🎙Apple Wants You to Think Video Podcasting Just Got Easier. Let's Talk About What They're Not Telling You.

Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

If you love travel, check out our sister publication “Mencari’s Travel Wire”

👋 Hi, Podsky!

We’re asking our readers: continue supporting independent podcast creators. Subscribe, share their work, and help ensure vital community spaces like this one can thrive.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (February 22 2026)

🎙️Today, we’ve got the inside scoop on:

Apple Wants You to Think Video Podcasting Just Got Easier. Let's Talk About What They're Not Telling You.

Sports Podcasts Are Eating Everyone Else's Lunch. And It's Getting Worse.

Audio Industry Declares Victory in "Golden Age of Measurement" While 55% of Advertisers Still Can't Figure Out How to Measure It

Podcast Insight: Tom Webster Says Apple’s Video Move Creates a “Wider Funnel.” The Data Says It’s Actually Fragmenting an Already Fragmented Market.

PodBusiness : The Olympics Attract Non-Sports Fans Better Than Any League. So Why Are Podcast Advertisers Still Dumping Money Into Year-Round Sports Content?

Job Board : Libsyn - Head of Business Analytics

APPLE

Apple Wants You to Think Video Podcasting Just Got Easier. Let's Talk About What They're Not Telling You

Podwires Rundown : Apple just announced HLS video support for podcasts, rolling out this spring. On the surface, it’s positioned as creator-friendly: seamless integration, dynamic ad insertion, and “you stay in control.” But dig into the details and you’ll find the usual pattern—platform consolidation disguised as innovation, with creators getting fewer choices while Apple tightens its grip on distribution.

The Source:

Apple Podcasts for Creators documentation, published February 2026, outlines the new HLS (HTTP Live Streaming) video standard that allows podcasters to deliver video through select hosting providers using API keys. Currently limited to Acast, Art19, Omny Studio, and Simplecast, with “expanding availability over time.”

The Key Points:

Only four hosting providers currently support Apple’s new HLS video format—Acast, Art19, Omny Studio, and Simplecast—with no timeline for broader availability

API key requirement creates a new authentication layer between creators and Apple, ostensibly for “seamless publishing” but effectively adding platform dependency

Video and audio analytics are grouped together under combined metrics, making it impossible to measure true video performance separately from audio consumption

Automatic downloads default to audio only for video episodes, with users required to opt-in for video downloads—potentially masking actual video engagement

Apple Podcasts Subscriptions remain audio-only, meaning creators can’t monetize video content through Apple’s premium offering despite the platform push

Why It Matters:

Apple’s framing this as giving creators “more ways to engage” and “control over monetization,” but the infrastructure tells a different story. By limiting HLS support to four hosting providers and requiring API keys for authentication, Apple’s creating new gatekeepers while claiming openness. The combined video/audio analytics obscure actual performance data—you can’t tell if viewers are actually watching or just listening to the audio track. And remember, we already know from Oxford Road and Podscribe data that video podcasts cost 77% more per hour of audience attention while delivering 18-25% worse conversion rates than audio. Now Apple’s pushing creators toward a format with demonstrated inferior advertising performance while making it harder to measure that underperformance. Let that sink in.

The Big Picture:

For podcasters, this creates a forced choice problem. If your hosting provider isn’t one of the chosen four, you’re locked out until Apple “expands availability”—and we know how Apple’s timelines work. For podcast producers, you’re now developing video content without clear ROI data since Apple won’t separate video analytics from audio. The industry implications are more troubling: Apple’s using “open standard” language (HLS) while building a closed implementation (limited hosts, API requirements, grouped metrics).

This follows the exact pattern we’ve tracked with Spotify’s consolidation—platforms offering “opportunities” that actually reduce creator leverage. The actionable insight? Don’t rush into video production just because Apple offers it. Demand separated analytics from your hosting provider. Calculate actual video production costs against the demonstrated lower ad performance. And if you’re locked out by hosting provider limitations, that might be doing you a favor. The podcast industry doesn’t need another format pushed by platform priorities rather than creator economics.

Fair play to Apple for maintaining creator control over ad partners and business models. But let’s not pretend this is about making podcasting easier—it’s about Apple maintaining relevance in the video podcast race while YouTube already owns that space. And they’re doing it by adding complexity for creators while reducing measurement transparency.

The quirks used to be the point. Now they’re just barriers disguised as features.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

MAGELLAN AI

Sports Podcasts Are Eating Everyone Else's Lunch. And It's Getting Worse.

Podwires Rundown : January’s podcast advertising data just dropped from Magellan AI, and if you’re not making sports content, you need to see what’s happening to your share of advertiser dollars. Thirteen of the top fifteen spenders chose sports as their primary genre. Not news. Not comedy. Not true crime. Sports. And before you tell yourself this is just seasonal Super Bowl spending, look closer—this isn’t a blip, it’s a structural shift that’s leaving everyone else fighting for scraps.

