Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

We are thrilled to present the latest Weekend edition of Podcast In Brief! And don't worry, our loyal listeners — you'll still get the occasional real-time update!

Thank you to all our free and paid subscribers for continuing to support us. As an independent media organisation, we can only continue our work with the support of readers like you, unlike others who are supported by well-funded organisations.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today's reading time is 5 minutes. - Miko Santos

🎙️Today, we've got the inside scoop on:

Australian Podcast Advertising Surges 20% in Q2 2025

Audio Advertising ROI Research Proves Superior Returns

How Do Humans Feel About AI Voices In Podcasting?

Rural America Still Loves Radio. That’s Not Nostalgia – It’s Strategy.

Bonus: Independent Podcasters Are Getting Left Behind in the Video Gold Rush. That’s a Problem for Everyone.

Australian Podcast Advertising Surges 20% in Q2 2025

The Podwires :Australian podcast advertising just hit different in Q2 2025. While everyone’s debating whether podcasting is having its “moment,” advertisers Down Under quietly doubled down with their wallets. Magellan AI’s latest data shows a 20% year-over-year spending surge that should make every podcaster and network exec sit up and pay attention. This isn’t just growth – it’s validation that smart money sees podcasting as essential, not experimental.

According to Magellan AI’s comprehensive analysis of over 10,000 podcast episodes across Australia in Q2 2025, the podcast advertising market demonstrated significant momentum with both spending growth and evolving advertiser behavior patterns.

The Key Points:

Podcast ad spending jumped 20% year-over-year in Q2, with gradual monthly increases throughout the quarter reaching 147% of Q1 levels by June.

Ad load density increased from 6.79% in Q1 to 7.53% in Q2, showing podcasters successfully monetizing without sacrificing listener experience.

Financial Services dominated spending at $2.5M, while Phone/Internet/Cable emerged as the fastest-growing sector with 72% quarterly growth.

Brand awareness campaigns represented 82% of all detected ads, significantly outpacing direct response efforts at just 18%.

Mid-roll placements captured 51% of ad inventory, with 30-second spots being the most common format at 37% of all advertisements

Why It Matters: This growth pattern signals that podcast advertising has moved beyond experimental budgets into core media strategies. When major financial institutions like Westpac and CommBank consistently rank among top spenders, and telecom companies increase investment by 72% in a single quarter, it demonstrates advertiser confidence in podcast ROI. For content creators, this means more opportunities for premium sponsorships and higher CPMs, while the dominance of brand awareness campaigns suggests podcasters can command better rates for building long-term advertiser relationships rather than just driving immediate conversions.

The Big Picture: For podcasters and producers, these trends create immediate opportunities and strategic imperatives. The 20% spending growth means competition for quality inventory is intensifying – podcasters should be raising their rates and being more selective with partnerships. The shift toward brand awareness campaigns (82% vs 18% direct response) indicates advertisers value podcast audiences for engagement and trust, not just clicks, which supports premium pricing for established shows.

Producers should focus on mid-roll inventory optimization since it captures 51% of ad placements, and consider developing 30-second creative standards as the most popular format. Most critically, the 72% growth in telecom spending and Financial Services’ $2.5M commitment suggest these sectors offer the most lucrative partnership opportunities for shows targeting professional and tech-savvy demographics.

The industry’s challenge now isn’t proving podcast advertising works – it’s scaling quality inventory to meet advertiser demand while maintaining the authentic host-read experiences that drive these results.

🛑 BE PODWIRES PAID SUBSCRIBER

As a paid subscriber, you will get all of the following for only $8 a month or $80 a year (or the equivalent in your local currency):

📰 Podwires Job Board - Get the latest Podcast job around the world

🎙️ Podcast Marketplace - 1000 + Independent Podcast Producers ready to help you.

Podwires Superfan - We can keep doing our work with the help of readers like you, unlike other media organisations that get money from big companies.

