🎙ABC Australia Bets Big on Podcasts While 59 Local Radio Shows Vanish Into Thin Air Daily;92% of Podcast Listeners Still Just Listen.

Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

👋 Hi, Podsky!

We are thrilled to present the latest edition of Podcast In Brief! And don’t worry, our loyal listeners — you’ll still get the occasional real-time update!

Thank you to all our free and paid subscribers for continuing to support us. As an independent media organisation, we can only continue our work with the support of readers like you, unlike others who are supported by well-funded organisations.

Your subscription to Podwires will help to fund our operations as an independent media organisation. Becoming a paid subscriber

First time reading? We would be delighted if you would join us – after all, we have over 1,000 intellectually curious readers already! Sign up here.

We want everyone to know about this, so please spread the word by sharing the email with your friends! (copy URL here)

And, as always, send us feedback at editor@podwires.com

Today’s reading time is 5 minutes. - Miko Santos (21 November 2025)

🎙️Today, we’ve got the inside scoop on:

ABC Australia Bets Big on Podcasts While 59 Local Radio Shows Vanish Into Thin Air Daily

Bill Burr Outperforms SmartLess in Sales. The Podcast Ad Market Has Been Lying to Itself.

Podcast Insight: Radio Listening Dropped 6% to Digital in Ten Years. The Industry Should Be Terrified.

PodBusiness : 92% of Podcast Listeners Still Just Listen. The Video Panic Was Overblown.

Job Board : ACAST - Ad Operations Coordinator

ABC NEWS AUSTRALIA

ABC Australia Bets Big on Podcasts While 59 Local Radio Shows Vanish Into Thin Air Daily

Podwires Rundown: Australia’s national broadcaster just announced something that should make every podcast producer and local audio journalist pay attention. ABC Managing Director Hugh Marks told the National Press Club they’re launching “a slate of new podcasts and on-demand audio” to complement their radio services. Great news, right?

Here’s the uncomfortable part: ABC currently produces 59 local breakfast radio programs across regional markets every single day. All that local audio news reporting? It “goes to air and it’s lost,” according to Marks himself. Let that sink in. The country’s public broadcaster admits they’re hemorrhaging local audio content daily because they haven’t figured out how to preserve it, distribute it, or make it discoverable.

Source: Hugh Marks’ National Press Club Address, November 2025

The Key Points:

ABC Australia is expanding its podcast slate while admitting 59 daily regional radio programs produce content that disappears after broadcast

The broadcaster plans to use AI tools to convert local audio news into digital products, creating localized versions of ABC News Digital

ABC sees audio storytelling as separate from platform and production skills—requiring mastery of all three to reach younger audiences effectively

The organization is piloting programs with local media operators to share emergency content and support regional journalism through audio partnerships

ABC’s Managing Director explicitly stated they’re “focused on the work, not the distribution”—prioritizing content creation over solving discovery and preservation problems

Why It Matters: When a major public broadcaster with massive resources admits they can’t figure out how to preserve and distribute their daily audio output, it exposes a fundamental problem plaguing the entire podcasting and audio industry. This isn’t about ABC’s content quality—it’s about the industry’s continued failure to solve basic audio discovery, archiving, and distribution challenges that video platforms solved years ago. If ABC with government funding can’t crack this, what chance do independent podcasters have?

The Big Picture :For podcasters and producers, ABC’s announcement reveals both opportunity and warning. The opportunity? Public broadcasters worldwide are finally investing seriously in podcast production, potentially elevating audio storytelling standards and bringing new audiences to the medium. Major institutions validating podcasting as a priority format helps legitimize the entire ecosystem.

The warning? Even well-funded organizations still treat audio as disposable. ABC produces 59 local programs daily that could become hundreds of podcast episodes, preserving regional voices and serving niche audiences—exactly what podcasting does best. Instead, that content vanishes because the infrastructure for audio preservation and discovery remains inadequate.

The AI repurposing angle deserves attention. Converting radio to digital/podcast formats using automation could revolutionize how local journalism reaches audiences, but only if the resulting content is actually discoverable. ABC’s plan to create “localized ABC News Digital services” from audio suggests they’re thinking about audio-to-text transcription and potentially audio newsletters—formats podcast producers should explore.