The Source:

Magellan AI’s January 2026 Top Podcast Advertisers report, analyzing advertising spend across the top 3,000 U.S. podcasts using their proprietary model that factors ad load, downloads, CPM rates, and brand share of voice. Rankings released February 2026.

The Key Points:

Sports genre captured 13 of the top 15 advertiser spots, with T-Mobile ($5.9M), FanDuel ($5.2M), TJX Companies ($4.0M), Toyota ($3.7M), Amazon ($3.7M), DraftKings ($3.7M), Public.com ($3.3M), Intuit ($2.9M), LinkedIn ($2.7M), Verizon ($2.6M), and Progressive ($2.4M) all choosing sports as their primary category

BetterHelp remained the #2 overall spender at $5.6M despite focusing on comedy podcasts, making it the only non-sports advertiser in the top tier besides Quince (#3, $5.2M) and Rocket Companies (#5, $4.5M in science)

Intuit led movers with 518% growth ($466K to $2.9M), while monday.com and Blucora entered with zero prior spend, signaling new advertiser confidence or desperation depending on your read

Massive percentage gains reveal volatility, with ANGI Group up 27,984%, Athletic Brewing up 7,236%, and Orangetheory up 17,746%—numbers that either indicate brilliant campaign timing or Magellan’s model struggling with small-to-large transitions

Total top-15 spend exceeded $56 million for January alone, with the top three advertisers (T-Mobile, BetterHelp, Quince) accounting for $16.8M or nearly 30% of tracked top-tier spending

Why It Matters:

If you’re producing podcasts outside sports, this data should terrify you. The advertiser dollar concentration in sports isn’t about sports podcasts being “better”—it’s about sports audiences delivering what advertisers actually want: consistent, predictable, highly engaged listeners who show up on schedule. Comedy got BetterHelp and Quince. Science got Rocket Companies. Everyone else is fighting for the remaining two spots in the top fifteen.

This isn’t about content quality or creativity—it’s about advertiser risk tolerance. Sports podcasts offer appointment listening with known audience demographics. Your beautifully crafted narrative podcast about 18th-century clockmakers? Advertisers see that as a gamble, even if your engagement numbers are stellar. The data proves what we’ve been avoiding: podcast advertising dollars are consolidating around the same reliable categories traditional radio learned to monetize decades ago. Let that sink in.

The Big Picture:

For podcasters outside sports, you’re staring at a structural disadvantage that has nothing to do with your show’s quality. The actionable move? Stop chasing the myth that great content automatically attracts great advertisers. Instead, focus on building direct audience relationships that don’t require competing for advertiser dollars against the sports industrial complex. That means memberships, premium content, live events, merchandise—anything that puts you in direct economic relationship with listeners rather than waiting for brand dollars that are increasingly earmarked for sports before the budget meetings even start.

For podcast producers, these numbers reveal where production investment actually pays off from an advertising perspective. Sports content gets advertiser commitment. Everything else gets experimentation budgets. Build accordingly, or build differently.

For the industry, we need to stop pretending podcast advertising is distributed across diverse content. The top fifteen spenders chose sports 87% of the time. That’s not diversity—that’s monopoly with two comedy exceptions. The “rising tide lifts all boats” narrative only works if advertisers actually spread spend across genres. They don’t. They’re buying sports podcasts the way they bought sports radio, and everyone else is getting what’s left after those deals close.

Fair play to BetterHelp for staying #2 by owning comedy. But one therapy advertiser doesn’t make a balanced ecosystem. The Intuit 518% growth looks impressive until you realize they’re spending $2.9M in... sports. monday.com’s $1.4M debut? Let me check their top genre. Oh right, they haven’t disclosed it, but want to bet it’s not your niche documentary series?

The movers & shakers list tells a different story than Magellan probably intended. Those massive percentage increases (27,984% for ANGI, 17,746% for Orangetheory) aren’t evidence of podcast advertising health—they’re evidence of extreme volatility in who’s spending and how much. When your month-over-month changes are measured in thousands of percent, you’re not looking at strategic media buying. You’re looking at experimental budgets getting turned on and off like light switches.

Here’s what nobody wants to say: podcast advertising is increasingly becoming sports podcast advertising with a therapy company on the side. If that’s your lane, congratulations. If it’s not, you better start building revenue streams that don’t depend on competing for attention from brands that have already decided where they’re spending.

The quirks aren’t the point anymore. The predictability is. And sports delivers that in ways your artisanal content never will to risk-averse media buyers.

