🎙Audio-Only Podcasts Outperform Video Despite Industry Hype – CoHost Agency Report Reveals What Actually Works

Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

Happy New Year, everyone! It’s the start of the first Podwires episode in 2026. We’ve got all the latest podcast news and research for you.

We would like to say a huge thank you to all our subscribers and supporters who continue to show their amazing support for our work by choosing to pay their subscription.

The Podwires Team is absolutely thrilled!

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (20 December 2025)

🎙️Today, we’ve got the inside scoop on:

Mental Health Podcasts Crush Fitness Shows in Ad Performance—Even During New Year's Resolution Season

Podtrac's New Multi-Channel Rankings Expose the Video Podcast Illusion

Podcast Insight: Advertisers Want AI-Powered Campaign Orchestration. Podcast Measurement Can't Deliver It.

PodBusiness : Audio-Only Podcasts Outperform Video Despite Industry Hype – CoHost Agency Report Reveals What Actually Works

Job Board : Libsyn - Vice President, Product

OXFORD ROAD

Mental Health Podcasts Crush Fitness Shows in Ad Performance—Even During New Year's Resolution Season

Podwires Rundown : January means gym ads flooding fitness podcasts. Right?

Wrong. Oxford Road just dropped their ORBIT rankings based on $1.6 billion in actual campaign data, and the results flip conventional wisdom on its head. Mental health podcasts don’t just compete with fitness shows during resolution season—they demolish them. And unlike fitness content that flames out by February, mental health shows keep converting through March, giving advertisers two extra months of Q1 performance.

Let that sink in.

Summary: Oxford Road's latest "ORBIT Top 15 Performing Self-Improvement Podcasts" analyzed 12 months of real sales results from 500+ advertisers. The rankings draw from ORBIT (Oxford Road Benchmark Intelligence Tool)—the industry's largest index of podcast advertising performance data, measuring actual customer acquisition costs, ROAS, and conversion metrics across health & fitness, mental health, professional growth, and health science shows.

The Key Points:

Mental health podcasts sustain performance January through March, not just during the New Year’s resolution spike that fitness shows depend on

Health & fitness shows are 8x more volatile than mental health shows, swinging between big wins and catastrophic misses with little predictability

Volume strategies work better than reach strategies in Q1 self-improvement—advertisers can hit consumers multiple times across mental health podcasts for faster statistically significant results

Mental health serves as the safer “base layer” for Q1 campaigns, with fitness shows requiring strict proof-of-performance guardrails before scaling

ORBIT’s dataset represents the industry’s largest podcast ad performance index, giving Oxford Road measurement advantages no other agency can match

Why It Matters

Every January, advertisers pour money into fitness podcasts chasing resolution season, then watch performance collapse by March. This data reveals that mental resilience and mindset work—not gym memberships and diet plans—drives sustained Q1 conversions. For advertisers, this means rethinking seasonal strategies entirely. For podcast producers in the self-improvement space, it's a clear signal about which content categories command premium advertising dollars year-round versus which ones trap you in a boom-bust cycle.

The Big Picture

For podcasters: If you’re producing self-improvement content, the mental health category offers more stable, year-round monetization than volatile fitness programming. Shows focusing on mental resilience, mindset work, and psychological wellness command consistent advertiser interest beyond seasonal spikes—creating predictable revenue streams instead of January bonanzas followed by advertising droughts.

For podcast producers: Build your Q1 advertising packages around mental health shows as the foundation, treating fitness inventory as higher-risk/higher-reward opportunities that require performance guarantees. The 8x volatility gap means you can’t pitch fitness and mental health podcasts the same way to performance marketers.

For the industry: Oxford Road’s ORBIT dataset—built on more podcast advertising performance data than any other agency—represents a competitive moat that challenges the measurement status quo. When one agency controls the industry’s largest performance database, they fundamentally reshape how advertisers evaluate podcast inventory. This isn’t just about January tactics. It’s about who owns the truth about what actually converts in podcast advertising.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

