generated transcripts and 30% use AI for content research, but average production time remained nearly identical between AI users and non-users, indicating that new tools often create new workflow rabbitholes that negate efficiency gains.

Video adds significant costs without necessarily adding production time – 50% of video podcasters spend $50+ monthly versus 28% of audio-only creators, yet both groups report similar time investments per episode (though audio-only creators are more likely to spend 6+ hours on detailed editing), revealing video’s real barrier is financial, not temporal.

The gap between pre-launch expectations and post-launch reality exposes podcasting’s broken promises – 64% of pre-launch creators plan video, 43% expect to measure success by audience growth, and 34% see sponsorships as their monetization path, but active creators discover that creative fulfillment (21%) matters as much as audience metrics, and that consistency requires managing burnout (cited by 22% who’ve considered quitting) over chasing viral growth.

Why It Matters: This data demolishes podcasting’s dominant narrative that every show must scale, monetize, and pivot to video to survive. The industry has spent years telling creators they’re “doing it wrong” if they’re not chasing sponsors, building video workflows, or hitting arbitrary download thresholds. But 85% of independent podcasters aren’t monetizing because they’re not podcasting to monetize—they’re creating to help others, enjoy the process, or share knowledge. When 41% have never considered quitting despite facing brutal discovery challenges and zero revenue, that’s not failure—that’s an entirely different success framework the advertising-dependent podcast industrial complex refuses to acknowledge. The cognitive dissonance is staggering: platforms and networks obsess over CPMs while the creators actually making shows care more about creative satisfaction than quarterly earnings.

The Big Picture: For podcasters and producers, this report should liberate you from industry-manufactured anxiety about growth hacking and monetization timelines.

Actionable reality check: If you’re podcasting to help others or for creative fulfillment, stop measuring yourself against shows chasing sponsor deals. The data shows these are fundamentally different missions requiring different strategies. Only 11% of podcasters even list “establish main income source” as their primary goal—meaning 89% are succeeding or failing on entirely different terms than the ones podcast conferences obsess over.

The sponsorship findings matter enormously for the small minority actually pursuing revenue.

Actionable takeaway: If you’re in the 15% trying to monetize, the data screams “pursue niche sponsorships over subscription platforms.” Despite Patreon’s ease of setup, traditional sponsorships deliver nearly double the results (41% vs 23% citing it as most profitable). This suggests indie podcasters are finding relevant businesses who’ll pay meaningful money for direct access to specific audiences—not relying on listeners to voluntarily subscribe. Start prospecting local or niche businesses in your topic area rather than begging your audience for $5/month.

The AI findings should terrify every productivity tool vendor selling “save hours with AI!” promises. When average production time is identical between AI users and non-users, that reveals a brutal truth: tools don’t save time, discipline saves time. AI transcripts might be instant, but then you’re editing them. AI show notes might be automatic, but then you’re refining them. AI marketing clip generators might be one-click, but then you’re reviewing and posting them.

Actionable discipline: Before adding any new tool—AI or otherwise—force yourself to remove something from your workflow first. The data proves that tool accumulation creates work, not efficiency.

The video cost revelation is critical for planning. Video doesn’t necessarily double your production time (both video and audio creators cluster in the 1-5 hour range), but it will increase your monthly spend. 50% of video podcasters spend $50+ monthly versus 28% of audio-only shows, likely due to software subscriptions, equipment upgrades, and higher editor costs (28% of video creators hire editors versus 15% of audio-only).

Actionable budgeting: If you’re considering video, plan for an extra $50-100/month minimum in ongoing costs, and recognize you’ll probably need to hire help. Don’t let “just turn on your webcam” advice fool you—if you want video people actually watch, expect to pay for it.

For the broader industry, the pre-launch versus post-launch data gap should be a wake-up call about podcasting’s broken promises. 64% of aspiring creators plan video, 43% will measure success by audience growth, and 34% expect sponsorship revenue—but active podcasters discover that creative fulfillment matters as much as metrics, that growth remains brutally difficult at every level, and that most shows never monetize at all.

The industry is selling a fantasy: “start a podcast, grow your audience, get sponsors, quit your job.” The reality is “start a podcast, struggle with discovery regardless of quality, maybe break even if you’re strategic about niche sponsors, and find fulfillment in the creative process itself.”