Most revealing? Marks’ distinction between storytelling skill, platform skill, and production skill. He’s right that reaching younger audiences requires mastering all three. But his statement about being “focused on the work, not the distribution” perfectly captures podcasting’s Achilles heel. Great content dies in obscurity without distribution. YouTube understood this. Spotify understood this. Open podcasting still hasn’t.

For the industry: when public broadcasters announce podcast expansion while simultaneously admitting they’re losing valuable local audio content daily, that’s not success—it’s evidence we’re still treating audio as a second-class digital citizen.

TOGETHER WITH MENCARI NEWS (AU)

The News Powerful People Don’t Want You to Read

Between meetings, emails, and deadlines, who has time to stay properly informed? The Mencari News Australia solves this. Five minutes each morning gives you everything you need about Australian politics, technology, and finance.

No endless scrolling. No clickbait. Just the essential insights that impact your work and life. Smart professionals choose efficiency. Join hundreds of subscribers.

This section is a paid advertisement. If you are interested in advertising, let’s talk.

OXFORD

Bill Burr Outperforms SmartLess in Sales. The Podcast Ad Market Has Been Lying to Itself.

Podwires Rundown : SmartLess hosts three A-list Hollywood celebrities. It regularly tops download charts. Major advertisers line up to buy spots. And according to Oxford Road’s new sales effectiveness ranking, it doesn’t even crack the top 15 comedy podcasts for actually moving product. Meanwhile, Bill Burr—who routinely says “wildly offensive things” during his ad reads—converts listeners into customers better than anyone else in comedy podcasting.

Here’s the uncomfortable part: the industry has spent years optimizing for the wrong metrics. Download numbers and celebrity wattage don’t predict sales performance. Authenticity and audience engagement do. Oxford Road just proved it with $1.6 billion in actual campaign data.

The Key Points:

Bill Burr’s Monday Morning Podcast delivers the best sales performance among all comedy podcasts despite—or because of—his unfiltered approach to ad reads that includes “wildly offensive” commentary

SmartLess, hosted by Jason Bateman, Sean Hayes, and Will Arnett, failed to make the top 15 for sales effectiveness despite massive download numbers and celebrity power

NPR’s Wait Wait Don’t Tell Me ranked high for direct response performance, demolishing the industry assumption that NPR podcasts only work for upper-funnel awareness campaigns

High performers include Las Culturistas, Stavvy’s World, and Fear& (hosted by streamers Hasan Piker, Will Neff, QTCinderella, and AustinShow)—shows with engaged niche audiences rather than broad celebrity appeal

Oxford Road’s ORBIT tool analyzed actual customer acquisition costs and return on ad spend from real campaigns, not vanity metrics like downloads or reach

Why It Matters :The podcasting industry has been selling ads based on a fundamental lie: that big audience numbers automatically translate to sales results. Oxford Road’s data exposes the gap between what advertisers pay for and what actually drives revenue. When a show with three Hollywood stars gets outperformed by a comedian doing unscripted, occasionally offensive ad reads, that’s not an anomaly—it’s evidence that podcast advertising effectiveness has almost nothing to do with polish and everything to do with audience trust and engagement. Advertisers have been overpaying for celebrity shine while undervaluing authentic creator relationships.

The Big Picture : For podcasters, this ranking demolishes the tyranny of download metrics. Bill Burr proves that smaller, intensely loyal audiences who trust the host convert better than massive audiences who tune in for celebrity guests. His willingness to break the fourth wall during ad reads—even saying things that make advertisers uncomfortable—strengthens rather than weakens his commercial effectiveness. The lesson? Stop trying to sound like a professional announcer. Your audience values authenticity over production quality.

For producers and ad sales teams, the SmartLess absence should trigger immediate strategy recalibration. If you’ve been pitching shows based on download numbers and celebrity hosts, you’re selling the wrong value proposition. Oxford Road’s data suggests that engaged niche audiences with high host trust outperform broad reach every time. Sales teams need to start emphasizing audience engagement metrics, host authenticity scores, and conversion data rather than CPM and reach.