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

SOUNDS PROFITABLE

Tom Webster Says Apple’s Video Move Creates a “Wider Funnel.” The Data Says It’s Actually Fragmenting an Already Fragmented Market.

Podwires Rundown : Tom Webster just published a characteristically thoughtful piece framing Apple’s video support as the “third leg of the stool” - stabilizing the podcast ecosystem by giving Apple users what they already want. He’s not wrong about the data. But he’s asking the wrong question. The issue isn’t whether Apple Podcasts users want video. It’s whether creators can afford to produce for three distinct platforms with three distinct audience expectations - and whether that “diversification” Webster celebrates is actually just expensive format chaos disguised as opportunity.

The Source:

Sounds Profitable article by Tom Webster, February 19, 2026, analyzing proprietary data from The Podcast Landscape 2025 study conducted with Signal Hill Insights. Study examines podcast consumption patterns, discovery methods, and format preferences across Apple Podcasts, Spotify, and YouTube audiences.

The Key Points:

Nearly 80% of Apple Podcasts users expect audio-first content, with only 4.5% defaulting to video expectations - making Apple the “most podcast-native audience of any major platform” but also the least video-ready

42% of Apple’s existing video podcast consumers spend more than half their podcast time watching video, indicating latent demand that’s currently being fulfilled on YouTube and other platforms

In-app browsing drives 17% of discovery for Apple users, but video-native platforms (YouTube 14%, Instagram 15%, TikTok 13%) collectively represent a larger discovery funnel than Apple’s own discovery tools

Three distinct audience compositions now require three production strategies: YouTube’s video-native audience (40% spending 75%+ time on video), Spotify’s hybrid music/podcast audience (clustering 25-50% video consumption), and Apple’s audio-native audience (16% “swing voters” open to video)

Webster frames this as “diversification” rather than platform competition, arguing the “third leg” stabilizes the ecosystem by serving different audiences with different expectations across different platforms

Why It Matters:

Webster’s analysis is technically accurate but strategically incomplete. Yes, Apple users who want video have been going elsewhere. Yes, bringing video into Apple “cleans up the data” by consolidating consumption in one platform. But here’s what he’s not emphasizing: you now need three completely different production strategies to serve three completely different audiences on three completely different platforms. That’s not a “wider funnel” - that’s tripling your production complexity while fragmenting your audience across incompatible ecosystems.

The 80% of Apple users expecting audio-first content aren’t going to suddenly start watching video just because Apple supports it. The 42% already watching video elsewhere aren’t necessarily coming back to Apple - they’ve already built YouTube habits. And that 16% of “swing voters” Webster identifies? They’re not demand - they’re indifference. “May be audio or video” doesn’t mean “eager for video” - it means “don’t care enough to have a preference.” Building an entire video production strategy to capture indifferent users is exactly the kind of format-chasing that the data on video podcast advertising effectiveness already told us doesn’t pay off.

Let that sink in: Webster is celebrating platform diversity while the actual creator experience is format fragmentation with no clear ROI path. Fair play to Apple for closing the gap between social discovery (TikTok clips) and in-app experience. But the idea that creators should now optimize for three different audience expectations simultaneously isn’t opportunity - it’s overhead.

The Big Picture:

For podcasters, Webster’s “three on-ramps” framing sounds appealing until you calculate what it actually costs to maintain three distinct production workflows. Audio-only for the 80% of Apple users who expect it. Video-optimized for YouTube’s video-native audience. Hybrid for Spotify’s music-first users. Each platform has different discovery algorithms, different ad integration, different community features. That’s not diversification - that’s platform dependency disguised as strategic optionality.

For podcast producers, the actionable reality is harsher than Webster’s optimistic framing suggests. You’re not serving “different audiences with different expectations” - you’re fragmenting your production resources across incompatible platforms while hoping each audience segment is large enough to justify the investment. The data Webster presents actually proves the problem: no platform has a clear majority format preference. Apple’s 80% audio-first is the closest thing to consensus, and even that leaves 20% wanting something else.

For the industry, this is the Saab problem all over again. Remember that reference from my earlier piece about podcast apps? Webster is essentially arguing that having three different Saab models (Swedish audio, GM video, Subaru hybrid) is better than having one car that works for everyone. But the actual lesson from Saab is that fragmentation kills the thing that made it special. Podcasting’s strength was never format flexibility - it was intimate, audio-first storytelling that built trust. Now we’re chasing video because platforms need it for their algorithms, not because it serves the creative medium.

Webster’s “stool” metaphor only works if all three legs are actually supporting the same table. But Apple, Spotify, and YouTube aren’t collaborating on a shared podcasting experience - they’re competing for audience time across fundamentally different content models. Apple wants podcast-native audio. YouTube wants video-first content that feeds its recommendation engine. Spotify wants music listeners who occasionally podcast. Those aren’t three legs of one stool. Those are three different stools in three different rooms, and creators are supposed to build furniture for all of them simultaneously.