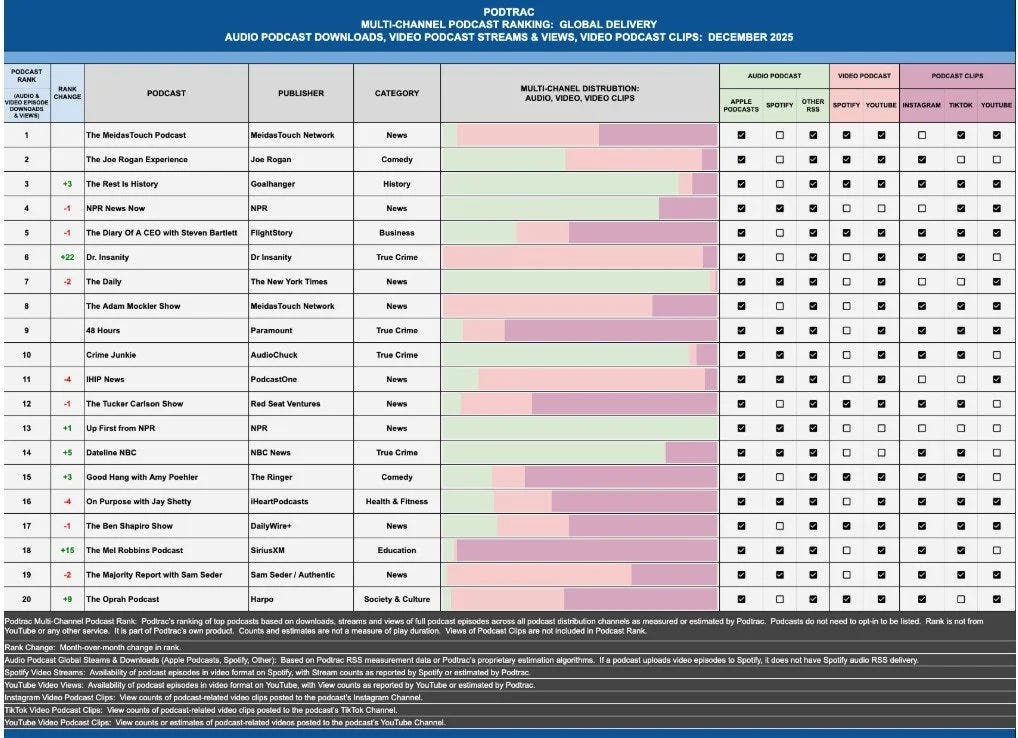

PODTRAC

Podtrac's New Multi-Channel Rankings Expose the Video Podcast Illusion

Podwires Rundown : The industry keeps telling podcasters to invest in video. Lights, cameras, YouTube thumbnails, the whole production circus. But Podtrac just released comprehensive Multi-Channel Podcast Rankings that reveal an uncomfortable truth: 74% of the Top 200 podcasts still get the majority of their delivery from audio—not video.

Even better? For shows ranked 51-200, that number jumps to 77% audio delivery. The video revolution isn’t evenly distributed. It’s concentrated at the top, and even there, it’s complicated.

Summary: Podtrac released the industry's first comprehensive Multi-Channel Podcast Ranking for December 2025, tracking audio downloads across podcast apps plus video episodes on YouTube and Spotify, plus clips on Instagram, TikTok, and YouTube. The Top 200 ranking includes every audio and video podcast with measurement data, providing the first complete picture of how podcast consumption actually splits across platforms.

The Key Points

148 podcasts (74%) get majority delivery from audio, not video—despite 64% posting video episodes to YouTube and industry pressure to “go video”

The Top 50 shows split 51% video/49% audio, but ranks 51-200 are 77% audio/23% video—video success is concentrated among mega-shows, not broadly distributed

YouTube podcast delivery is 53% clips and 47% full episodes—the platform’s podcast growth is driven by short-form derivative content, not long-form episode consumption

37% of podcasts get more clip delivery than episode delivery—meaning more people watch highlights than full shows, fundamentally changing the content-to-audience relationship

All 200 Top podcasts still post to RSS, maintaining audio distribution even as they experiment with video—nobody’s abandoning the open ecosystem yet

Why It Matters:

The industry narrative says video is the future. The data says video is optional for most shows, essential for mega-shows, and even then it’s complicated by the clip economy. This matters because production decisions have cost implications. Investing in video studio setups, lighting, cameras, and multi-format editing workflows makes sense if video drives meaningful delivery growth. But if you’re outside the Top 50 and 77% of your audience still consumes audio, those production dollars might deliver better ROI elsewhere—like marketing, guest acquisition, or audio quality improvements that actually serve your majority format.

The clip economy revelation is even more significant. If 53% of YouTube podcast delivery comes from clips rather than full episodes, the platform isn’t primarily a podcast distribution channel—it’s a podcast marketing channel. That changes everything about how producers should approach YouTube strategy.

The Big Picture

For podcasters outside the Top 50: Resist the pressure to over-invest in video production infrastructure. Your audience is still 77% audio. Consider YouTube a marketing channel for clips that drive awareness and funnel people to your primary audio product, rather than rebuilding your entire production workflow around video episodes that most of your audience won’t consume that way.