The NPR finding deserves special attention. Wait Wait Don’t Tell Me ranking high for direct response advertising contradicts years of industry conventional wisdom positioning NPR as purely an awareness play. If NPR can drive sales, the problem wasn’t the network—it was how advertisers and agencies understood and deployed it. This suggests the entire industry has been leaving money on the table by miscategorizing shows based on brand perception rather than performance data.

Most importantly, Oxford Road built this ranking from $1.6 billion in actual campaign data measuring real customer acquisition costs and sales results. Not impressions. Not reach. Not downloads. Sales. This represents the first time the podcast industry has access to performance rankings based on what advertisers actually care about: ROI. Every other ranking system—from Chartable to Podtrac to Apple’s charts—measures popularity, not effectiveness.

For advertisers, the message is clear: stop buying podcast ads based on download numbers. Start demanding performance data. Oxford Road claims they’ve “processed more podcast advertising performance data than any other agency,” which means they’re sitting on the industry’s most valuable dataset. Smart advertisers will use tools like ORBIT to de-risk buys and identify high-performing shows before they get expensive.

The comedy ranking is just the beginning. Oxford Road plans monthly releases covering genre-specific performance, international markets, emerging shows, and vertical-specific results. As this performance data proliferates, the podcast advertising market will face a reckoning between what shows charge and what they actually deliver.

Bill Burr being an offensive genius who moves product isn’t the story. The story is that nobody knew it until someone actually measured sales instead of downloads.

Source: Oxford Road’s “ORBIT Top 15 Comedy Podcasts Measured by Ad Performance,” based on 12 months of real campaign outcomes across hundreds of advertisers, November 2025