The discovery data Webster highlights actually undermines his own argument. If video-native platforms (YouTube, Instagram, TikTok) collectively drive more discovery than Apple’s in-app browsing, that’s not evidence that Apple needs video support - it’s evidence that social video discovery doesn’t convert to podcast listening at rates that justify the production investment. People see a TikTok clip, maybe check out the show, and then... what? Webster assumes they come to Apple Podcasts wanting video. The data says 80% of them will expect audio. So you spent money creating that TikTok clip to acquire listeners who don’t actually want the format you created it in.

Fair play to Tom for the optimistic framing. The podcast industry needs voices who see opportunities rather than just problems. But when that optimism requires creators to triple their production complexity while serving three fragmented audiences with no clear format consensus, we’re not building a wider funnel - we’re building an expensive mess that platforms benefit from while creators pay for.

The stool metaphor is apt, actually. But I grew up in New England too, and I remember those Allston Christmas stools Tom’s talking about. You know what happened to most of them? They broke. Because when you’re balancing on three uneven legs trying to serve three different purposes, eventually something gives. Usually it’s the creator’s budget.

Webster’s right that this “promotes competition and innovation.” What he’s not saying is that creators fund that competition with their production budgets while platforms compete for their attention. The third leg of the stool just got sturdier? Maybe. But the table it’s supporting is still three different platforms pulling in three different directions, and the person trying to eat dinner on it is the podcaster who just tripled their workflow.

The couch stays on the curb, but so does the fantasy that platform fragmentation equals creator opportunity.

EDISON RESEARCH

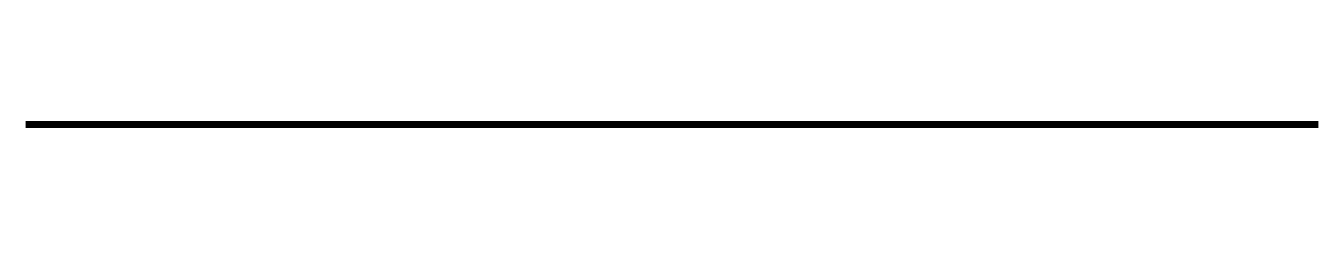

The Olympics Attract Non-Sports Fans Better Than Any League. So Why Are Podcast Advertisers Still Dumping Money Into Year-Round Sports Content?

Podwires Rundown: Edison Research just dropped data that should make every sports podcaster rethink their entire advertising pitch. The Olympics attract more interest from non-sports fans and light sports fans than any professional or collegiate league - and it’s not even close. They’ve been winning this category for 30 years straight. Meanwhile, remember that Magellan AI data showing 13 of the top 15 podcast advertisers choosing sports as their primary genre? Those advertisers are spending millions on content that only reaches existing sports fans while ignoring the one sports property that actually converts casual audiences.

The Source:

Edison Research Weekly Insights, February 18, 2026, analyzing data from the SSRS Sports Poll tracking audience interest across professional and collegiate sports leagues among U.S. audiences 12+. The 2021 SSRS Opinion Panel examined the Olympics’ role in developing sports fandom, surveying Americans aged 12 and older.

The Key Points:

The Olympics generate significantly more interest than any professional or collegiate sports league among non-sports fans and light sports fans, a pattern that has held consistent for over 30 years of Sports Poll tracking

68% of Americans 12+ identified the Olympics as an important factor in becoming a sports fan, making the Games the primary gateway for sports fandom development rather than professional leagues

The 2026 Winter Olympics competed directly with the Super Bowl (Seattle Seahawks vs. New England Patriots) in February, creating a rare opportunity to compare audience composition across elite sports properties

Non-sports fans and light sports fans represent the audience segments most influenced by Olympic coverage, while professional league interest clusters among existing average and avid sports fans

The Olympics’ 30-year dominance in converting casual viewers suggests a fundamentally different audience relationship than what professional sports leagues achieve with year-round content

Why It Matters:

This data exposes a massive disconnect in podcast advertising strategy. Sports podcasts dominate advertiser spending because they deliver “consistent, predictable, highly engaged listeners” - but that’s exactly the problem. They’re only reaching people who are already sports fans. The Olympics prove that sports content CAN attract casual audiences and non-fans, but it requires a fundamentally different approach than what sports podcasts are currently delivering.