For podcast producers: Build multi-channel strategies that acknowledge the split: invest in clip creation and optimization for YouTube/TikTok/Instagram as discovery and marketing tools, while maintaining production focus on the audio format where majority consumption actually happens. The 37% of shows getting more clip delivery than episode delivery proves the content-to-audience funnel has fundamentally changed—people discover through clips, then choose whether to commit to full episodes.

For the industry: Podtrac’s Multi-Channel Rankings finally quantify what everyone suspected but couldn’t measure: video podcast growth is real but concentrated, clips matter more than full episodes on YouTube, and audio still dominates for most shows. This data should recalibrate investment advice, production guidance, and platform strategy across the ecosystem. The video revolution isn’t cancelled—it’s just not universal, and it’s more complicated than “add cameras and upload to YouTube.”

The expensive question: how many podcasters have already over-invested in video infrastructure based on hype rather than data about their actual audience consumption patterns?

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

MEDIAOCEAN

Advertisers Want AI-Powered Campaign Orchestration. Podcast Measurement Can't Deliver It.

Podwires Rundown : Mediaocean just dropped their 2026 H1 Advertising Outlook Report, surveying hundreds of marketers about where advertising budgets and AI capabilities are actually headed. The headline finding? 86% of marketers say cross-channel orchestration is critical, but only 10% have unified ad tech systems that can actually do it.

That 76-point gap between what advertisers need and what their systems can deliver isn’t just a marketing operations problem. It’s a podcast advertising crisis that nobody’s talking about.

Summary: Mediaocean's ninth bi-annual Advertising Outlook Report surveyed marketers in November 2025 across brands, agencies, media companies, and technology providers (6,100+ total respondents across all editions). The research examines AI adoption patterns, media investment priorities, and the growing execution gap between AI ambition and actual implementation as fragmented systems slow progress across planning, activation, and measurement.

The Key Points:

Gen AI ranks as the most important consumer trend (70%), but adoption drops sharply as AI moves from analysis to execution—43% use AI for data analysis, but only 19% for campaign orchestration

Media investment rebounds selectively: CTV and digital video lead at 63% each, social platforms at 61%, AI-driven media at 54%—traditional channels like print and linear TV continue declining

The orchestration gap is massive: 86% say cross-channel orchestration is important, but only 10% have unified ad tech systems, creating friction in coordinating planning, activation, measurement, and optimization

Data quality and system fragmentation are the biggest AI barriers: 42% cite data quality/access issues, 41% cite difficulty connecting AI insights across systems

Strategic shift from channel-level to system-level thinking: 39% prioritize AI and 39% prioritize cross-platform orchestration, moving away from siloed point solutions toward connected infrastructure

Why It Matters

Advertisers are drowning in disconnected systems that can’t talk to each other. They’re measuring podcast performance in one platform, social in another, CTV in a third, with AI insights trapped in silos that don’t connect planning to activation to optimization. When only 10% have unified systems but 86% need cross-channel orchestration, that’s not a feature gap—that’s a structural crisis.

For podcasting, this matters because podcast advertising attribution and measurement already lag behind other digital channels. While CTV and digital video can offer pixel-level tracking and real-time optimization, podcast attribution still relies on promo codes, vanity URLs, and attribution windows that can’t feed into unified AI-driven campaign orchestration systems. When advertisers demand system-level intelligence that connects insights across channels, podcasting’s measurement infrastructure simply can’t integrate at the level these marketers require.

The Big Picture :

For podcasters: The selective media investment rebound (CTV/digital video at 63%, social at 61%) doesn’t explicitly mention podcast advertising growth—and that omission is the story. When advertisers prioritize channels that integrate cleanly into unified orchestration systems, podcasting’s fragmented measurement ecosystem becomes a competitive disadvantage. Your show’s performance might be strong, but if that data can’t flow into the advertiser’s AI-driven optimization engine alongside their CTV and social campaigns, you’re fighting with one hand tied behind your back.

For podcast producers and networks: The gap between AI analysis (43% adoption) and AI campaign orchestration (19% adoption) reveals where the industry execution bottleneck actually lives. Advertisers have the data and insights—they can’t operationalize them because their systems don’t connect. This means podcast ad tech providers who solve the orchestration gap—who can feed attribution data into unified campaign management platforms rather than requiring separate dashboards and manual optimization—will capture disproportionate advertiser spend as the industry moves from 10% to higher unified system adoption.

For the industry: Mediaocean’s research exposes a hard truth: fragmented systems cost more than fragmented data. The 41% who cite “difficulty connecting AI insights across systems” as their biggest barrier aren’t complaining about measurement accuracy—they’re complaining about operational friction. Podcast advertising’s biggest competitive threat isn’t attribution methodology debates or download versus impression counting. It’s that the industry’s measurement infrastructure doesn’t integrate into the unified orchestration platforms that 86% of advertisers consider critical.