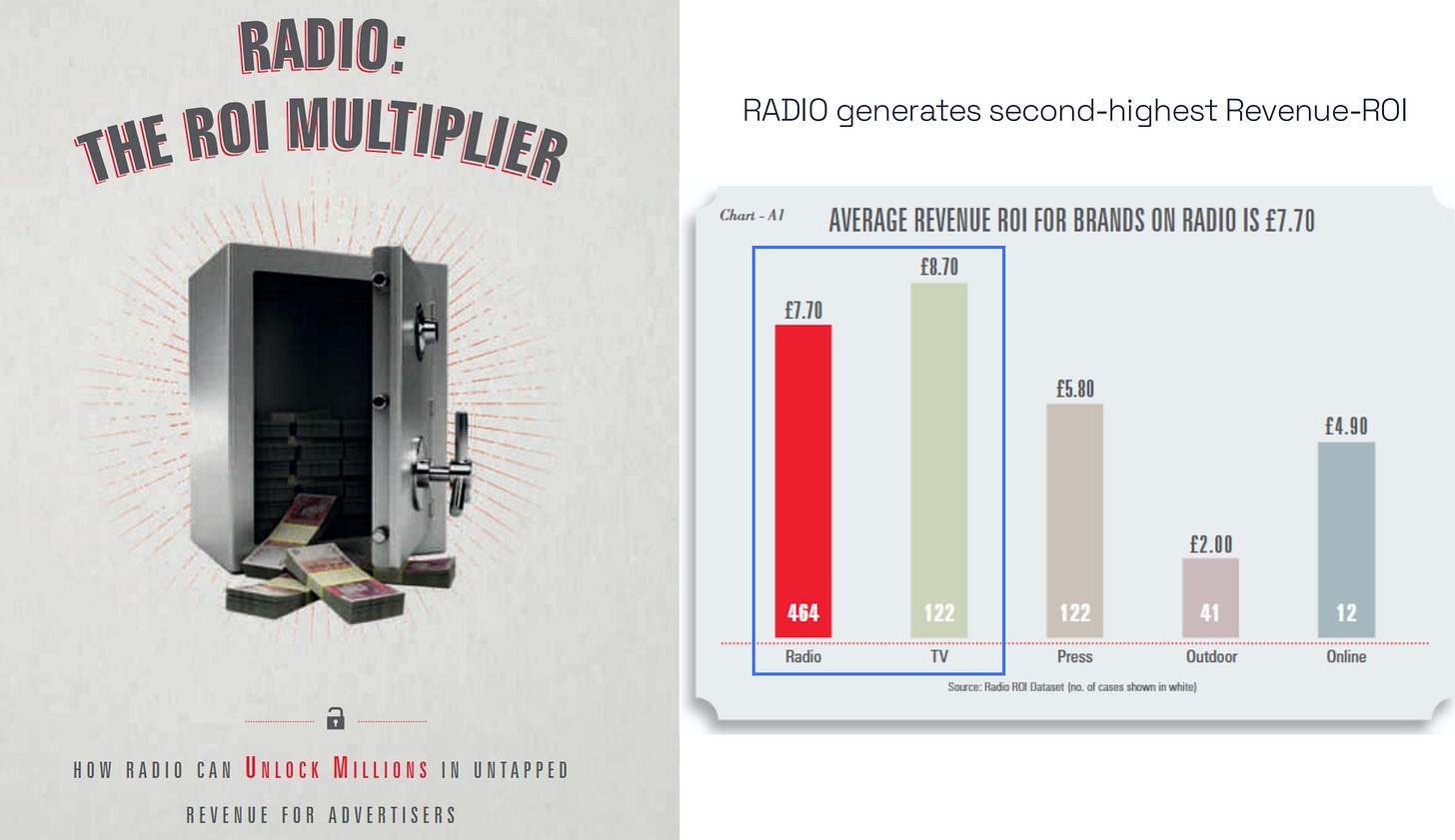

Audio Advertising ROI Research Proves Superior Returns

The Podwires: Audio advertising just served up the numbers that should make every media planner rethink their spreadsheets. Radiocentre’s new “High Gain Audio” research doesn’t just suggest audio works – it proves audio consistently outearns other media channels by substantial margins. When digital audio returns £5.20 and broadcast radio delivers £5 for every pound invested compared to the all-media average of £4.11, we’re not talking about marginal gains. We’re looking at a medium that’s been sitting there, undervalued and underutilized, while delivering profit returns that would make any CFO take notice.

Radiocentre unveiled “High Gain Audio,” a comprehensive ROI analysis conducted by WPP Media, at their Tuning In conference on September 23rd, 2025. The study utilized robust data from Thinkbox’s award-winning Profit Ability 2 study combined with WPP Media’s multiplatform audio dataset to demonstrate audio advertising’s superior profit performance.

The Key Points:

Digital audio delivers £5.20 full-term profit return per £1 spent, while broadcast radio returns £5, both significantly outperforming the all-media average of £4.11.

Short-term ROI follows the same pattern with digital audio at £2.70 and broadcast radio at £2.30 per £1 spent, versus the all-media average of £1.87.

Reallocating existing media budgets to maximize audio’s share can amplify total campaign short-term ROI by 8% compared to campaigns with no audio.

Both audio formats exceed all-media profit ROI averages for demand-generation and demand-conversion campaigns.