Think about what 68% actually means. More than two-thirds of Americans credit the Olympics with making them sports fans in the first place. That’s not just “interest” - that’s conversion from non-fan to fan. Professional sports leagues don’t do this. They cultivate existing fans and deepen engagement with avid followers. The Olympics create new fans from scratch, which should be the holy grail for any advertiser trying to reach beyond their core demographic.

But look at where podcast advertising dollars are going. T-Mobile, FanDuel, DraftKings, Toyota - all spending millions in sports podcasts that primarily reach existing sports fans. Meanwhile, the one sports property proven to attract non-sports fans happens once every two years (Summer and Winter Games) and generates almost zero year-round podcasting content strategy. Let that sink in.

The Big Picture:

For podcasters, this reveals the fundamental strategic error in chasing sports content for advertising dollars. You’re competing for budget allocated to reach existing fans when the conversion opportunity - the Olympics model of attracting casual audiences - remains almost completely unexploited in podcasting. The actionable insight? Stop making sports podcasts that serve avid fans and start making Olympics-style content that converts non-fans.

What does that actually mean? The Olympics work because they combine human interest storytelling, accessible explanations of unfamiliar sports, and emotional narratives that transcend pure athletic competition. They make curling interesting to people who’ve never seen ice outside a freezer. They turn figure skating into compelling drama for audiences who couldn’t name a single professional skater. That’s the format insight sports podcasts are missing.

For podcast producers, the Olympics data suggests you’ve been optimizing for the wrong metrics. Depth of fan engagement (which sports podcasts excel at) generates advertising dollars today, but breadth of audience conversion (which Olympics-style content achieves) builds the larger addressable market that advertisers actually need for growth. You’re serving the existing fan base instead of expanding it, which makes you replaceable the moment those fans’ habits shift.

For the industry, this explains why sports podcast advertising appears so dominant while simultaneously being so fragile. You’re concentrating budget in content that serves a self-limiting audience. The Olympics prove sports content can reach beyond hardcore fans, but only 30 years of consistent data proving it matters if podcasters don’t actually change their production approach.

Fair play to sports podcasters for capturing advertiser dollars in a competitive market. But Edison’s data reveals you’re leaving the bigger opportunity completely untapped. The Olympics attract non-sports fans because they prioritize storytelling over statistics, human drama over technical analysis, and accessibility over insider expertise. Sports podcasts do the exact opposite, then wonder why they can’t expand beyond the avid fan demo.

Here’s the uncomfortable truth: 68% of sports fans credit the Olympics with their fandom, but almost zero ongoing podcasting content tries to replicate what made that conversion successful. Instead, the industry produces endless content for the avid fans who are already converted, competing for the same advertising dollars while the actual growth audience - casual fans and non-fans - remains underserved.

The Olympics happen in February and August. Sports podcast advertising flows year-round to content that can’t replicate the Olympics’ audience conversion success. That’s not strategy - that’s mistaking consistent cash flow for sustainable growth. And when advertiser priorities shift or sports fan habits change, the podcasts optimized for depth rather than breadth won’t have anywhere to expand.

The data’s been consistent for 30 years. The industry’s been ignoring it for just as long.

WESTWOOD ONE

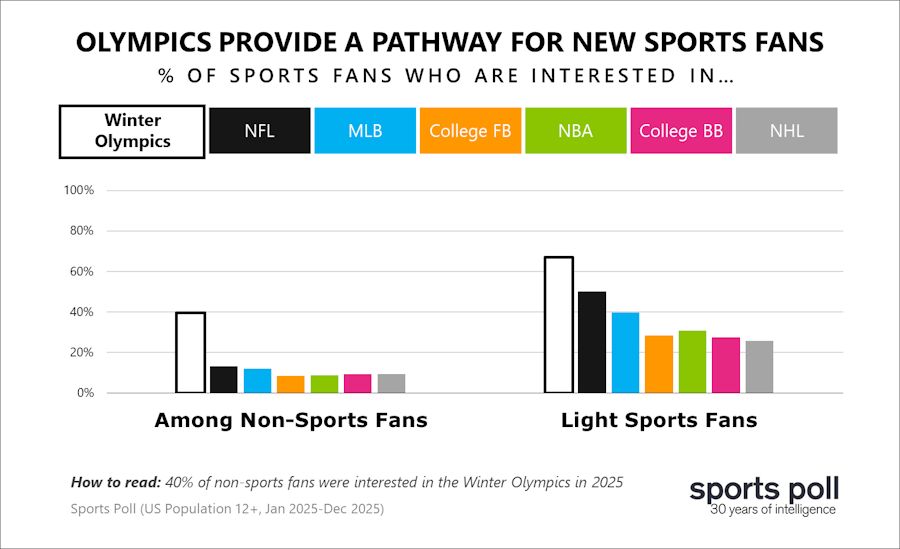

Audio Industry Declares Victory in "Golden Age of Measurement" While 55% of Advertisers Still Can't Figure Out How to Measure It