When advertisers shift from channel-level optimization to system-level intelligence, podcasting either builds the connective tissue that feeds real-time attribution into unified platforms, or it gets relegated to experimental budget that can’t scale because it won’t integrate. The report is clear: advertisers aren’t looking for better point solutions. They’re looking for orchestration infrastructure that turns isolated AI capabilities into unified execution.

Podcast measurement better catch up.

COHOST

Audio-Only Podcasts Outperform Video Despite Industry Hype – CoHost Agency Report Reveals What Actually Works

Podwires Rundown: Forget the video podcast hysteria. CoHost’s annual State of Podcast Agencies survey of 50 agencies worldwide just dropped data that should make every producer rethink their 2026 strategy: 35% of agencies report audio-only podcasts perform better than video, while only 28% say video wins. Let that sink in. The industry’s been screaming “video or die” for two years, yet when agencies actually measure results, audio keeps winning.

The 2026 State of Podcast Agencies report, released January 27 by CoHost (the podcast analytics platform) and Quill (CEO Fatima Zaidi’s branded podcast agency), surveyed 51 podcast agencies on everything from client budgets to AI adoption. Third year running, this report cuts through marketing fluff to show what’s actually happening in agency trenches.

The Key Points:

76% of podcast agencies employ 10 or fewer people, up from 67% in 2024, yet these small teams serve clients from startups to Fortune 500s – proving agility beats headcount

Audio-only podcasts outperform video (35% vs 28% agency reporting), despite 37% of clients now producing video – content quality matters more than format trends

Budget constraints (29%) and proving ROI (25%) are agencies’ biggest client challenges, creating a chicken-and-egg problem where brands need budget to prove results but need results to justify budget

Thought leadership is now the #1 podcast benefit (33%, up from 29% in 2024), overtaking brand storytelling (down to 8% from 36%) – brands want credibility over narrative control

92% of agencies now use AI (up from 86%), primarily for transcription, show notes, and audio editing, while the 8% who don’t cite quality concerns and data privacy

Why It Matters :

This report exposes the gap between what the podcast industry says is happening and what's actually working. While platforms push video and influencers claim it's mandatory for growth, the agencies doing the work report audio-only shows deliver better results. This matters because production decisions based on trend-chasing instead of strategy waste client budgets and agency resources. The shift from brand storytelling to thought leadership as the primary benefit reveals podcasting's maturation – it's no longer experimental content but a strategic tool for establishing authority. And the budget/ROI constraint cycle explains why so many promising shows get cancelled: brands can't sustain investment without measurable returns, but proving those returns requires sustained investment first.

The Big Picture :

For podcasters and producers, this evolution creates both pressure and opportunity. The data showing audio-only performance undermines the “you must do video” narrative, giving strategic cover to focus resources on audio excellence rather than expensive video production. Fair play to those who’ve been saying format follows strategy, not trends. But the ROI pressure means producers must get serious about measurement beyond downloads – agencies want demographic data, consumption rates, attribution to business outcomes, and listener retention metrics. Downloads won’t cut it anymore.

For podcast agencies, the findings reveal uncomfortable truths about sustainable growth. Lead generation overtook resourcing as the top constraint (36% vs 29%), while word of mouth drives 38% of new clients. REALLY? Yes. Really. Agencies struggle to find new business while their best acquisition channel is making existing clients so happy they refer others. The solution isn’t more marketing spend – it’s doubling down on client success and making referrals systematic, not accidental.

For the industry, this report documents podcasting’s shift from creative medium to marketing infrastructure. Most agencies now offer full-service (strategy through distribution), typical budgets run $5,001-$15,000 per season, and brands increasingly view podcasts for thought leadership rather than storytelling. The industry’s growing up, which means the “figure it out as we go” era is ending. Agencies predict robust analytics (26%) and content repurposing (24%) will dominate the next five years – not video formats or celebrity hosts, but measurement and efficiency.

The contrarian read: video podcasting might be podcasting’s Saab moment. Remember those Swedish engineering marvels that required constant maintenance and devotee-level commitment? Video demands more resources, more distribution complexity, and more audience commitment to consume. Meanwhile audio keeps performing because it fits how people actually use podcasts – as background companions during commutes, workouts, and household tasks. YouTube might be winning eyeballs, but ears are winning conversions.

One agency perspective captures it perfectly: “Success depends more on content quality and strategy than format.” Not exactly headline material, but it’s the truth agencies live with daily while the rest of the industry chases shiny objects.