Radiocentre recommends advertisers allocate 20% of total media spend to audio to fully benefit from its amplification effect

Why It Matters: This research provides concrete financial justification for audio investment at a time when many advertisers still treat radio and digital audio as supplementary channels. The consistent outperformance across both short-term and full-term metrics, plus the 8% ROI amplification effect, means audio isn’t just competing with other media – it’s enhancing overall campaign effectiveness. With commercial audio audiences growing 23% over five years, advertisers who increase their audio allocation now are positioning themselves ahead of inevitable market corrections where audio commands higher premiums.

The Big Picture: For podcasters and audio content producers, this research fundamentally shifts the conversation from “why audio?” to “why not more audio?” The 20% recommended allocation represents a massive opportunity gap – most campaigns currently dedicate far less to audio formats.

Producers should use these ROI figures when negotiating with advertisers, emphasizing that audio investment doesn’t just fill inventory, it amplifies entire campaign performance. The distinction between digital audio’s £5.20 return versus broadcast radio’s £5 return also validates premium pricing for podcast and streaming placements.

Most importantly, this data arms the audio industry with the business case it needs to compete for larger budget allocations. When audio demonstrably delivers 26% higher full-term ROI than the media average, the question isn’t whether brands can afford to invest more in audio – it’s whether they can afford not to.

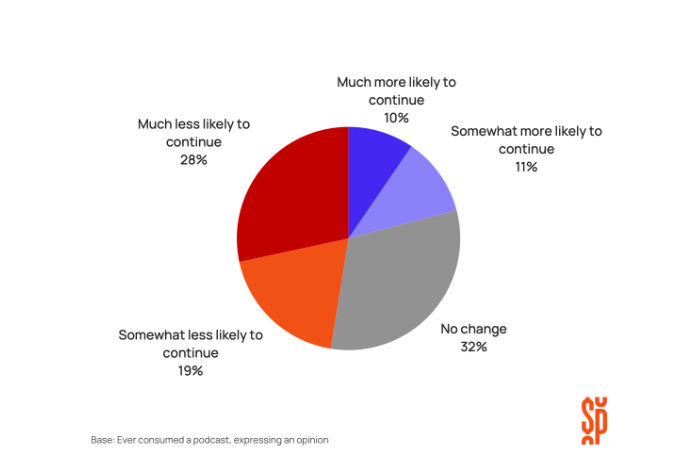

How Do Humans Feel About AI Voices In Podcasting?