Podwires Rundown: Pierre Bouvard just published a comprehensive roundup of audio advertising measurement studies, and the disconnect is staggering. 55% of brands and agencies claim “difficulty measuring ROI” prevents increased audio spending. But study after study—from WPP Media, Circana, ABCS Insights, Affinity Solutions, Podscribe—proves audio delivers measurable, superior ROI compared to most other media. So either advertisers are genuinely unaware of all this measurement data, or they’re using “hard to measure” as cover for decisions they’re making for other reasons. Neither option is good for podcasting.

The Source:

Cumulus Media | Westwood One Audio Active Group analysis by Pierre Bouvard, Chief Insights Officer, published February 17, 2026. Synthesizes data from eMarketer’s partnership with Amazon Ads surveying 100 marketers, plus ROI studies from WPP Media (141 brands, $2.46B spend), Circana global Media Mix Modeling, ABCS Insights, Affinity Solutions, Podscribe Q4 2025 benchmark report, Adelaide attentiveness scores, and Lumen attention studies commissioned by Dentsu.

The Key Points:

55% of advertisers cite “difficulty measuring ROI” as the barrier to audio investment, while 36% believe audio is less effective than other channels—yet this perception exists despite dozens of published measurement studies proving audio’s effectiveness

Advertisers use audio primarily for awareness, consideration, and brand favorability (top/mid-funnel objectives) but then mistakenly evaluate these brand-building campaigns using lower-funnel metrics like sales conversions—what Bouvard calls “testing a Spanish class with a calculus exam”

WPP Media’s study of 141 brands spending $2.46B found digital audio tied for first in short-term ROI while AM/FM radio ranked second, both outperforming digital media and linear TV—yet Circana’s CMO survey ranked audio dead last in perceived effectiveness

Podcasts generate 94% of linear TV’s attentiveness according to Adelaide AU scores, while audio ads outperformed video for attention and brand recall in Lumen’s study for Dentsu—debunking the “sight, sound, and motion” superiority myth

Podscribe’s Q4 2025 report analyzed 79,000 campaigns from 600+ advertisers generating 20 billion impressions, providing comprehensive conversion norms and ROI benchmarks by industry and podcast genre—publicly available data that advertisers claiming measurement difficulty apparently aren’t reading

Why It Matters:

This isn’t a measurement problem—it’s a perception problem masquerading as a measurement problem. The data exists. The studies are published. The benchmarks are available. Advertisers claiming they can’t measure audio ROI are either ignorant of the measurement options or using “difficulty measuring” as diplomatic cover for preferring video formats they’re more comfortable with. Let that sink in.

The “testing a Spanish class with a calculus exam” framing is actually brilliant. Advertisers say they’re using audio for brand building (awareness, consideration, favorability), then complain they can’t measure ROI using performance marketing metrics (conversions, sales, lower-funnel KPIs). Of course you can’t—you’re measuring the wrong thing. Brand lift studies from firms like Upwave exist specifically for this purpose, but 55% of advertisers apparently don’t know this or don’t care to find out.

Here’s the uncomfortable reality: Audio delivers superior ROI in actual Media Mix Modeling studies while ranking dead last in CMO perception surveys. That gap isn’t about measurement availability—it’s about advertiser education, internal politics, or preference for visual formats regardless of performance data. Fair play to Pierre Bouvard for compiling all this evidence, but if comprehensive ROI data from WPP, Circana, ABCS, and Podscribe isn’t moving the needle on advertiser perception, the problem isn’t measurement—it’s willful ignorance or deliberate misdirection.

The Big Picture:

For podcasters, this data dump should be both encouraging and infuriating. Encouraging because the ROI evidence is overwhelming—podcasts generate 94% of TV’s attentiveness while costing a fraction of TV CPMs, Podscribe provides quarterly benchmarks showing actual conversion rates and cost-per-acquisition, and global Media Mix Modeling consistently ranks audio in the top tier for ROI. You have the ammunition to prove podcast advertising works. The measurements exist. The benchmarks are published. The case studies are documented.