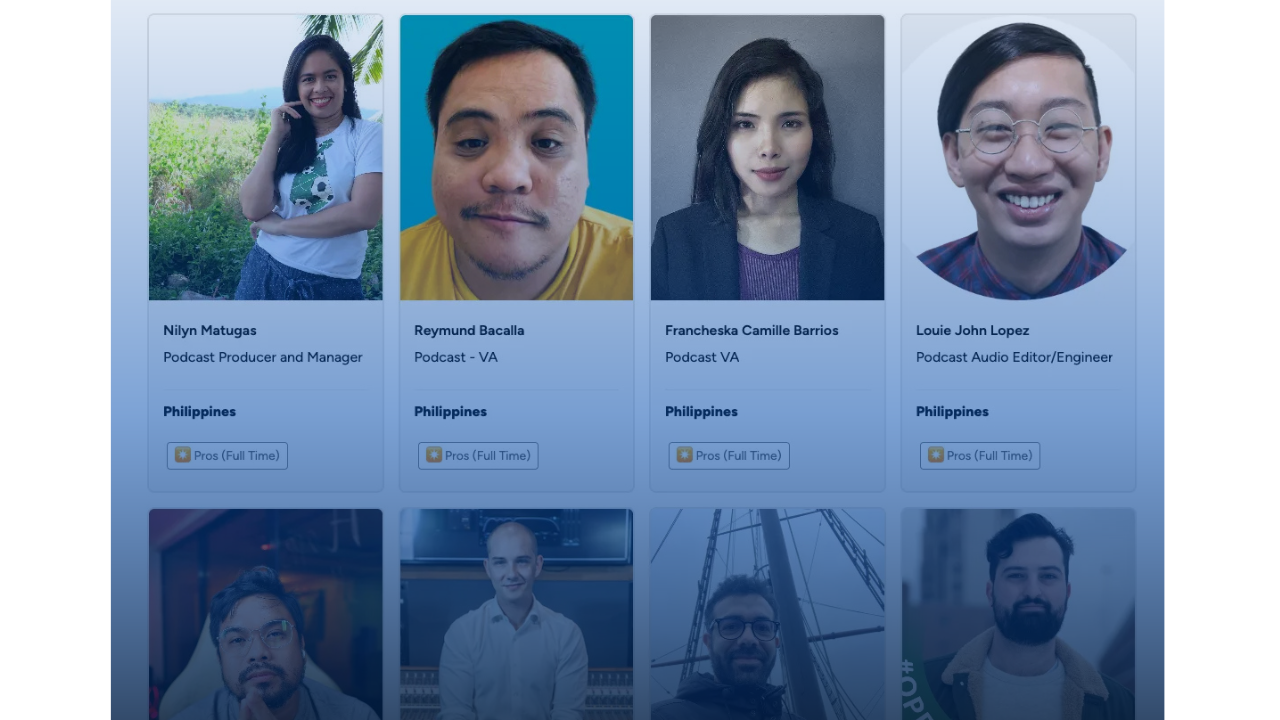

PRESENTED BY PODWIRES MARKETPLACE

Hire Top Independent Podcast Producers for Your Business

Podcasting is a powerful way to grow business, and Marketplace Podwires is here to assist you in the easy hiring of top-rated independent podcast producers. Be it branded podcasts that share your products with the entire world or internal series aimed at engaging and energizing your teams, our expert producers can craft stories that meet any brief and bring more personality to your brand’s voice. Begin with Marketplace Podwires, and find a dream producer for your project today!

EDISON RESEARCH

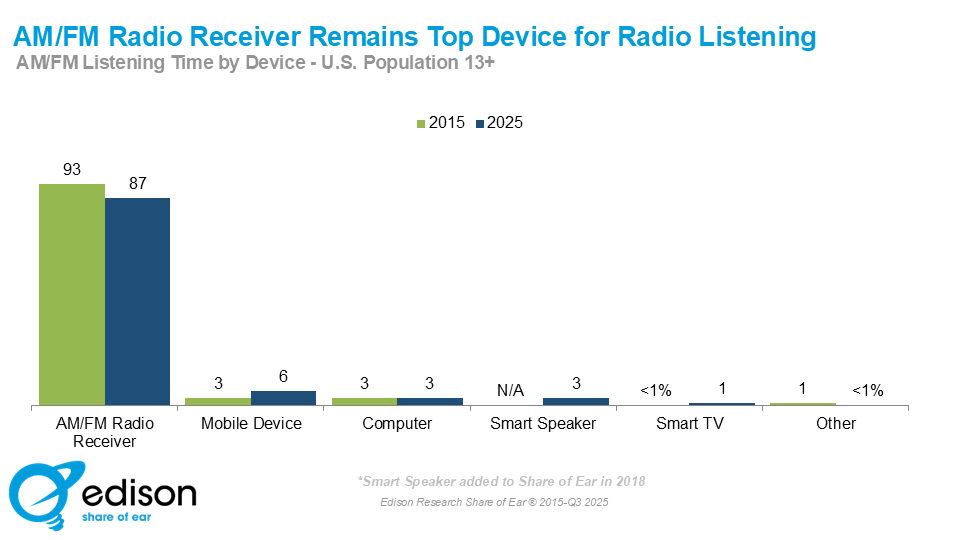

Radio Listening Dropped 6% to Digital in Ten Years. The Industry Should Be Terrified.

Podwires Rundown: Edison Research just released data that should make every broadcast radio executive stop what they’re doing and pay attention. After a decade of digital audio platforms exploding across phones, computers, smart speakers, and smart TVs, broadcast radio’s grip on traditional receivers has barely budged. In 2015, 93% of AM/FM listening happened on radio receivers. In 2025? It’s 87%.

That’s a 6-percentage-point decline over ten years while the entire audio landscape transformed around them. Let that sink in.