The Podwires: Hollywood Reporter dropped news about Inception Point AI planning to crank out thousands of AI-generated podcasts weekly, and the podcast community collectively lost its mind. The reaction was swift – from Adopter Media’s call for disclosure requirements to Adam Bowie’s less-than-impressed sampling of the actual content. But here’s the thing: hot takes are easy. Data’s harder. Tom Webster dug into the numbers to find out what actual humans think about AI voices in their podcasts, and the results should make everyone in this industry pay attention.

The Research: Tom Webster, Partner at Sounds Profitable and veteran audio researcher, analyzed data from the 2025 Podcast Landscape study and previous Audio Publishers Association consumer surveys to gauge listener attitudes toward AI-generated voices in podcast content and advertising.

The Key Points:

47% of podcast listeners say they’d be less likely to continue with a favorite podcast if they learned it featured AI-generated voices (28% “much less likely”)

Only 21% would be more likely to continue listening, with 32% neutral on the issue

The rejection isn’t age-based – 18-24s (45% less likely) mirror 55+ listeners (49% less likely) in their skepticism

Educational attainment is the real predictor: 49% of those with post-graduate degrees are less likely to accept AI voices, compared to just 37% of those without high school diplomas

Among audiobook listeners, willingness to try AI narration dropped from 77% in 2023 to 70% in 2025, showing declining receptivity over time

Why It Matters The educated wariness isn’t about technological literacy – it’s about job security. White collar workers with college degrees understand that AI is coming for their jobs first, and that existential threat colors how they receive AI-generated content. This means the podcasters and agencies rushing into AI voice production aren’t just fighting a quality battle. They’re fighting a perception war with an audience that sees this technology as a direct threat to human livelihoods. You can’t data your way out of that.

The Big Picture For podcasters and producers, this creates a minefield that excellent execution alone won’t navigate. The industry needs disclosure standards – listeners deserve to know what they’re consuming. Producers should consider hybrid approaches where AI augments rather than replaces human voices, or focus AI applications on areas that don’t threaten creative jobs.

The advertising implications are equally critical: brands need to understand that AI-voiced ads could actively harm campaign performance with nearly half of listeners. This isn’t a trend to ride – it’s a transformation that requires strategy. The data shows AI might be coming to podcasting, but the audience isn’t rolling out the welcome mat. Anyone diving into AI-generated podcast content needs a plan that addresses listener concerns head-on, not just a plan to create content cheaper and faster.

Human voices built this medium. The path forward requires respecting that.