But it’s infuriating because none of this seems to matter to the 55% of advertisers claiming measurement difficulty. The actionable reality? Stop waiting for advertisers to discover measurement solutions they’re apparently not looking for. Instead, proactively present the Podscribe benchmarks, the WPP ROI rankings, the Adelaide attentiveness scores in your pitch materials. Make ignorance of measurement options impossible by forcing the data into every advertiser conversation. If they still claim they “can’t measure” after you’ve handed them Podscribe’s 79,000-campaign benchmark report, you know the objection is fake.

For podcast producers, this reveals where to focus your energy. Advertisers say they’re using audio for brand building but evaluating with performance metrics—so build measurement partnerships that track both. Work with hosting providers who integrate Podscribe attribution. Include brand lift measurement in campaign proposals. Educate clients on the difference between brand-building KPIs (awareness, consideration, favorability) and performance KPIs (conversions, sales, traffic). The measurement exists—your job is making it impossible for advertisers to claim ignorance.

For the industry, Bouvard’s roundup exposes a troubling pattern: perception lags reality by years, maybe decades. CMOs rank audio dead last in effectiveness while Media Mix Modeling proves it’s top tier for ROI. Advertisers claim measurement difficulty while firms like ABCS Insights, Affinity Solutions, and Podscribe publish quarterly benchmarks. This isn’t a measurement gap—it’s a communication failure or a preference gap disguised as a measurement problem.

The Spanish class/calculus exam metaphor cuts deep because it’s exactly right. You can’t measure brand-building campaigns (which is what advertisers say they use audio for) with lower-funnel performance metrics (which is what they demand for “proof”). But here’s what Bouvard doesn’t emphasize enough: TikTok and Tracksuit data proves strong brand awareness significantly improves conversion rates. So even if advertisers want lower-funnel results, the path there runs through the brand building they’re currently unable or unwilling to measure properly.

Fair play to Pierre Bouvard for assembling this comprehensive evidence. The WPP study alone should end the “hard to measure” objection—141 brands, $2.46 billion in spend, ten media channels compared, and audio ranks first or second in both short-term and long-term ROI. But if the podcast industry’s response to “we can’t measure audio” is just “here are more studies” rather than “here’s exactly how we’re measuring YOUR campaign,” we’re missing the point.

The measurement exists. The benchmarks are published. The ROI is proven. If 55% of advertisers still claim difficulty measuring audio, that’s not an audio problem—that’s an advertiser education problem, or more likely, a preference problem hiding behind measurement rhetoric.

The data’s been available for years. The perception hasn’t changed. Let that sink in.

OXFORD ROAD

The Biggest Sports Podcasts Aren't The Best Performing Ones. Not Even Close.

Podwires Rundown: Oxford Road just dropped their February ORBIT rankings, and if you’ve been buying sports podcast ads based on download numbers or celebrity hosts, you’ve been doing it wrong. Their analysis of 500+ advertisers spending $1.6 billion annually reveals the shows actually converting listeners into customers have almost nothing in common with the shows dominating the download charts. 67% of top-performing sports podcasts come from niche sports categories, not the NFL and NBA juggernauts eating up advertiser budgets. Let that sink in.

The Source:

Oxford Road’s ORBIT (Oxford Road Benchmark Intelligence Tool) February 2026 rankings, published February 18, 2026. Analysis draws from actual campaign performance data across 500+ advertisers representing $1.6+ billion in annual spend, normalized across different attribution models including pixels, codes, URLs, and survey-based attribution. Rankings require minimum three distinct advertisers per show, minimum three paid drops per advertiser, with at least 50% of placements exceeding advertiser goals across 12-month rolling analysis.

The Key Points:

67% of top-performing sports podcasts focus on niche sports rather than mainstream NFL/NBA content, with motorsports alone accounting for over 25% of the top 15 shows—indicating concentrated community engagement drives better conversion than broad audience reach

Daily sports podcasts claimed the #1 and #2 performance spots, capitalizing on “perishable content” that forces rapid consumption and enables sequential messaging at higher frequency than weekly formats

Participatory sports podcasts (golf, fantasy, hunting) captured 45% of the top 15 despite representing a small fraction of total sports content, significantly outperforming passive commentary shows on conversion metrics

Fantasy sports podcasts deliver 2.4x better performance during NFL off-season (February-August) compared to in-season due to reduced ad crowding while maintaining hardcore fan engagement—revealing a massive efficiency arbitrage opportunity

Good Karma Brands (ESPN’s podcast network) topped network rankings through aggregated performance of smaller shows rather than individual blockbuster hits, demonstrating consistent conversion across portfolio beats celebrity-driven tentpole strategy

Why It Matters:

Remember that Magellan AI data showing sports dominating advertiser spending? Turns out those advertisers are buying the wrong sports inventory. Oxford Road’s ORBIT doesn’t measure downloads or celebrity appeal—it measures which shows made money and which ones didn’t. And the shows making money are motorsports podcasts, daily format shows, and participatory sports content that most media buyers are ignoring in favor of the big-name NFL and NBA shows that look good in pitch decks but apparently don’t convert.