The Key Points:

Traditional radio receivers still dominate AM/FM listening at 87% of total time spent, down from 93% in 2015—a decline of only 6 percentage points over a decade

Mobile devices and smart speakers have made “small gains” chipping away at receiver primacy, but haven’t fundamentally disrupted in-car and at-home AM/FM listening patterns

Even outside of cars—where listening is “almost entirely” on traditional receivers—AM/FM consumption happens predominantly via over-the-air signals rather than digital platforms

Broadcast radio companies have “made efforts to embrace digital platforms and technologies,” but traditional receivers continue to “dramatically outperform all other devices” for radio listening

This resistance to digital migration occurred during a decade when streaming audio content exploded to dominate the overall audio sphere across all age demographics

Why It Matters: This data reveals something the podcast and streaming audio industries keep missing: people’s audio consumption habits are incredibly sticky to device and context. Radio didn’t migrate to digital despite a decade of technological advancement and industry investment because radio listeners don’t want radio on their phones—they want it in their cars and homes where receivers already exist. The uncomfortable truth? Just because digital distribution exists doesn’t mean audiences will follow. Podcasting should pay attention to this lesson, because the same resistance could explain why podcast apps never achieved mass adoption despite being technically superior to listening on YouTube or Spotify.

The Big Picture: For podcasters and audio producers, radio’s resistance to digital migration exposes a critical strategic insight: distribution platforms matter less than listening contexts and habits. Radio succeeded at maintaining receiver dominance not through better technology but by remaining embedded in environments where people already consume audio—primarily cars. This explains why video podcasts are winning: they’re not winning because video is inherently better, but because they live on platforms (YouTube, Spotify) where audiences already spend time.

The modest 6-point shift over ten years suggests that even when better digital options exist, audiences require massive contextual disruption to change consumption patterns. Broadcast radio companies tried embracing digital platforms, but couldn’t overcome the fundamental advantage of being pre-installed in vehicles and available without apps, logins, or internet connections.

For the podcast industry, this data should trigger serious questions about platform strategy. If radio couldn’t convince listeners to migrate to digital despite superior features like pause/rewind, zero commercials on streams, and personalization options, what makes podcasters think they can convince audiences to download dedicated podcast apps? The answer increasingly appears to be: they can’t. Smart podcast producers are following audiences to existing platforms (YouTube, Spotify) rather than demanding audiences come to podcast-specific apps.

The car context is particularly revealing. In-vehicle listening is “almost entirely on a traditional receiver” because that’s the path of least resistance. As cars increasingly ship with integrated streaming platforms and podcast apps (Apple CarPlay, Android Auto), this could finally represent the contextual disruption needed to shift listening patterns. But it took a decade and a complete overhaul of in-car entertainment systems to even begin that transition.

For radio executives, this 87% number shouldn’t be celebrated—it should be a warning. The fact that digital audio “now dominates the audio sphere” according to Edison Research, yet radio maintained receiver dominance suggests radio listening overall is declining even as its share of remaining radio listeners stays on receivers. The 6-point decline isn’t the full story; the question is how many total people are still listening to AM/FM at all. If radio’s audience shrinks by 30% but 87% of remaining listeners use receivers, that’s not stability—it’s managed decline.

Most importantly, this decade-long resistance to digital migration demonstrates that technology alone doesn’t change behavior. Radio’s lesson for podcasting: you can’t force audiences to adopt new platforms just because they’re technically superior. You have to meet audiences where they already are, in the contexts where they already consume audio. Video podcasts aren’t winning because they’re better—they’re winning because they show up on platforms people already use.

The podcast industry spent ten years trying to convince people to download podcast apps. Radio spent ten years trying to convince people to stream instead of tune in. Both failed for the same reason: audiences don’t switch platforms without extraordinary contextual pressure.