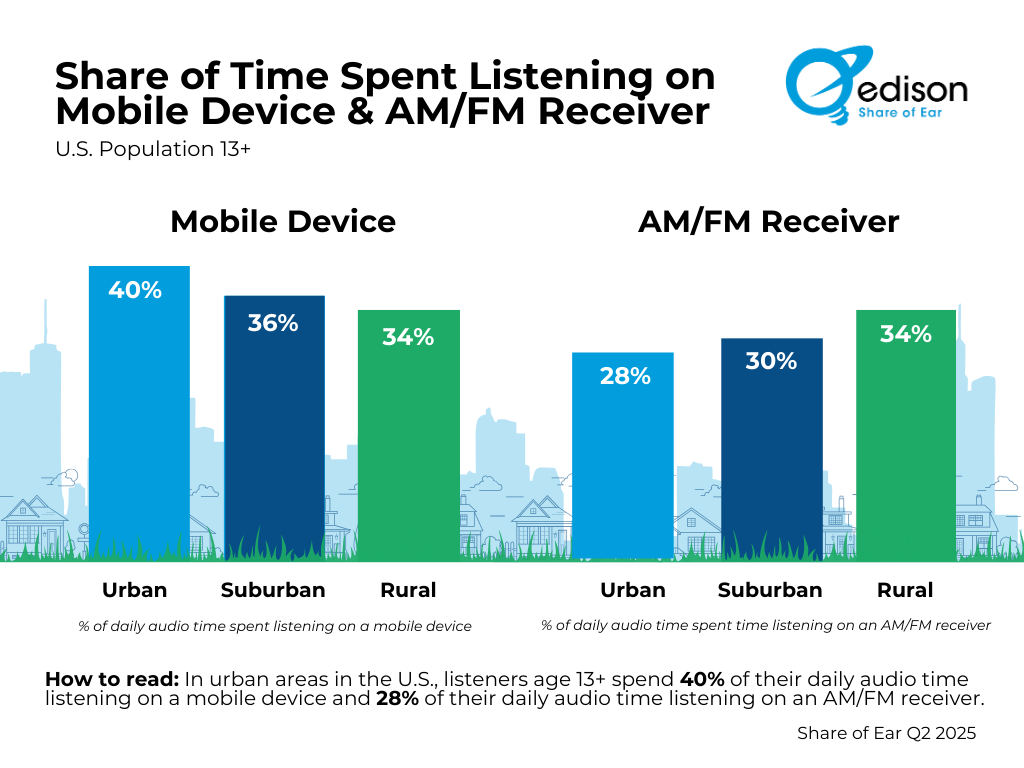

Rural America Still Loves Radio. That’s Not Nostalgia – It’s Strategy.

The Podwires: Mobile devices crushed AM/FM radio receivers as the primary audio listening device back in Q3 2022. Case closed, right? Not so fast. Edison Research’s latest Share of Ear data reveals something the “radio is dead” crowd keeps missing: in rural America, AM/FM radio receivers tie mobile devices at 34% of listening time each. That’s not a rounding error. That’s a market reality that podcasters and audio producers ignore at their own peril.

The Research: Edison Research’s Share of Ear Q2 2025 study analyzed how Americans 13+ consume audio across different device types, breaking down listening patterns by community type (urban, suburban, and rural). The research tracks daily audio engagement to understand device preferences across different geographic segments.

The Key Points:

Mobile devices account for 38% of audio listening time nationally, while AM/FM radio receivers capture 30%

Urban listeners strongly favor mobile (40%) over radio (28%), with a 12-point gap showing clear device preference

Suburban communities mirror the national trend with mobile at 36% and radio at 30%

Rural communities are the outlier: AM/FM radio and mobile devices each command 34% of listening time

The mobile device overtook radio nationally in Q3 2022, but rural markets never fully made that switch

Why It Matters Geography isn’t just demographics – it’s behavior. Rural listeners have different audio habits than urban and suburban audiences, and that 34-34 split tells you everything about infrastructure, lifestyle, and media consumption patterns. These communities still rely heavily on over-the-air broadcasting, whether it’s during commutes, at work sites, or in areas where mobile connectivity remains spotty. For anyone trying to reach rural America with audio content, understanding this device parity means you can’t build a mobile-only strategy and expect to win.

The Big Picture : For podcasters and producers, this data demands a multi-platform distribution strategy. If you’re creating content meant to reach beyond coastal metros, you need to think about broadcast radio syndication alongside your streaming distribution. Radio station partnerships in rural markets aren’t legacy plays – they’re audience acquisition strategies.

Advertisers targeting rural demographics need to split their audio budgets accordingly: streaming-only campaigns will miss half the available listening time. The podcast industry’s obsession with mobile-first distribution works brilliantly in cities, but rural America requires a different playbook. Smart producers will use Share of Ear data to map their distribution strategy to actual listening behavior by geography, ensuring their content meets audiences where they already are instead of where Silicon Valley thinks they should be.

The mobile revolution happened. Just not everywhere equally.

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand's voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

MORE FROM PODWIRES:

Independent Podcasters Are Getting Left Behind in the Video Gold Rush. That’s a Problem for Everyone.