The 67% niche sports figure destroys the conventional wisdom that broad audience reach drives performance. Oxford Road’s explanation is devastating in its simplicity: “For a general NFL show, listeners spread out across all the options. For niche shows, the community rallies around a single host and feels a greater affinity.” Closeness drives action. The massive NFL podcasts have massive audiences who feel no particular connection to the host. Niche motorsports podcasts have smaller audiences who trust the host enough to act on recommendations.

This directly contradicts the platform consolidation story we’ve been tracking. Sports advertisers are dumping millions into the biggest shows on the biggest platforms, chasing scale, while the actual conversion data proves intimacy and community beat reach and celebrity. Fair play to Oxford Road for measuring what actually matters—ROI—instead of what’s easy to measure—downloads.

The Big Picture:

For podcasters, this is your permission slip to stop chasing mainstream sports categories. The data proves niche communities outperform broad audiences on the metric that actually pays your bills—advertiser ROI. Motorsports, golf, hunting, fantasy sports in off-season—these aren’t premium categories in download rankings, but they’re gold in conversion rankings. The actionable move? Stop trying to compete with Barstool and ESPN on their turf. Build tight communities in niches where listeners actually act on host recommendations.

For podcast producers, the daily format insight is critical. Those #1 and #2 rankings aren’t accidents—they’re structural advantages. “Perishable content” creates urgency that weekly shows can’t match. Listeners tune in fast or the content becomes irrelevant, which means they hear ads at higher frequency, which means advertisers can test sequential messaging, which means better attribution, which means measurable ROI. You’re not just choosing a publishing cadence—you’re choosing whether advertisers can measure your effectiveness.

For the industry, Oxford Road’s methodology exposes how broken podcast advertising buying has become. They require minimum three advertisers, minimum three paid drops each, with at least 50% of placements exceeding goals. That’s the standard. Meanwhile, most podcast advertising is still bought on CPM and download estimates with no performance accountability. ORBIT shows which podcasts made money. Most buying is still based on which podcasts have the biggest audiences. These aren’t the same thing.

The fantasy sports off-season data is particularly damning for conventional media buying. 2.4x better performance February-August versus in-season? That’s not a marginal improvement—that’s a category arbitrage screaming to be exploited. But it requires advertisers to buy counter-cyclically, which requires trusting performance data over intuition, which apparently 55% of advertisers claiming “difficulty measuring ROI” aren’t doing.

Here’s what Oxford Road isn’t saying directly but the data proves: Download-based rankings are worse than useless for media buying—they’re actively misleading. The shows with the most downloads aren’t the shows with the best conversion. The categories with the most content (NFL, NBA) aren’t the categories with the best performance (motorsports, participatory sports). The formats that seem most impressive (weekly deep dives) aren’t the formats that convert best (daily perishable content).

Good Karma Brands topping the network rankings through aggregated smaller shows rather than tentpole hits deserves more attention than Oxford Road gives it. That’s the exact opposite of how most networks are built. Most chase the celebrity host and the breakout hit. Good Karma proves consistent conversion across a portfolio of smaller, focused shows beats the blockbuster strategy when you’re measuring actual ROI instead of vanity metrics.

The participatory sports insight connects everything. These aren’t entertainment shows—they’re educational content helping listeners improve skills. “That deeper engagement in the content means deeper engagement with the ads.” This is the intimacy and trust pattern we keep seeing in all the effective podcast data. Not scale. Not celebrity. Not production value. Trust and utility drive conversion.

Fair play to Oxford Road for building ORBIT and actually publishing the rankings. Most agencies guard this performance data like state secrets. But notice what they’re not doing—they’re not naming the specific shows in their top 15 in the public article. You want to know which motorsports podcasts actually convert? You need to subscribe to their insights or become a client. Can’t blame them for that business model, but it means most advertisers will keep buying based on download charts while the smart money uses ORBIT to find “hidden gems before they become expensive tier-1 shows.”

The era of buying sports podcast ads based on which athlete has the biggest name is over. Or at least it should be. But given that 55% of advertisers claim difficulty measuring ROI despite firms like Oxford Road publishing conversion benchmarks, I’m not optimistic the industry will actually change buying behavior to match the performance data.

The data’s been available. The measurements exist. The rankings prove niche beats mainstream. Whether advertisers actually act on it is a different question entirely.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

ACAST - Programmatic Sales Executive

AUDACY - Ad Ops Coordinator, Podcast Operations

Libsyn - Head of Business Analytics

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.