Source: Edison Research Share of Ear® study, 2015-2025

CUMULUS MEDIA

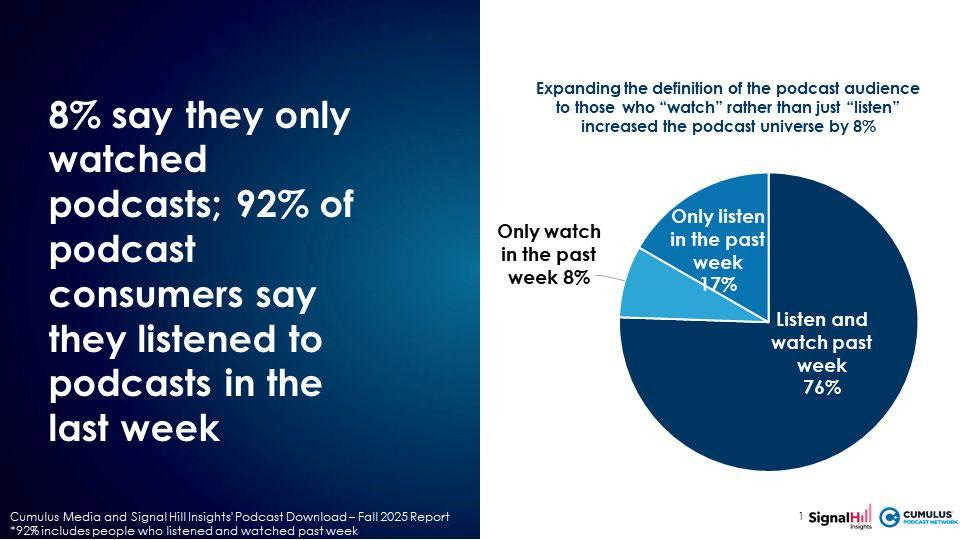

92% of Podcast Listeners Still Just Listen. The Video Panic Was Overblown.

Podwires Rundown: Every podcast conference panel this year featured the same breathless discussion: video is taking over, audio-only is dying, you need cameras or you’re finished. Cumulus Media and Signal Hill Insights just released data showing the video podcast revolution happened entirely in industry executives’ heads. 92% of weekly podcast consumers still choose to listen. Only 8% watch exclusively.

But here’s where it gets interesting: people think they use YouTube for podcasts way more than they actually do. YouTube dominates perception surveys as the “most used” podcast platform. Yet when Edison Research tracked actual listening behavior, Spotify edged out YouTube 29% to 28% in time spent. The gap between what people say and what people do just exposed podcasting’s biggest strategic miscalculation of the decade.

The Key Points:

92% of weekly podcast consumers choose to “listen” to podcasts, with only 8% reporting they exclusively watch—a ratio that’s held steady at 91%/9% across eight studies since April 2022

YouTube leads perception surveys as “most used” platform (42% claim it), but actual time spent reveals Spotify (29%) slightly beats YouTube (28%), with Apple capturing 18% and the “big three” combining for 75% of total U.S. podcast time spent

YouTube is not a walled garden: 70% of YouTube podcast listeners say they’d switch platforms if a podcast moved elsewhere, and 52% already consume the same podcasts on other platforms—demonstrating content loyalty trumps platform loyalty

YouTube dominates discovery as the world’s “entertainment search engine”—45% of listeners who found a new podcast in the past six months discovered it on YouTube, making it the critical platform for being found rather than for exclusive listening

Smart TVs now represent nearly 10% of podcast time spent (8% per Edison), four times the share of smart speakers (2%)—the “watch while you listen” behavior is real, but it’s background viewing while doing other activities, not active watching

Why It Matters: The podcast industry spent three years in a collective panic about video, with creators scrambling to add cameras, producers redesigning studios, and platforms promoting video-first features. This data reveals the panic was based on misunderstanding what audiences actually want. People aren’t abandoning audio for video—they’re using video platforms as convenient audio delivery systems. YouTube’s strength isn’t that it’s video; it’s that it’s YouTube, the entertainment platform where audiences already spend time. The industry mistook platform preference for format preference, triggering billions in misallocated investment toward video production that audiences never asked for.

The Big Picture: For podcasters and producers, this study demolishes the “pivot to video or die” narrative. The 92% audio-first consumption rate has held remarkably steady since 2022 despite massive industry investment in video capabilities. Audiences are telling you clearly: they want audio convenience, not video content. The 76% who say they “watch and listen” aren’t actively watching—they’re letting videos play in the background while commuting, working, or doing other activities. That’s audio consumption on a video platform, not video consumption.