The 72% citing audience growth as their primary challenge—including 47% of shows with 5,000+ downloads—proves podcast discovery is systemically broken, not a creator skill issue. When even successful shows struggle with growth, that’s not a marketing failure—that’s platforms failing to surface good content. Apple Podcasts, Spotify, YouTube, and every other player should be held accountable for discovery mechanisms that leave creators screaming into the void regardless of show quality.

Most importantly, the 41% who’ve never considered quitting despite making zero money and facing brutal growth challenges represent podcasting’s actual foundation. These aren’t hobbyists settling for mediocrity—they’re creators who’ve defined success on their own terms and built sustainable creative practices around those definitions. The industry would be better served studying their resilience than lecturing them about conversion funnels.

Fair play to the 85% not monetizing. You’re not doing it wrong. You’re just doing something different than what the growth hackers are selling.

🎙️ EVERYTHING ELSE IN PODCASTING TODAY

⏭️ WPP Media Study Reveals Digital Audio and AM/FM Radio Deliver Top ROI Performance Among 11 Media Channels in $2.2 Billion Analysis. A major WPP Media and Radiocentre study analyzing $2.2 billion in advertising spend across 142 brands from 2021 to 2023 found that digital audio and AM/FM radio significantly outperform average media ROI, with digital audio ranking third and broadcast radio fourth among 11 media channels for two-year return on investment while both dominate short-term performance over 13 weeks.

⏭️ USC Study Reveals 64% of Top Podcast Hosts Are Male and 77% Are White as Podcasting Diversity Trails Film and Television in 2024. A comprehensive USC study by Dr. Stacy L. Smith and the Annenberg Inclusion Initiative examining the top 100 podcasts of 2024 and 592 popular podcasts based on Spotify data found that 64% of hosts are male and 77% are white, with women of color representing only 6.6% of top podcast hosts and 62.6% of episodes featuring no woman guests, significantly trailing the diversity levels of film and television where 50% of top 100 films had female leads.

⏭️ Video Podcasting Costs 77% More Per Hour of Attention Than Audio-Only Shows Despite Higher Engagement, New Study of 308 Podcasters Reveals. A comprehensive Podcast Marketing Trends study analyzing 308 podcasters across diverse formats and industries found that while audio/video podcasts produced for platforms like YouTube and Spotify generate 49% more audio plays and attract creators with significantly higher revenues, video production costs 3.6 times more per episode and delivers attention at 77% higher cost compared to audio-only shows, with video podcasters employing 63% more full-time employees and 600% more agency support to manage the increased production complexity.

⏭️ Acast Expands AdCollab Chat Feature to Entire Podcast Sponsorship Process, Reducing Creator Response Time by 85% in November 2025. Acast announced on November 12, 2025, that its AdCollab sponsorship platform now offers chat functionality throughout the entire podcast advertising process including the pre-acceptance vetting stage, enabling creators, advertisers, and sales teams to communicate earlier and reducing the time for creators to accept sponsorship opportunities by 85%, with some partnerships moving from accepted to live host-read campaigns in as little as one week.

⏭️ Podscribe Launches In-Store Attribution Tracking for Audio Ads Through Shopify S2S, Ibotta, and Credit Card Transaction Data in November 2025. Podscribe announced on November 13, 2025, the launch of In-Store Attribution, a measurement solution that links audio advertising exposure to verified brick-and-mortar purchases for CPG brands and retailers through three tracking methods including Shopify Server-To-Server integration for point-of-sale transactions, credit card transaction data covering 86 billion purchases, and Ibotta rewards data across 80+ retailers with 50 million registered users, providing unified online and offline conversion tracking in a single dashboard. advertisers and retailers evaluating podcast attribution solutions

⏭️ Netflix Plans 50 to 75 Video Podcasts for 2026 Launch to Challenge YouTube Dominance, Offering $7 Million to $8 Million Licensing Deals. Netflix is preparing a major video podcast expansion launching in early 2026 with 50 to 75 shows initially and plans to reach 200 programs over time, offering podcast hosts licensing deals worth $7 million to $8 million annually but requiring them to remove their video content from YouTube and eliminate host-read ads in favor of traditional TV-style advertising, following the streaming giant’s October 2025 deal with Spotify to feature popular shows including The Bill Simmons Podcast as part of its strategy to challenge YouTube’s dominance in podcast consumption.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism

.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

SiriusXM - Associate Planner, Ad Sales

CitizenRacecar - Producer/Coaches, Afterschool Podcasting: San Diego

ABC News Australia - Video Producer, Podcasts

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.