The Podwires: Here’s something the industry doesn’t want to talk about: while everyone’s chasing video podcast dollars, we’re about to kneecap the creators who actually built this medium. Independent podcasters – the roughly 435,000 shows operating outside major media companies – are the backbone of podcasting. They’re also about to get financially gutted if we’re not careful.

A new piece in Fast Company by Giles Martin, EVP of strategy at Oxford Road (the world’s largest podcast agency), lays out the uncomfortable math. Indies don’t just make up the majority of podcasts – they deliver better results. Their shows are 37% more likely to hit advertiser performance targets compared to network podcasts. Their ads are 50% more likely to keep delivering impressions months after insertion. They feature more and longer host-read ads, which remain podcasting’s most effective format.

The Key Points:

Independent podcasters represent the vast majority of approximately 435,000 actively publishing podcasts, operating outside major media company umbrellas.

Indies are 37% more likely to hit advertising performance targets compared to network podcasts, with ads that are 50% more likely to deliver impressions long-term.

The top 500 podcasts receive nearly half of all podcast advertising spend, concentrating revenue among major shows.

Video production demands and potential budget shifts toward video-enabled shows threaten to defund independent audio podcasters.

Successful podcast advertising strategies require a balanced mix of major network shows and independent creators to maximize both reach and ROI.

Why It Matters: The shift to video isn’t just changing how podcasts look – it’s changing who can afford to make them. Video production requires more equipment, more skills, and more money. If advertisers start moving budgets exclusively toward video-enabled shows, independent podcasters who built loyal audiences through authentic audio storytelling could lose their funding. That’s not just bad for indies – it’s bad for the entire industry. These creators built podcasting’s reputation for authenticity and direct audience connection, the very qualities that make podcast advertising effective in the first place.

The Big Picture: For podcasters and producers, this creates a critical strategic decision point. Indies need to decide whether investing in video equipment and skills is worth potentially sacrificing the lean, authentic production style that made them successful.

Major publishers and advertisers need to resist the temptation to chase scale and “easily executed media buys” at the expense of the creators who deliver superior performance metrics. The industry as a whole benefits when media plans balance major network reach with independent authenticity – but that only works if advertisers fund both.

Without deliberate investment in independent creators, podcasting risks losing the low barrier to entry and creative experimentation that differentiated it from traditional media. The irony? In chasing video to compete with YouTube, we might destroy the very thing that made podcasting special in the first place.

🎙️ EVERYTHING ELSE IN PODCASTING TODAY

Big Tech Bets on Programmatic Audio: Amazon, Spotify, and Trade Desk Expand Digital Audio Advertising

TWiT.tv Signs Distribution Deal With Airwave: ‘This Week in Tech’ and 12 Shows Join Podcast Network.

NPR College Podcast Challenge 2025: $5,000 Grand Prize Contest Opens September 19 for Students.

DAX US and NumberEight Launch Privacy-First Podcast Audience Targeting as Ad Revenue Tops $2 Billion.

Podscribe Launches Engagement Scores, Vanity URL Tracking, and Multi-Factor Authentication for Podcast Ad Measurement

Video for Podcasts: Why You Can’t Ignore it and How to Make Video Easy

Spotify Rolls Out AI Impersonation Rules and Music Spam Detection System

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

🎧 PODCASTING JOB OPPORTUNITIES

YAP Media - Senior Marketing & Audience Development Specialist

Boston University - Associate Podcast Producer Audio + video

Colorado Public Radio (CPR) - Executive Producer

Agents Only - Podcast Agent

Boosteras - Podcast YouTube Video Editor

Boosteras - Podcast Executive Assistant

👀 Hiring? Or looking for a new job

Grow your business through podcasting. Marketplace Podwires connects you with skilled producers who can craft compelling stories that align with your brand. Start your podcast journey today! 👈

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it's newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners' unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it.

Thanks to the support of our readers, we can continue to provide free reporting. If you can, please choose to support The Podwires