The perception versus reality gap around YouTube usage exposes a critical strategic insight. When people say YouTube is their “most used” podcast platform (42%), but actual logged behavior shows Spotify and YouTube nearly tied, that’s not measurement error—that’s audiences conflating their overall YouTube usage with podcast-specific behavior. As the study notes, Americans spend enormous amounts of time on YouTube generally, consuming long-form content. They’re overestimating podcast time because YouTube is their “entertainment home base.” This explains why 52% of YouTube podcast listeners already consume the same content elsewhere: they’re platform-agnostic, following shows across wherever is convenient for their current context.

The 70% who’d switch platforms if a podcast moved is the most important finding in this entire study. YouTube’s podcast dominance isn’t sticky—it’s convenient. Unlike radio’s device loyalty (87% still on traditional receivers after a decade), podcast listeners demonstrate zero platform loyalty. Content wears the crown. This should fundamentally change how creators think about platform exclusivity deals. Taking a Spotify or YouTube exclusive deal makes sense only if the money compensates for audience fragmentation, because those audiences will follow you anywhere.

For producers, the smart TV finding (10% of podcast time spent) reveals where “video podcasting” actually matters: passive background viewing on large screens while audiences do other things. That’s not a format demanding cinematic production values—it’s audio with occasional visual interest. Stop investing in expensive video production infrastructure and start thinking about minimal viable video: static images, simple graphics, or unedited recording feeds that give audiences something to glance at occasionally without requiring active attention.

The discovery insight is the actionable takeaway. YouTube as the world’s “entertainment search engine” means 45% of new podcast listeners found their latest show there. You need to be discoverable on YouTube—but that doesn’t mean you need to be exclusively on YouTube or even primarily focused on YouTube. The 52% who consume the same podcasts on other platforms demonstrate that YouTube excels at top-of-funnel discovery while other platforms handle the majority of ongoing consumption. Smart strategy: use YouTube for discovery and trailers, optimize other platforms for loyal listening.

Most revealing? People don’t actually know where they consume podcasts. They think they’re spending way more time on YouTube than behavior tracking reveals. This perception-reality gap explains why so many creators got video strategy wrong: they listened to what audiences said rather than watching what audiences did. David Ogilvy nailed it decades ago: “People don’t think what they feel, they don’t say what they think, and they don’t do what they say.”

The podcast industry’s video panic was driven by surveys asking people what they do, not data tracking what they actually do. Let that sink in.

The 8% watch-only segment has remained stable for years. Video podcasting isn’t taking over—it’s a niche consumption pattern being mischaracterized as a transformation. 92% still choose audio. The format isn’t changing. The platforms are.

Source: Cumulus Media and Signal Hill Insights’ Podcast Download Fall 2025 Report (603 weekly podcast consumers, October 2025) and Edison Research Share of Ear Q3 2025

🎙️ EVERYTHING ELSE IN PODCASTING TODAY

⏭️ Survey Data Reveals Video Podcasters Spend More Money But Less Time Than Audio-Only Creators. Survey data from The Podcast Host analyzing 500+ independent podcasters reveals video podcasting and audio-only podcasting have evolved into two distinct production approaches, with video creators spending more money but less time on interview-format shows released weekly, while audio-only podcasters invest longer hours in solo shows and highly-edited content, raising industry concerns about maintaining creative diversity as economic pressures favor lower-cost video chat formats over production-intensive audio storytelling.

⏭️ Kelly Tarlton’s Final Treasure Hunt Wins Podcast of the Year at 2025 New Zealand Podcast Awards in Auckland. The 2025 New Zealand Podcast Awards, supported by headline sponsor Acast and partners PodLab, Generate KiwiSaver, and AUT, announced winners on November 20 in Auckland with Kelly Tarlton’s Final Treasure Hunt claiming Podcast of the Year honors alongside major wins for Fury of the Small, The Curve Podcast, and The Dom Harvey Podcast, while #BHN Big Hairy News won Listeners’ Choice following record engagement with over 30,000 fan votes and 600 podcast submissions celebrating Aotearoa’s growing independent audio industry.