EDISON RESEARCH

Monday Dominates Podcast Releases – Edison Research Data Reveals What Top Shows Know About Listener Habits

Podwires Rundown: The Top 50 podcasts aren’t guessing when to drop episodes. They’re following data. Edison Podcast Metrics Q4 2025 tracking reveals the most successful podcasts in America overwhelmingly release on Monday (268 episodes among Top 50 shows) and Thursday (173 episodes), while weekends see dramatic dropoffs. This isn’t accident or convenience – it’s strategy built on understanding when Americans actually have podcasting habits.

Edison Podcast Metrics, the gold standard for U.S. podcast audience measurement (capturing weekly reach among 13+ listeners), released its Q4 2025 rankings January 28. The data tracks the entire podcast universe with specific audience size information on thousands of shows. The quarterly release provides the most comprehensive picture of what’s actually being consumed, not just what’s being downloaded.

The Key Points:

The Joe Rogan Experience remains #1, followed by Crime Junkie, The Daily, Call Her Daddy, and SmartLess in the top five – no surprises, these shows own their categories

Stuff You Should Know jumps four spots to #6 and This American Life rises five positions to #7, proving evergreen educational content and quality storytelling still compete against celebrity-driven shows

Monday captures 268 episode releases among Top 50 podcasts, nearly 60% more than Thursday’s second-place showing – the start of the work week dominates strategic release planning

Good Hang with Amy Poehler hits #38 (the Golden Globes best podcast winner we covered previously), while Steven Bartlett’s The Diary of a CEO breaks Top 50 for first time

Weekend episode releases crater across Top 50, with publication tallies calculated using last 20 episode drops per show – successful podcasters know listeners have weekday routines, weekend chaos

Why It Matters:

Episode timing isn’t just logistics – it’s competitive strategy. The Monday concentration reveals something crucial about podcast consumption patterns: listeners integrate shows into weekday routines (commutes, gym sessions, work tasks) far more than weekend activities. This matters because release timing affects discoverability and algorithmic promotion across platforms. Drop your episode Monday morning and you’re competing in the platform’s busiest, most active discovery window. Release Saturday afternoon and you’re shouting into void when most listeners aren’t even opening podcast apps.

The data also exposes why so many shows struggle with audience growth despite quality content. Releasing episodes randomly or when production finishes ignores the structural reality that podcast listening follows predictable weekly patterns. Fair play to the Top 50 for understanding this – they’re not just making better content, they’re releasing it when audiences are actually looking for new episodes.

The Big Picture:

For podcasters and producers, this timing data provides clear strategic guidance that’s been validated by the most successful shows in America. The Monday dominance suggests starting the week with fresh content captures listeners building weekly routines. Thursday’s second-place showing makes sense as pre-weekend listening when people want something for longer commutes or weekend activities. The weekend dropoff indicates most listeners don’t discover new content Saturday-Sunday – they consume queued episodes from weekday releases.

The contrarian move: deliberately release Thursday evening to capture the Friday-morning commute window when Monday drops are already 4+ days old and listeners want something fresh. You’re not competing in Monday’s crowded release window, but you’re still hitting the weekday routine cycle before the weekend dead zone.

For agencies and brand podcast producers, the consistency matters more than the specific day. Notice how Top 50 shows maintain regular schedules – audience building requires predictability. Missing scheduled releases breaks listener habits, and those habits are what transform casual sampling into weekly listening. The data showing 268 Monday episodes across 50 shows (averaging 5+ episodes per show tracked) demonstrates commitment to consistent scheduling, not just one-off timing optimization.

For the industry, the Edison data documents podcast maturation from experimental medium to habitual behavior. Weekday concentration mirrors how audiences consume other scheduled media – people want content that fits routines, not random discovery moments. This explains why algorithmic recommendation hasn’t replaced scheduled releases: even in on-demand media, temporal patterns matter.

The bigger implication connects to the CoHost agency data showing thought leadership overtaking brand storytelling as podcasting’s primary benefit. If podcasts are becoming weekly touchpoints for relationship building rather than one-time content experiences, release timing becomes critical for maintaining those relationships. Miss your scheduled slot and you’re not just losing one episode’s reach – you’re disrupting the habit that keeps audiences coming back.

One insight that Edison and Ausha’s collaboration highlights: “Releasing episodes on weekdays aligns with when many Americans are more likely to have set routines and structure to their days.” Simple observation, massive strategic implications. The Top 50 aren’t just making content people want to hear – they’re releasing it when people are already listening.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

Libsyn - Vice President, Product

Magellan AI - Measurement Success Coordinator

The Podcast Guys - Podcast Producer

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.