⏭️ Australian Audio Awards 2026 Presented by Mumbrella Opens Entries Across 27 Radio and Podcast Categories. The Australian Audio Awards 2026, presented by Mumbrella, Radioinfo, and RadioToday, opens entries on November 20, 2025 for 27 categories spanning Australia’s radio and podcasting industry with submissions closing March 6, 2026 ahead of the awards gala scheduled for May 28, 2026 at Carriageworks Sydney on the closing night of Mumbrella360, featuring categories including Best Breakfast Show, Best Investigative Journalism Podcast, and Best Branded Podcast judged by senior industry professionals.

⏭️ Joe Rogan Experience Tops Triton Digital Q3 2025 Podcast Ranker With New Heights Jumping to Number 5. Triton Digital’s Q3 2025 podcast ranker, developed with Signal Hill Insights using Demos+ survey methodology, reveals Joe Rogan Experience maintained the top position among 200 ranked shows while New Heights with Jason and Travis Kelce jumped from number 12 to number 5, Charlie Kirk Show surged from number 70 to number 12, and news genre listenership increased 7 percent with sports podcast audiences growing 9 percent as comedy remained the most-listened genre at 41 percent share, with separate download rankings showing iHeart Audience Network, NPR, and Audacy Podcast Network leading among measured sales networks.

⏭️ Netflix Partners With Spotify for The Ringer Video Podcasts as Streaming Giant Pursues 40-Show Launch Slate. Netflix entered the video podcast market in October 2025 with a Spotify deal for The Ringer podcasts starting early 2026 and is pursuing exclusivity agreements with podcast companies including iHeartMedia, SiriusXM, and Acast for a planned 40-show slate, while Fox’s Red Seat Ventures secured a $150 million multiyear distribution deal with Ashley Flowers’ Crime Junkie and Audiochuck network following Fox’s February acquisition of the podcasting company, setting up competition between the streaming giants and YouTube as video podcasting gains popularity with creators and advertisers.

JOIN PODWIRES MARKETPLACE

If you’re building a podcast team, Join Podwires Marketplace to access monthly curated lists of experienced podcast professionals—producers, audio engineers, scriptwriters, and hosts—actively seeking new opportunities in news, storytelling, and audio journalism

.

If you’re a podcast professional seeking your next opportunity, join the PodWires talent directory to connect with podcast companies and media organizations.

📣 Featured job opportunities 📣

Posterboy Media - Video Podcast Producer (Casual)

Spotify - Editor (Pop), Editorial CE - Berlin (Fixed-Term 12 months)

ACAST - Ad Operations Coordinator

🚨 Stay on top of your deadlines with our weekly-updated calendar of fellowships, grants, training opportunities and podcasting events. If your organisation has a fellowship, grant or event to share, just 👉 fill out this form or want to contribute an article 👉 click here or reply to this message.

THAT’S WRAP

SPONSOR US

Reach over 1000 podcast producers with your product.

Thousands of podcast producers, audio/video editors, podcasters, executives, and business owners worldwide read our newsletter. Contact us now.

📖 I appreciate you taking the time to read! See you in the next issue. Got a question or criticism? Just click on Reply. We can talk while we are here.

✍️ Give us a press release and a good-sized landscape photo. Make sure it’s newsworthy. Send press releases to editor@podwires.com or click here. Editorially, we may rewrite headlines and descriptions.

📬 Sponsor us and get your brand in front of thousands of Independent Podcast Producers and podcasters. Email us at sales@podwires.com for more information or as personal supporters via Patreon, as your contributions help us enhance the experiences of all our users.

🖊️We are delighted to hear from our subscribers! We would be happy to publish your testimonial if you have found our newsletter to be helpful or if you have a success story to share. 👉 Post a Testimonial: https://testimonial.to/podwires

🚀 We are here to help you succeed! Fill out a 5 minute survey and tell us more about your business and yourself. These questions will help us better understand you and promote your business as part of our mission. It’s a win-win!

🚨 Did someone forward this to you?

Become one of the more than 1000 valued email subscribers. Find Out More 👈

We’d love to share what our Podwires readers have been saying!

We’re so grateful to our previous Podwires advertisers!

Podwires is here because of our incredible partners’ unwavering support. The Podwires readers receive journalism free of financial and political influence. If you found this valuable, consider Restacking so more people can see it. Get together with them today.